- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Thank you for the response.

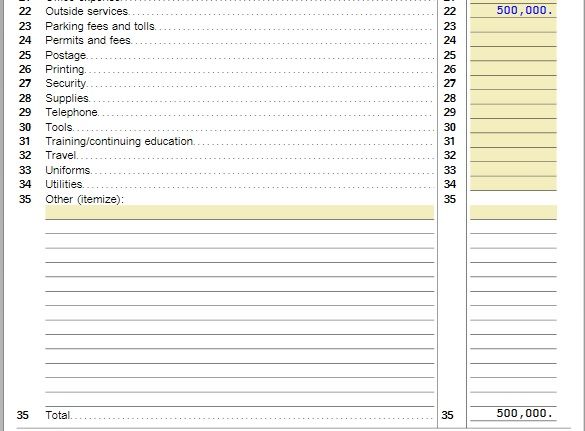

As I stated in the next to last paragraph of my original post, I did switch to the FORMS mode and viewed the 1065. Line 20 does not include the value for Outside services, Lines 21 and 22 are also off by exactly the value that was entered for Payments to independent contractors. The Other Deductions Worksheet viewed in FORMS mode does include the value entered for Payments to independent contractors on its Line 22 which is labeled as "Outside services". Line 35 of this worksheet does show the correct total.

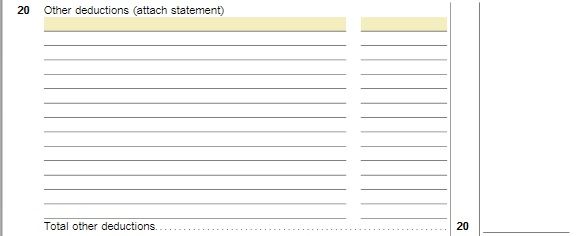

Here is a snippet of Form 1065 showing its Line 20 which shows no value.

Here is a snippet of the Other Deductions Worksheet showing Lines 22 (Outside services) through 35 (Total) showing the $500,000 value.

Something weird is going on. The 500,000 from Line 35 of the Other Deductions Worksheet should be showing up on Line 20 of Form 1065 and it is not. I'm happy to provide more screenshots if that will help.