- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: 2022 1099R and Qualified Charitable Distribution (QCD) - After entered on 1099-R, where does ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 1099R and Qualified Charitable Distribution (QCD) - After entered on 1099-R, where does the QCD amount auto populate?

2022 - 1099-R has a place for Qualified Charitable Distribution. When that amount is filled in, does it auto-populate any other form? If so, what is that form?

It looks like I can add specific information about where the QCD gift(s) went. Is this suggested or required by the IRS?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 1099R and Qualified Charitable Distribution (QCD) - After entered on 1099-R, where does the QCD amount auto populate?

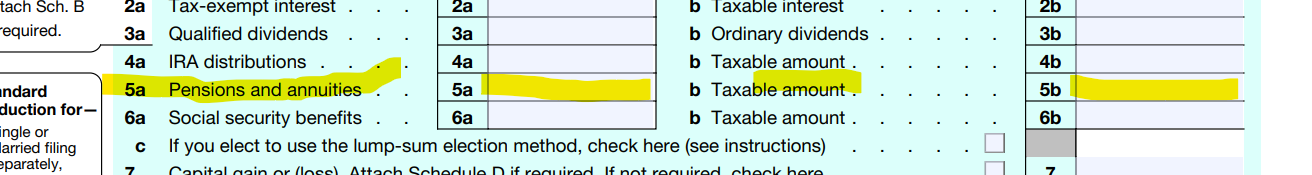

PattiF meant to say lines 4a and 4b, not 5a and 5b. QCDs can only be made from IRAs, not from pensions and annuities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 1099R and Qualified Charitable Distribution (QCD) - After entered on 1099-R, where does the QCD amount auto populate?

The amount of the IRA distribution that was a Qualified Charitable Distribution will show on page 1, line 5a of the 1040, but none of it is taxable if the whole amount was donated to charity.

It is not required that you enter specific information about the charitable gift. Remember that you cannot also claim this amount as a charitable deduction since you are getting a tax break already for the donation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 1099R and Qualified Charitable Distribution (QCD) - After entered on 1099-R, where does the QCD amount auto populate?

PattiF meant to say lines 4a and 4b, not 5a and 5b. QCDs can only be made from IRAs, not from pensions and annuities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 1099R and Qualified Charitable Distribution (QCD) - After entered on 1099-R, where does the QCD amount auto populate?

where do you enter QCD in turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2022 1099R and Qualified Charitable Distribution (QCD) - After entered on 1099-R, where does the QCD amount auto populate?

@philener wrote:

where do you enter QCD in turbotax

Enter the Form 1099-R you received for the distribution from your IRA. You also must be age 72 or older for a QCD. The question for QCD will be asked on the screens following entry of the 1099-R.

To enter, edit or delete a form 1099-R -

Click on Federal Taxes (Personal using Home and Business)

Click on Wages and Income (Personal Income using Home and Business)

Click on I'll choose what I work on (if shown)

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click the start or update button

Or enter 1099-r in the Search box located in the upper right of the program screen. Click on Jump to 1099-R

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

stefaniestiegel

New Member

anonymouse1

Level 5

in Education

currib

New Member

Cindy10

Level 1

ecufour

Returning Member