- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

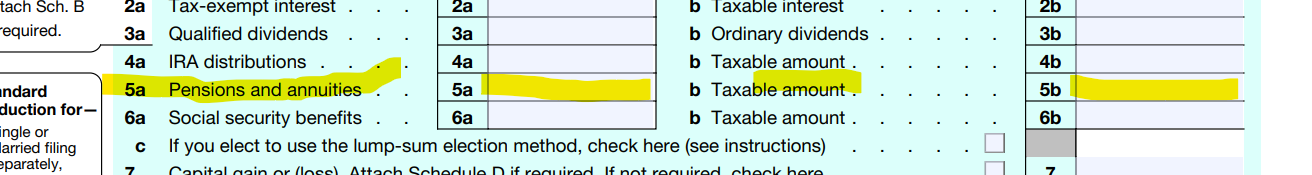

The amount of the IRA distribution that was a Qualified Charitable Distribution will show on page 1, line 5a of the 1040, but none of it is taxable if the whole amount was donated to charity.

It is not required that you enter specific information about the charitable gift. Remember that you cannot also claim this amount as a charitable deduction since you are getting a tax break already for the donation.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 24, 2023

4:13 PM