- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

In the preview of my 1040, could you review your total tax owed? Although you can get up to $7,500 back on your return, the EV tax credit is nonrefundable, which means it will only reduce the amount of tax owed. If your tax owed is less than the credit amounts, then an adjustment will be made to the EV credit to reduce the tax liability to zero, and any other refundable credits or withholdings will then adjust your refund amount. If you review this and still feel there is an error, we can look at your return if you would like to provide a token. The token offers a sanitized version of your return. We will be able to see the numbers but not any personal information such as your name, SSN, or address.

If you would like to do this, here are the instructions:

In TurboTax Online, go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen, and you will get a Token number.

In TurboTax CD/Download versions, go to the black panel on your screen and select Online.

- Scroll down and select Send tax file to Agent.

- You will see a message explaining what the diagnostic copy is. Click send through this screen, and you will get a Token number.

Reply to this thread with your Token number.

We will then be able to see precisely what you are seeing, and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

Say I pay more than $7500 federal tax effective after other deductions in 2023 and let us say that I am receiving refunds regardless of the EV credit. Would I still receive $7500 EV credit + other usual refund?

If no then what should I do in 2023 in order to receive my full EV credit, assuming that I will pay well above $7500 federal tax in 2023.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

If your federal tax is more than $7,500, after deducting any non-EV credits, then you will get full benefit of the EV credit of $7,500. If not, then the only thing you could do is accelerate the receipt of taxable income in 2023, for instance by selling investments at a gain or earning more money by working more. Also, you may be able to delay the deduction of expenses if you are self-employed, by choosing depreciation methods that delay depreciation on assets for instance. If you contribute money to retirement accounts, you may be able to delay that into the next year to increase your income in 2023. That would likely only be beneficial if you can catch up the retirement plan contributions in the next year. @dineshoverhere

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

Hi Brittany,

Married filing jointly with 3 kids. Plain tax return, nothing exciting at all and made 70k. Do I qualify for the full 7500 EV credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

the amount of the credit depends on the vehicle. the maximum that can be used depends on line 18 of the 1040 reduced by certain personal credits.

the following is only a guess because we lack information about your taxes such as other tax credits and whether you itemize or take the standard deduction. many other factors can also affect your tax liability that is eligible for offset by the EV credit. also, different rules would apply if this was a tax credit for business use of the vehicle. see IRS form 8936 and instructions.

if the $70K is your adjusted gross income then with the standard deduction your taxable income would be about $44K. the tax on that is only about $4900 and this would have to be reduced by certain personal credits. To get to a tax liability of $7,500 before personal credits your AGI with the standard deduction would need to go up by about $22K.

in other words, it takes about $66K in taxable income (MFJ) to produce a $7500 tax liability and that's before any reduction for certain personal tax credits (form 8936 line 21)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

Some more figures:

AGI 73k

Taxable Income 48k

Total Tax 5.3k

Total Payments Credits 11.5k

Refund 6.2k

Price of new car: 42k

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

It's not whether you get a refund or tax due. And the withholding doesn't matter. It's if you have a tax liability on your income. Look at your 1040 line 22 for total tax. So as long as Line 22 is more than $7500 (before applying the credit), you'll get the whole credit back.

The EV credit only reduces the tax liability on 1040 line 22 to zero. Then you will get back all your withholding. But it doesn't reduce any other taxes on line 23.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

Unfortunately line 22 is only $5,300.

So in short, I have ZERO benefit from the 7,500 EV credit?

If I do purchase a used PHEV that qualifes for the $4000, how does it look?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

No. You can use up $5,300 of the credit. You can reduce line 22 to zero. Then you would get back all your withholding and any refundable credits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

the amount of the credit depends on the vehicle. there are many criteria that must be met to qualify. in other words, not every EV will qualify for the credit and some nothing at all or a lower credit. so, make sure you ask the dealer before purchasing.

in your situation line 18 and line 22 may be the same but technically its line 18 reduced by certain credits

from Schedule 3 (Form 1040), lines 1 through 4, 6d, 6e, and 6I; and Form 5695, line 30.

you may want to read the IRS guidance for vehicles purchase in 2023

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

also note that the standard deduction for 2023 is increasing by about $2000 so if your AGI remains about the same your taxable income will drop to $46,000 and the tax would be about $5k.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

So if my tax refund is 4k, will it go up by 5.3k and total 9.3k?

Also, thank you so much for this. I appreciate you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

Hi Mike,

Looking at a Model 3 with the 7,500 tax credit.

I am just trying to understand how this will apply to my tax situation with my taxes at approximately 5k, with a 4k tax refund. Is it realistic for me to expect a 5k increase in my refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

Hi Vanessa,

So if my tax liability is 5k, 5k will be subtracted from it (7.5k - 5k) thereby bringing it to zero, which should boost my refund up by 5k correct?

I have 4k in refund and would like to make sure I at least get some benefit from buying the car.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

@RyanCangco wrote:

Hi Vanessa,

So if my tax liability is 5k, 5k will be subtracted from it (7.5k - 5k) thereby bringing it to zero, which should boost my refund up by 5k correct?

I have 4k in refund and would like to make sure I at least get some benefit from buying the car.

If your tax liability is zero after the EV credit is applied then your tax refund will be the amount of tax payments (taxes withheld or paid) you have reported on your tax return and no more than that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchase an electric vehicle with the 7500 tax credit, how do I ensure that I will owe enough at the end of the year to see that full credit when I do my taxes?

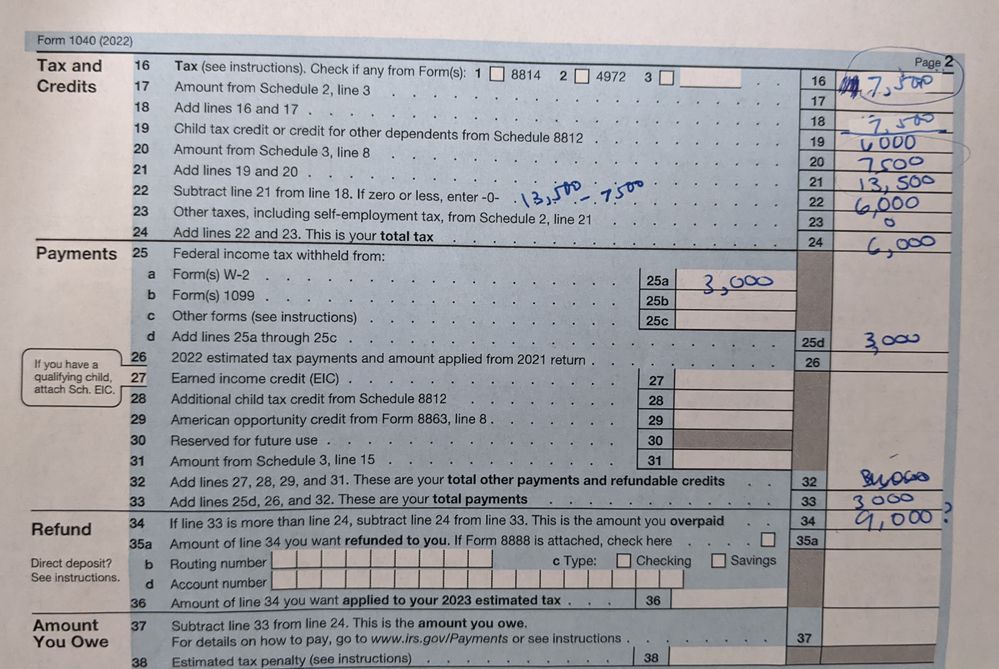

I printed the 1040 form and followed the instructions.

Can anyone check if this is correct? These are just rough estimates...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

teewilly1962

New Member

Binoy1279

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

bawbfree

New Member

RE-Semi-pro

New Member

justine626

Level 1