- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

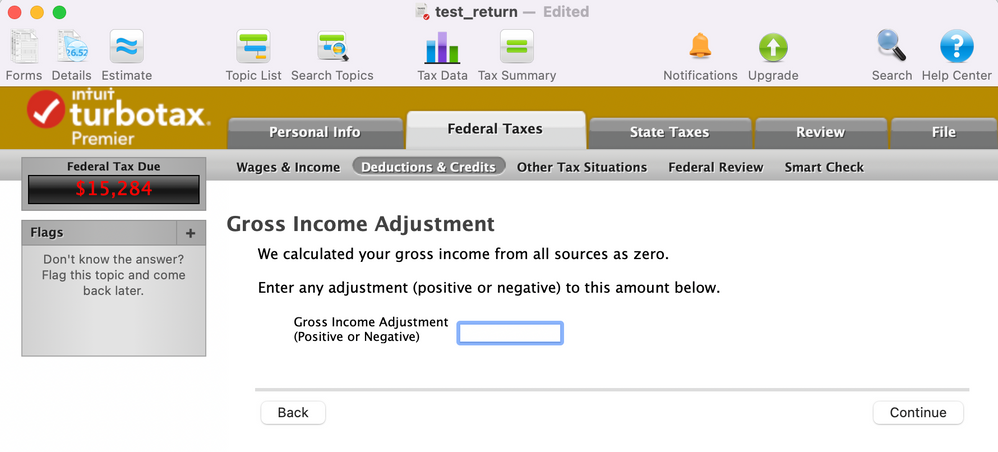

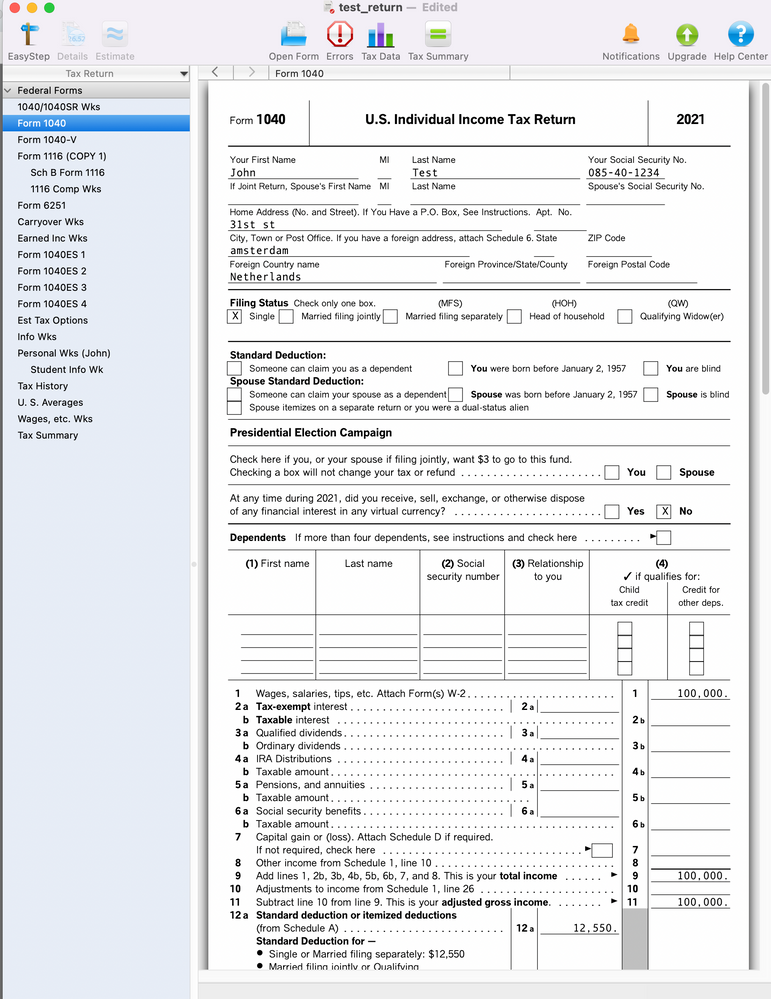

I am on Turbo Tax Premier 2021 Mac

I started a completely new return.

1) Put that I live in the Netherlands for the entire year.

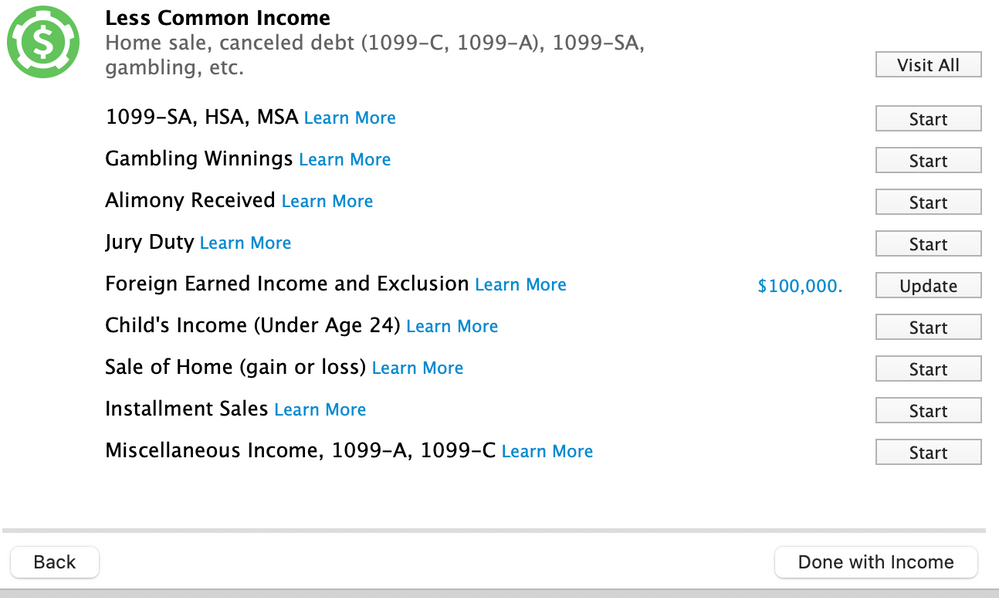

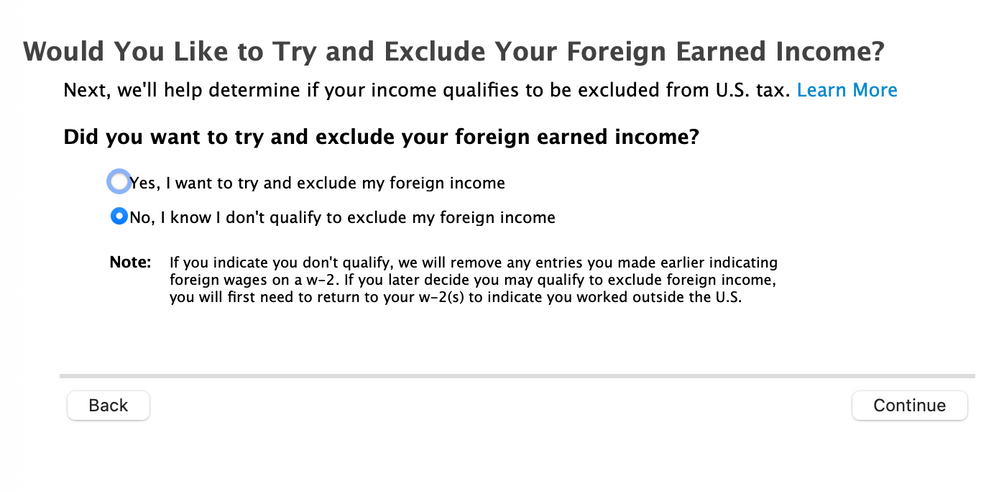

2) Entered 100K (to test out, not actual) under Federal Taxes -> Wages & Income -> Less common income -> Foreign Earned income and exclusion. Seletected NOT to exclude my foreign income

3) Went to Federal Taxes -> Deductions & Credits -> Estimates and other taxes paid -> foreign taxes

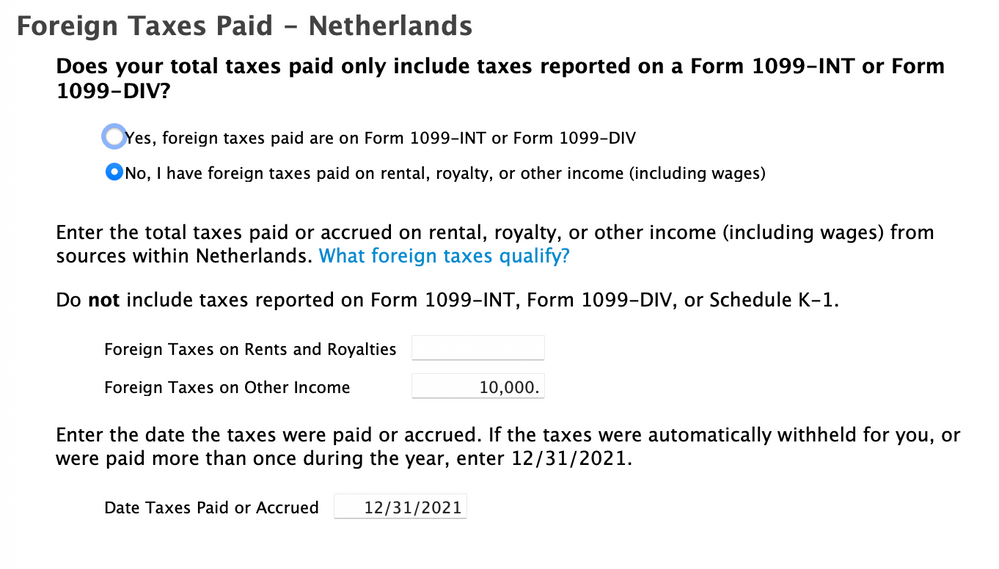

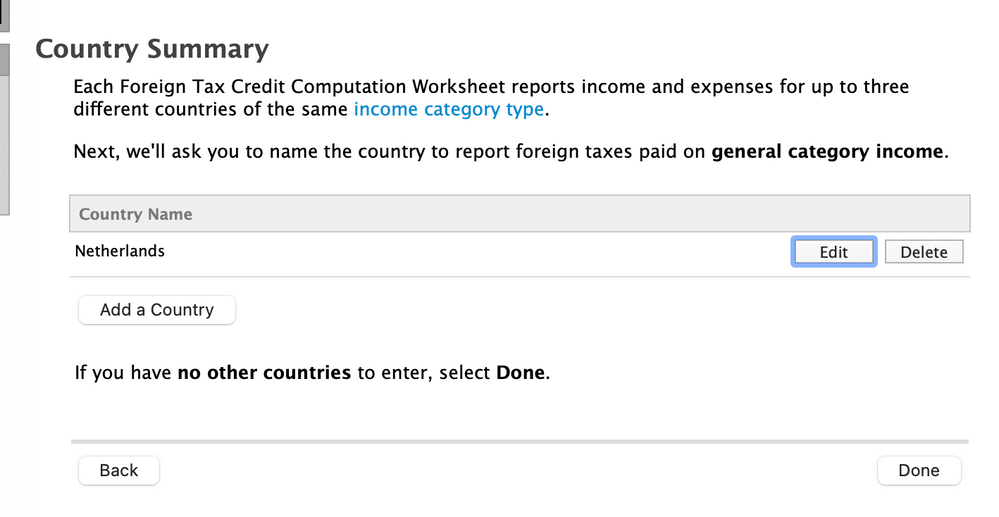

4) Entered General Category Income for Netherlands with taxes paid of $10K (to test out, not actual).

5) Later, Turbotax tells me gross income from all sources is zero

6) Also I see no credit applied

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

Yes, I have the same issue! Can someone please help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

If you excluded the entire foreign income then you have ZERO federal tax owed on that amount thus you don't get a foreign tax credit at all ... your tax is already at zero and the credit is NOT refundable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

@Critter-3 I had said in my post: " Seletected NOT to exclude my foreign income" . And thus a tax is owed. No foreign credit was given to offset.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

Review the entire return to see where/how this income is being reported ... is it on the 2555, form 1040, Sch D/8849. Then look for the taxable income and the tax liability on the form 1040. Do you have any taxes that can be negated by the credit? And have you completed the form 1116 properly ? Are you itemizing or taking the standard deduction? Did you choose to take the credit or the Sch A deduction ?

Contact Customer Service to see if someone can look at your tax file to see what is happening...

5am-5pm Pacific Time Monday -Friday

https://support.turbotax.intuit.com/contact/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

I created an entirely new return and performed the exact steps in my post. Nothing was done beyond that.

To answer your questions

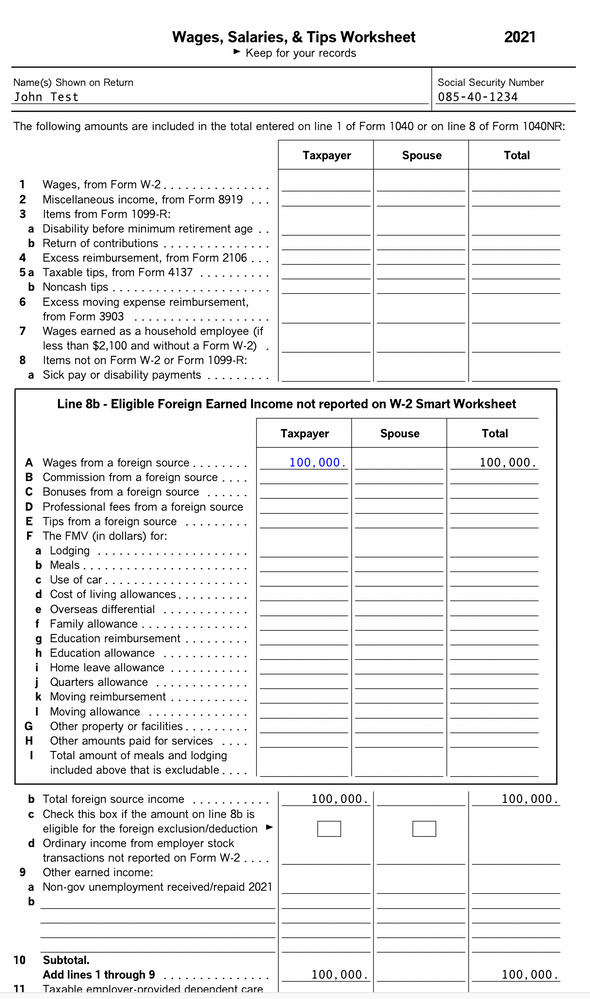

1) I do not see a form 2555 (probably because I said NOT to take the exclusion)

2) The income is one Wages, Salaries, and Tips worksheet as "Wages from a foreign source". As I mentioned in my original post, I went to Federal Taxes -> Wages & Income -> Less common income -> Foreign Earned income and exclusion and added 100K to a statement from my foreign employer. Seletected NOT to exclude my foreign income

3) It also appears on my 1040 (as I would expect) on line 1.

4) No schedule D/8849. As mentioned in my original post, this is a test return, with nothing entered beyond what I said above.

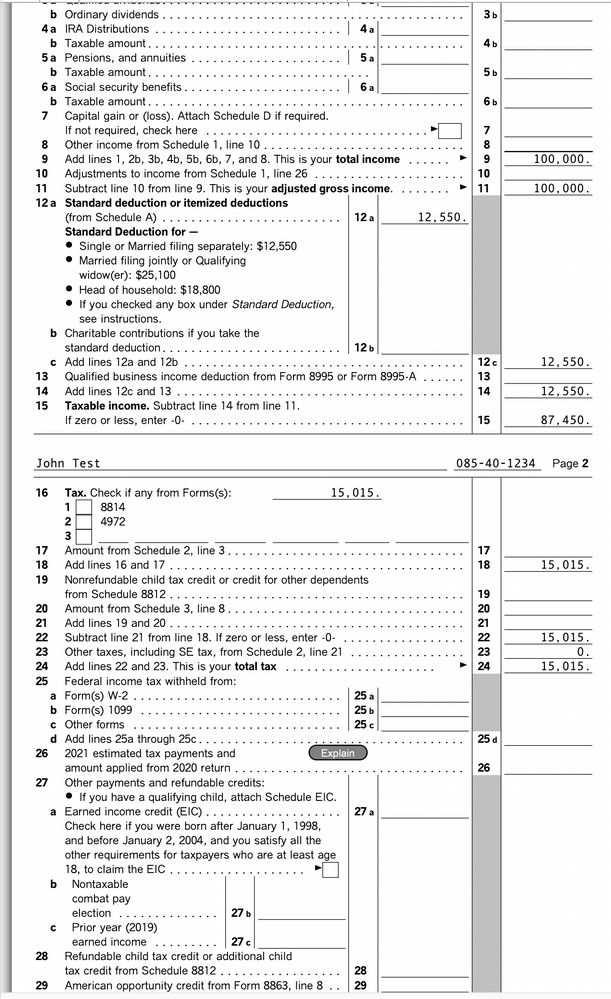

5) AGI on line 11 is the 100K. Taxable is income is 87.45K (which is just the 100K less standard deduction)

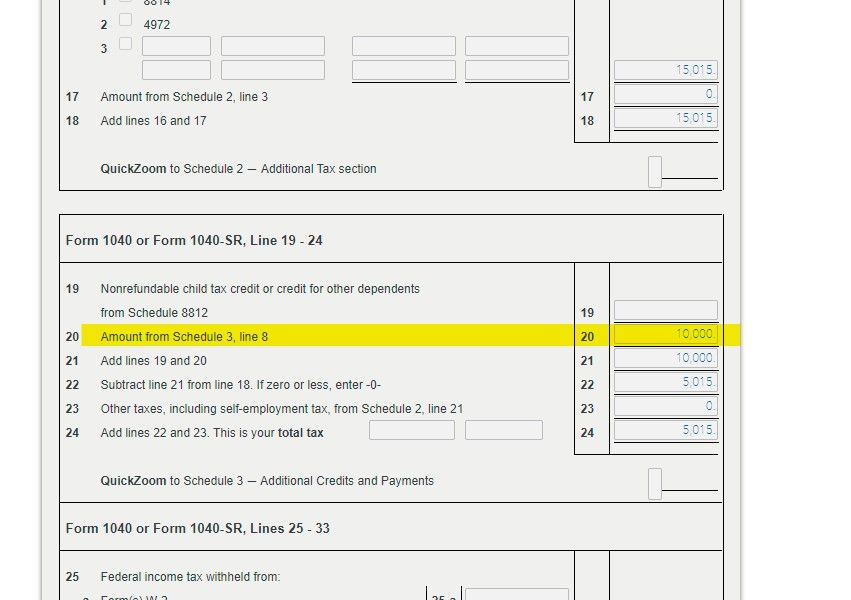

6) Tax liability is 15015 on line 24 of 1040

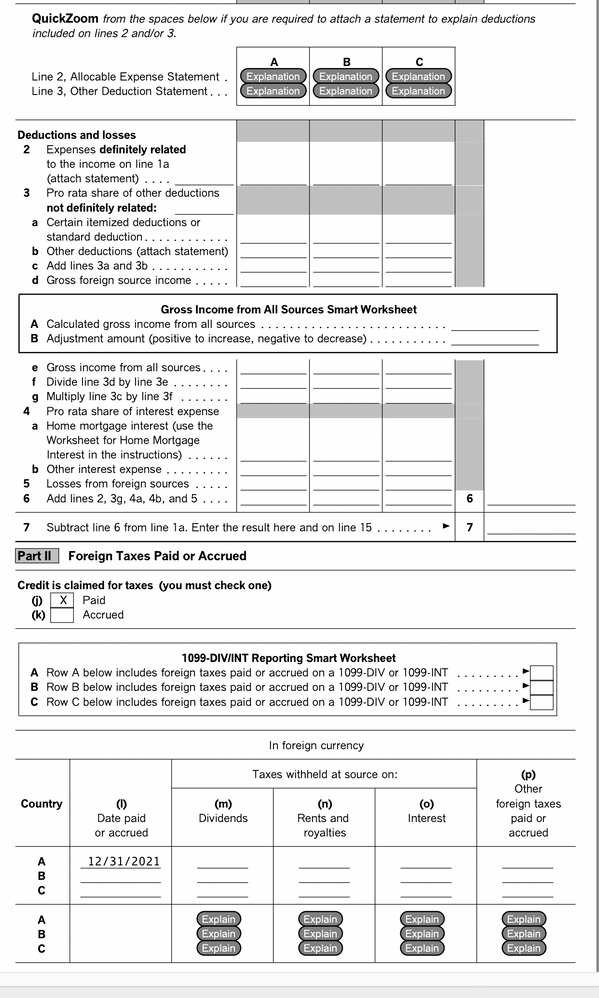

7) I completed form 1116 by ignoring anything except general category income, saying I do not have carryover, and putting in 10K of taxes already paid to "other".

😎I don't see a schedule A (probably because i'm taking standard), but I chose to take the credit on the interview.

Link to my test return: https://drive.google.com/file/d/1fRz39krf1HUX1damhRCUiiMofLhcPflu/view?usp=sharing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

First your links are useless but I put in exactly what you listed and the credit was allowed without issue ... so which country did you choose on the 1116 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

Thank you for helping me along. See below.

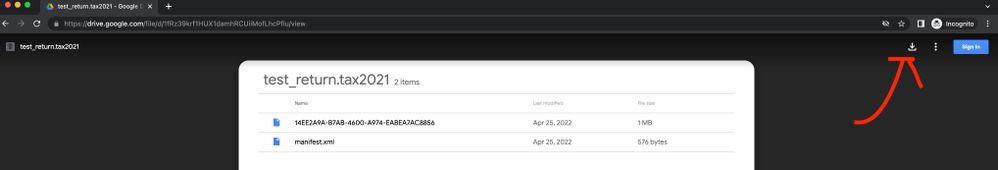

Strange the link works for me on incognito on my other computer, so it should work. In pic below, click the download button where the red arrow is. Does that work?

Also, what software of turbotax are you using? That does not look the same as my turbo tax premier Mac desktop version even in forms view.

The country I chose is Netherlands. See below for how I entered everything.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

I am using the downloaded version ... same bottom line screen shots just looks different.

I cannot get your result so talk to someone at TT support who can get a sanitized copy of the return from you to look at as I cannot see where you are making an incorrect entry... contact details can be found here

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

Actually, I uploaded a video of exactly what I am doing:

It is very short. 4 minutes, but you can watch on x2 for 2 minutes total.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

Actually I uploaded a video of exactly what I am doing:

It is very short. 4 minutes, but you can watch on x2 for 2 minutes total.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

Revisit the foreign tax credit interview. On the screen with the header "other gross income -netherlands", enter the amount even though reported elsewhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

Wow, thanks! That actually worked!

Is this the way to do it though?

It seems @Critter-3 didn't mention that.....which if that was the case, I would have imagined he would have mentioned that since it is NOT obvious.

I thought there would be a way for Turbotax to "link" with income you had already entered from "Wages and income" section. What's the point of entering my income already in the foreign section under wages & income?

It seems I have to do the same for capital gains, and other income as well. Turbotax mentions "linking" with your wages and income section. Is this a bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

Form 1116 is largely isolated from the "Wages and Income" section. There is no way to link income to the form to eliminate the need for duplicate entries. Additionally for foreign capital gains, it is necessary to use the worksheets outside of TT to determine if any adjustments are needed before entering the amount in f1116 using the same screen as for earned income etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Gross income from all sources show zero. Also no foreign tax credit applied. Bug?

fascinating. thank you again. Do you know why @Critter-3 has not mentioned this or any other TurboTax search results? I went through over 500 TurboTax forum links and have yet to see this very not obvious nuance mentioned. It would seem like something that would be mentioned either from the TurboTax prompts (which clearly mention that you should list the form 1116 in order, etc, but in that specific screen, it says to only list OTHER income not already mentioned elsewhere) or from turbotax forum.

Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

2022 Deluxe

Level 1

trenton-mains

New Member

queencleopatra2279

New Member

rtoler

Returning Member

karin.okada

New Member