- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Do I have to report EIP payments

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to report EIP payments

I haven't come across any place to enter the info for my two EIP payments. Do I need to enter them somewhere. I believe they're not taxable.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to report EIP payments

You report receiving the stimulus payments in the Federal Review section of the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to report EIP payments

Yes you have to enter them or Turbo Tax will give it to you again. They are not taxable but you may see your refund change when you enter them because Turbo Tax starts out assuming you didn't get it.

When you go through the federal review tab it will ask how much you got if any. Enter a 0 in the box if you didn't get one. Or to enter your stimulus payment in TurboTax, type "stimulus" (without the quotes) in the Search box, then click the link that says "Jump to stimulus."

After you have entered your tax information and are ready for the Federal Review, it will be the first question.

If you are trying to trigger it, you can go to Other Situations, answer any questions and click Done. The next automatic selection is Federal Review and it will ask about payments received.

The Recovery rebate credit is on 1040 line 30. It either adds to your refund or reduced a tax due.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to report EIP payments

Where do I report EIP on 1040-X?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to report EIP payments

You report receiving the stimulus payments in the Federal Review section of the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to report EIP payments

Thank you for responding, however, my 1040 X does not have a line reading "federal review." What line number should I enter EIP I forgot to report on 1040 SR?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I have to report EIP payments

You do not do this on the 1040X form itself. Turbo Tax will do that for you.

- Log into Turbo Tax assuming you use Turbo Tax online

- When you reach the landing page, scroll to the bottom where your tax returns and documents are.

- Select 2020, and click on the option to amend and change return.

- Answer the questions about why you are amending

- Once you begin working in your return, your refund monitor will reset to 0.

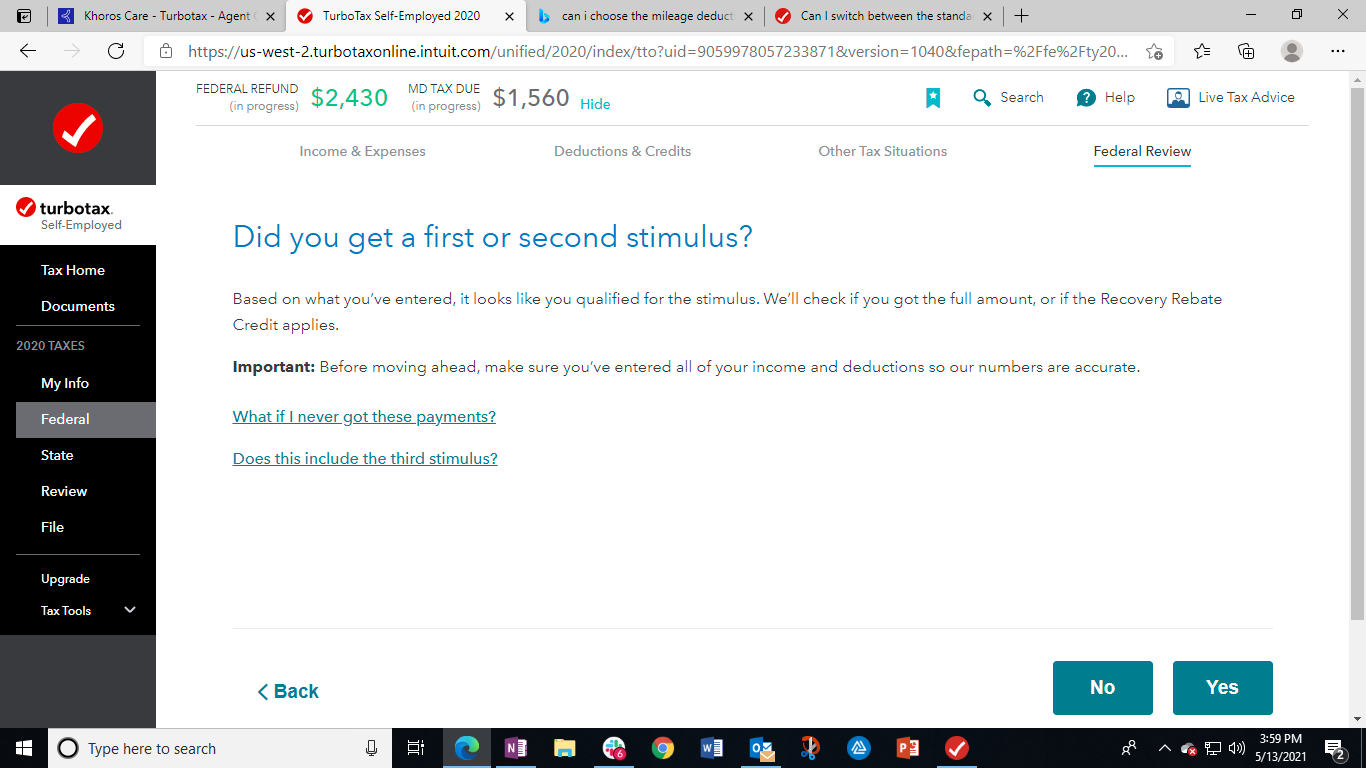

- Once you are in the return, select the federal review tab at the top of the page. When you do, you should reach a screen that looks like this.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cspfire2024

Level 3

Av74O0OhzB

Returning Member

mytax26

Level 2

KarenL

Employee Tax Expert

LeoDude

Level 1