in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Why is California taxing the $10,200. Unemployment that the IRS is waiving

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is California taxing the $10,200. Unemployment that the IRS is waiving

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is California taxing the $10,200. Unemployment that the IRS is waiving

Why do you think CA is taxing your unemployment? CA was one of the states that did NOT tax unemployment at all even BEFORE the new federal law was passed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is California taxing the $10,200. Unemployment that the IRS is waiving

Thank you for replying, but it didn't answer the question , as to why the $10,200 is being tax by the state of California

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is California taxing the $10,200. Unemployment that the IRS is waiving

And again----what makes you think it is being taxed by CA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is California taxing the $10,200. Unemployment that the IRS is waiving

On the the 540 line 16 it added to income, SCH Ca.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is California taxing the $10,200. Unemployment that the IRS is waiving

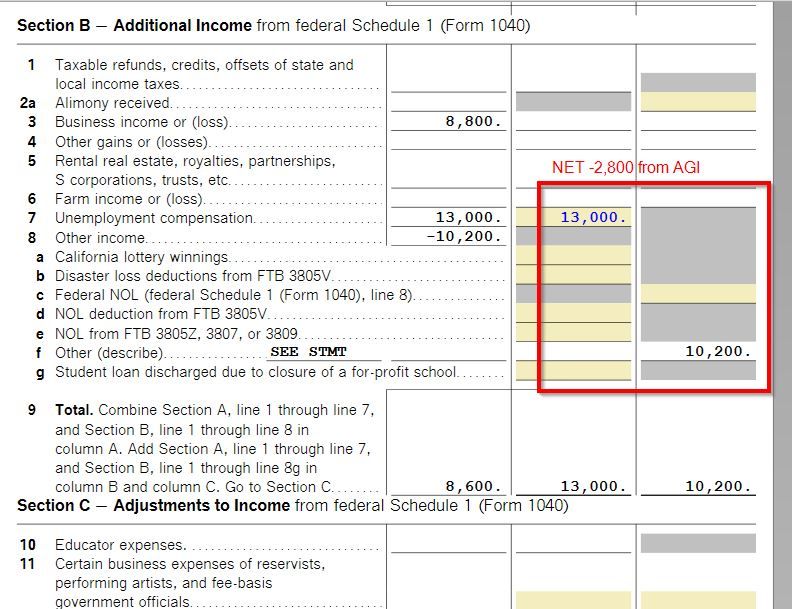

Line 7, Column B of your California Schedule CA (540) should show a subtraction for the unemployment compensation you received.

2020 Schedule CA (540) California Adjustments - Residents

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is California taxing the $10,200. Unemployment that the IRS is waiving

It's not taxable in the state of CA

xmasbaby0 is correct

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is California taxing the $10,200. Unemployment that the IRS is waiving

Correct but then it's added as other income on 540 SCH CA line 8(f) as UTE , maybe the Turbo tax has not updated their software????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is California taxing the $10,200. Unemployment that the IRS is waiving

OK I turned on my program. I see what's happening. Up on 540 CA line 7 it is adding back to the federal AGI the WHOLE unemployment amount. I had entered 13,000 unemployment. But the Federal AGI only included the difference of 2,800 (13,000-10,200) so CA has to add in the 10,200 to the federal AGI to make it match the total 13,000 it excluded on line 7.

Just the way for CA to show all the amounts on CA. Federal AGI only included the 2,800 so CA is excluding 2,800 from federal. By first excluding the full 13,000, then they have to add back in the 10,200.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is California taxing the $10,200. Unemployment that the IRS is waiving

@sergiorate wrote:

Correct but then it's added as other income on 540 SCH CA line 8(f) as UTE , maybe the Turbo tax has not updated their software????

Net 0. The unemployment compensation is not taxed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is California taxing the $10,200. Unemployment that the IRS is waiving

I guess I should have said that on 540 CA line 7 it is Subtracting the whole 13,000 from the federal AGI. But the federal AGI only included 2,800 (13,000-10,200) in the first place. So then Calif has to ADD back in the 10,200 to net out to the 2,800 in the federal AGI. OK?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is California taxing the $10,200. Unemployment that the IRS is waiving

I think I've condensed it down to this. Does this make sense to everyone and explain it more coherently? @sergiorate @DoninGA

California does not tax unemployment. First California is subtracting the whole unemployment amount on 540 CA line 7. Not just the taxable amount from the Federal. Then it has to ADD back in the 10,200 excluded amount on line 8 so it is only subtracting out the taxable amount from the Federal AGI.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17525168329

Level 1

Candyman

New Member

Laf923

Returning Member

corneliusconnelly

New Member

shelley0969

New Member