- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: I read the forms. I am talking about California State ta...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

You may be aware that in late December Congress passed a major tax reform bill. That has the IRS scrambling to get tax return forms ready for this tax filing season. They were waiting for the laws to pass.

Some forms are not finalized so you cannot file. The IRS has to finalize a number of forms and then approve the finalized forms in the TT software. Many state forms are not finalized either. What's the rush? The IRS will not be accepting returns until January 29 at the earliest, so filing early will not get you a faster refund. The earliest refunds will not be released until mid to late February. You just have to wait for the forms to be ready.

https://ttlc.intuit.com/questions/1908857-forms-availability-table-for-turbotax-state-except-bu...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

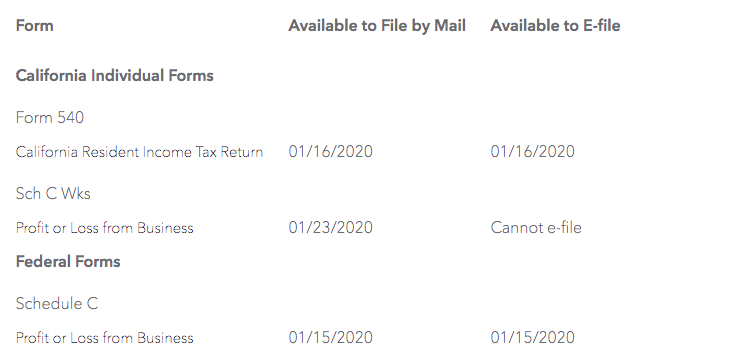

Were you ever able to efile your State? I am having that message now on Turbo with my Schedule C. Says, form available 1/23 then it says can not efile? WTH? I have never had this issue before.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

@Puravida143 wrote:

Were you ever able to efile your State? I am having that message now on Turbo with my Schedule C. Says, form available 1/23 then it says can not efile? WTH? I have never had this issue before.

The Schedule C on your federal tax return has not yet been finalized for e-filing. Click on Review to see the forms and schedules for your return and the dates they will be available for filing.

TurboTax support FAQ for IRS forms availability - https://ttlc.intuit.com/community/forms/help/irs-forms-availability-table-for-turbotax-individual-pe...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

It says the date the form will be available, but in the column that says Available to efile-it clearly states Cannot efile

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I e-file California state tax return with Schedule C and Form 8829? I have done this in the past but Turbo Tax says that I cannot now.

Hey there I just wanted to come by and say my Sch C says the same thing. On that link it says available to e-file by 1/16/2020. I’m just gonna wait. I always do my taxes early and I remember last year it said something about some forms not being ready just can’t remember exactly what forms. Can anyone confirm if the link says it’s to be released 1/16. I couldn’t really understand everything on that chart.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

itzty33

New Member

ava-nasseri

New Member

phil_amhjhunver

New Member

mrsscamp316

New Member

rdegrella

New Member