- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- IA Department of Revenue letter re: Line 18 of 1040 Iowa tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IA Department of Revenue letter re: Line 18 of 1040 Iowa tax return

I received a letter from the Iowa Department of Revenue re: my 2017 taxes. The letter states I owe additional taxes because $12,297 was stated on the tax form as a health insurance premium adjustment to income. This is from DD on my W-2. I NEVER entered this amount in turbo tax when processing my taxes. This also happened for 2016. However, for years prior to 2016 and after 2017, this did not pull to my tax form. I don't feel I should pay the extra tax for 2017 because of an error in the turbo tax programming. I did pay for 2016, but now I'm just angry that this error occurred 2 years in a row. Because the IA Department of Revenue is stating I owe an additional tax of $954.44 before June 30th, this should be paid by Turbo Tax. Please let me know when this will be taken care of. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IA Department of Revenue letter re: Line 18 of 1040 Iowa tax return

Form W-2 Line 12 Code DD - DD—Cost of employer-sponsored health coverage. The amount

reported with code DD is not taxable

The amount reported on your W-2 on Line 12 with a code of DD was not entered on your tax return. It is not taxable. What exactly is the Iowa DOR referring to in the letter you received?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IA Department of Revenue letter re: Line 18 of 1040 Iowa tax return

Received the same letter and situation from Iowa. TurboTax listed the $ amount from W-2 box DD on line 18 Health Insurance Premium in the Step 6 Adjustments to Income section. Here's a link to the 2018 form which is identical to 2017 so you can see where the adjustment occurred: https://tax.iowa.gov/sites/files/idr/forms1/2018IA1040%2841001%29.pdf

This didn't occur in 2016 or 2018 - 0's were listed by the TurboTax program. Looks like there was an error with the program in 2017 as I didn't manually enter this amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IA Department of Revenue letter re: Line 18 of 1040 Iowa tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IA Department of Revenue letter re: Line 18 of 1040 Iowa tax return

I've had the same thing happen...I received a letter today stating that we owe $1560.24. In looking at the tax docs from 2017, it appears that items from line DD were carried over to the state form (Step 6 - Adjustments to Income - Line 18). I did not enter values in for my state tax return...I just allowed TT to populate the information and assumed that everything was applied correctly.

In cross checking this with the 2016 and 2018 forms, this didn't happen and I took the same steps to input and process my tax information as I always do.

I'd like to be contacted about how Intuit plans to resolve this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IA Department of Revenue letter re: Line 18 of 1040 Iowa tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IA Department of Revenue letter re: Line 18 of 1040 Iowa tax return

Updating my prior post - the reality is we do all owe the actual tax to the Iowa Department of Revenue. What you can do is file a claim with TurboTax for the penalty that's been assessed. Here's the link: https://ttlc.intuit.com/community/charges-and-fees/help/how-do-i-submit-a-claim-under-the-turbotax-1...

I just completed the form, scanned the notice from IA and uploaded the documents. You'll get assigned a case # and an analyst will reach out with questions per the instructions. Process was super simple - the refund of the penalty should be fairly straightforward as none of us input the deduction, the software did.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IA Department of Revenue letter re: Line 18 of 1040 Iowa tax return

Same issue here for 2016 and 2017. After receiving a call back from the Iowa Department of Revenue, the assessor leaving a message specifically said, "This happens a lot on TurboTax."

Once is a mistake. Two years in a row is a problem. Being a known issue at the Iowa Department of Revenue is unacceptable. TurboTax, you just lost a customer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IA Department of Revenue letter re: Line 18 of 1040 Iowa tax return

@HazyMusicIA @CiceroBC @love2lbr @jmorse18 @Cholland

_____________________________

While I cannot know what the early versions of the IA software might have done...certainly the final version didn't have that error in in the 2017 "desktop" software (Can't know about the Online software either).

I had entered a $999 code DD in box 12 of a W-2 (long ago...maybe testing this possible problem), and $999 did not show up on line 18 of the IA1040.

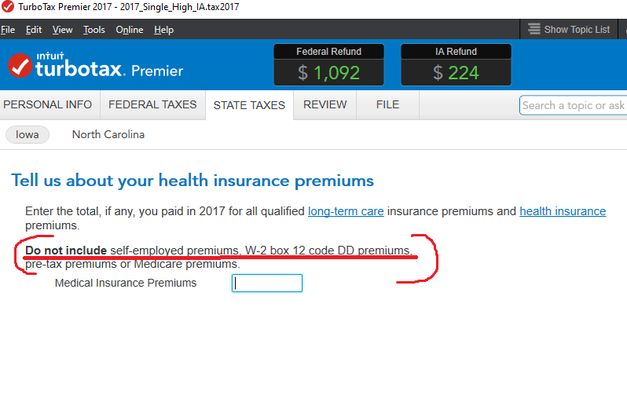

When I go thru the IA interview, it specifically requires you to enter the Medical Premium $$ and tells you NOT to include any code DD $$. (picture below). No auto-entry was made in my 2017 IA desktop software.

Of course you can submit a claim to TTX (url link, as noted by HazyMusicIA above) and see what happens, but TTX will only pay any interest and penalties....IF they determine there really was a software fault, and will not pay the tax you should have owed to IA anyhow....or any repayment of excess IA refund..

___________________________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IA Department of Revenue letter re: Line 18 of 1040 Iowa tax return

I appreciate the attempt to clarify what is happening on the current version of TurboTax Premier, but I would encourage you to be mindful the beginning of this thread. If you are implying that data was entered in error due to negligence, the beginning of this thread specifically notes that the data was not entered at the prompt you displayed.

That leads me to believe one of three theories must be true (from least to most plausible):

- All of the people noting the same problem in this thread, including me, and the State Assessor noting this is very common (see below) are negligent and cannot follow simple instructions.

- Earlier and/or online versions of this question were poorly worded and/or absent this notice.

- TurboTax had/has an error placing a deduction where it should not be.

As for me, here is an update. I've received an e-mail back from TurboTax requesting the "In order to open a claim for you, we need ALL pages of the original notice you received from Department of Revenue for the state of Iowa -- we need the detailed computation of the additional taxes due." For those of us that have received this letter from the Iowa Department of Revenue, I assume you also received the single page letter stating the Tax Period(s), Tax, Penalty, Interest, and Total. I've noted that in my response (although it should be self-evident for anyone who looked at the letter) and included the voicemail audio file left from the State assessor explaining:

"...based on the W-2 information, it appears that you didn't qualify for the deduction there. The amount in box 12 on the W-2 there's a code DD. That's actually the amount that the employer contributes to health insurance premiums and that was put on line 18 as a deduction when it shouldn't have been. I know that happens a lot with TurboTax...."

I'll plan on updating this thread if/when further events unfold.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IA Department of Revenue letter re: Line 18 of 1040 Iowa tax return

I have had the same issue with 2016 and now 2017... I payed had to pay the penalty's for 2016 because turboTax rejected my claim stating that there was nothing wrong with their software and that I must have entered that while doing my taxes... I disagreed, I'm 100% sure I did not enter a random number into that box (I say random because it was a dollar amount NO WHERE on my W2)... but how can I argue, I had no real proof that I did not enter... Now that I see this thread and I got the 2nd letter (for 2017) I'm convinced that there's was/is a issue on their side... I understand I own for the missing taxes (due to their mistake), but I would like to at least have turboTax pay for the penalty's since it was their mistake...

So my question is... Has anyone ever had any luck getting turboTax pay the penalty's?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

michelleroett

New Member

swayzedavid22

New Member

girishapte

Level 3

InTheRuff

Returning Member

selbym

Level 2

in Education