- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

@HazyMusicIA @CiceroBC @love2lbr @jmorse18 @Cholland

_____________________________

While I cannot know what the early versions of the IA software might have done...certainly the final version didn't have that error in in the 2017 "desktop" software (Can't know about the Online software either).

I had entered a $999 code DD in box 12 of a W-2 (long ago...maybe testing this possible problem), and $999 did not show up on line 18 of the IA1040.

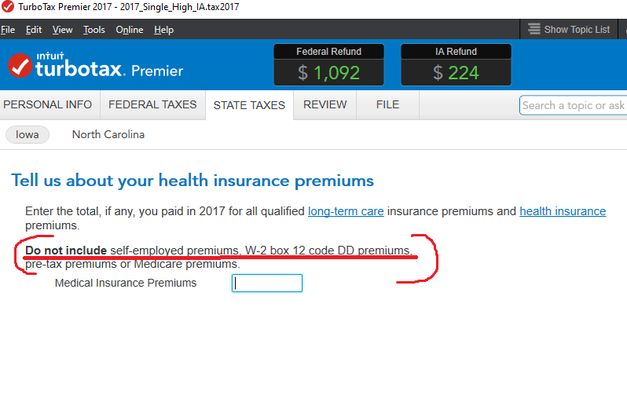

When I go thru the IA interview, it specifically requires you to enter the Medical Premium $$ and tells you NOT to include any code DD $$. (picture below). No auto-entry was made in my 2017 IA desktop software.

Of course you can submit a claim to TTX (url link, as noted by HazyMusicIA above) and see what happens, but TTX will only pay any interest and penalties....IF they determine there really was a software fault, and will not pay the tax you should have owed to IA anyhow....or any repayment of excess IA refund..

___________________________________________________