- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

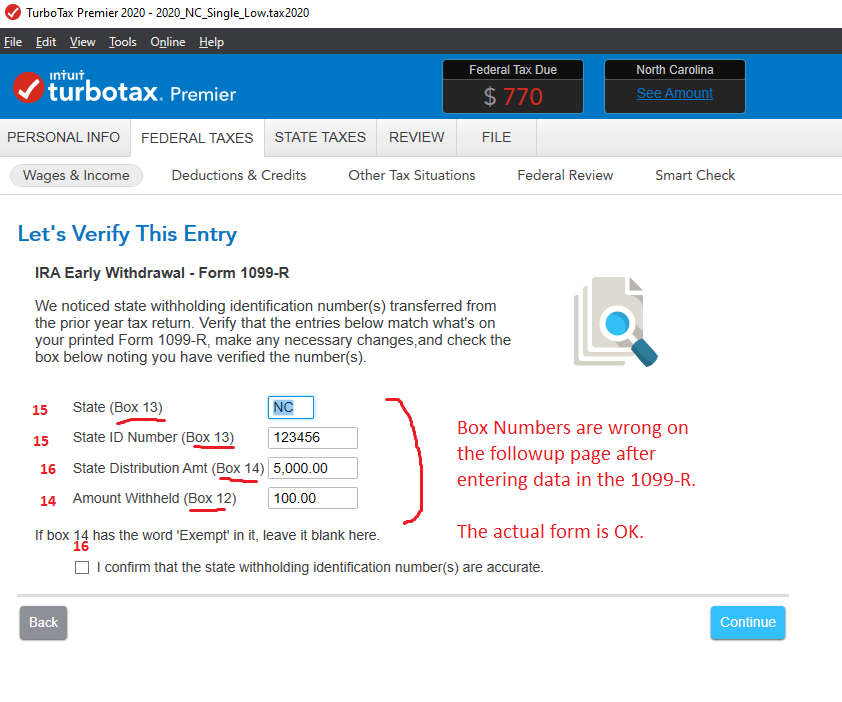

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

TTax box 14 should be box 16 State distribution

TTax box 12 should be box box 14 amount withheld

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

The TurboTax 2020 Form1099-R is the same as the 2020 IRS Form 1099-R

IRS Form 1099-R (2020) - https://www.irs.gov/pub/irs-prior/f1099r--2020.pdf

Box 14 - State tax withheld

Box 15 - State

Box 15 - State number

Box 16 - State distribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

Hmmm...

1) there was a one-time follow-up screen in the Desktop software for a 1099-R, that ask for a confirmation for the state box values...and in the Desktop software, those boxes were mis-labelled as 12,13,14.....but only in the text in that follow-up screen....the did go into the proper boxes in the main form. This particular display problem is being investigated. I haven't been able to check to see if it happens on an Online interview series, because I need a transferred 1099-R form from a 2019 tax file (it only shows that screen for a transferred 1099-R) ...and I don't have one in the "Online" software.

_______________

2) Be sure you are asking about a simple 1099-R form.....not a CSA- or CSF-1099-R. The software does list those state entries as boxes 12, 13, 14 for those two form types. I have no idea if that is an error or not, since no one has yet come up with examples of "real" 2020 CSF- or CSA-1099-R forms to establish whether the CSA/CSF forms were updated from prior year's settings as boxes 12,13,14 to boxes 14,15,16 as the standard 1099-R forms were......or whether they remain as boxes 12,13,14.

SO... @regor1954 are you really talking about an actual "2020" CSF- or CSA-1099-R that you might have in your possession as in #2 ???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

I have noticed the same issue in the desktop version of TurboTax Home & Business. The followup "Let's Verify This Entry" screen displays the entry from Box 14, in the "Amount Withheld (Box12)" line. My 1099R doesn't even have a box 12.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

The FORM 1099-R and the TurboTax input screens do correlate correctly. Please confirm that you have a 1099-R. It is labeled in the top right corner of the form.

The IRS instructions indicate that BOX 12 should contain:

Box 12. FATCA Filing Requirement Checkbox Check the box if you are an FFI reporting a cash value insurance contract or annuity contract that is a U.S. account in a manner similar to that required under section 6047(d). See Regulations section 1.1471-4(d)(5)(i)(B) for this election. In addition, check the box if you are a U.S. payer that is reporting on Form 1099-R as part of satisfying your requirement to report with respect to a U.S. account for chapter 4 purposes as described in Regulations section 1.1471-4(d)(2)(iii)(A).

The other boxes are similarly correct.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

..................that's what I indicated above...there IS a follow-up screen in the desktop software that lists the boxes improperly...the "followup verification " page is using 2019 box labels....but only if the 1099-R is one that transferred in empty from the prior year's tax file.

Like I said,.....it IS being investigated, and should be corrected in the next couple weeks. The primary thing that needs checking is to ensure that the state and State ID number is still correct....that's why they insist on a confirmation page. ignore the box numbers on that follow-up page.....check the values and subject of each box

_________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

Thanks, I thought I was crazy when I saw the numbers. Sounds like there will be an update soon. The actual form looks correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

The follow up comes up for every 1099-R I have and it is still incorrect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

Software updates usually occur on Wed or Thursday nights....every week until ~ 1 April.

Might be corrected this coming week, or the week after...or ????...no way for any of us to know.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

The boxes on my 1099r from Allianz Life insurance are different from Turbo Tax. Box 13 is State/Payers state no.Box 14 is State distribution. Should I use these boxes even though they dont match?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

As noted...first make sure it is a 2020 1099-R. IF it's a 2019 form, then it doesn't go into a 2020 tax return.

IF it is a 2020 1099-R form, then...match the subject of what's in each box:

box 12 on your Allianz form goes in TTX box 14

box 13 on your Allianz form goes in TTX box 15

(box 14 on your Allianz form goes in TTX box 16....but box 16 may not be presented in TTX, since box 2a or box 1 are used in its place))

_____________________________________

Then, Allianz has mis-issued their forms in an improper 2020 format...call them and find out if they are going to correct their screw-up

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

Yes... there was a verification page that listed the boxes using the improper 2019 format...it's been reported and corrected in one of the latest software updates...so it's all boxes 14,15,16 now for the state section on the standard 1099-R form.

That verification page only comes up for 1099-R forms that you reused after they transferred in form last year....once you check the box that the numbers are correct, that page won't show up again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

Same issue and thank you for the explanation. I was handling it the same way.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

I'm working from a Coast Guard retirement 1099R (it's March 17, and I updated yesterday) and the numbered boxes in Turbotax Premier still DO NOT match the boxes in the 1099R. MY 1099's Box 12 is State Tax Withheld, but Turbotax says that should be in Box 14. My box 13 is TT's Box 15 (note that Turbos has 2 box 15s), and my box 14 is State Distribution Amt, which TurboTax is asking for in Box 16.

This is enough of a PIA without the software being wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should the box numbers on the 1099R in the turbo tax screens match the box numbers on the 2020 1099-R boxes 12, 14, 16 they don't how should we proceed?

Note that this is not a verification page - this is the hand-entry page, as TT doesn't have the Coast Guard on the import list. And yes, I'm using the correct year's 1099.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kimberly-franks

New Member

jclutte

New Member

mlpinvestor

Level 3

johntheretiree

Level 2

Jeff-W

Level 1