- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

It doesn't. It calculates the taxable amount of Social Security based on your other income.

If the IRS says more of your SS is taxable it might be because they changed and increased some other income on your return. Read the letter again. A common change is they increased the taxable amount of any 1099R you got for Pensions, and 401k or IRA withdrawals or conversions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

Nope, I checked the IRS by downloading a Worksheet for "figuring your taxable benefits", plugged in my figures from my submitted tax return and the IRS is right, Turbo Tax is wrong. That is why I'm reporting it. The IRS notice reads :"We believe there's a miscalculation on your 2018 Form 1040, which affects the following area of your return: (Tax on Social Security Benefits) They corrected it which reduced my refund by $155.00

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

TurboTax's Social Security Benefits Worksheet implements the IRS calculation. Compare this worksheet to your own calculation to find why TurboTax calculated a different taxable amount. Given the same inputs to this worksheet and the worksheet that you used to do the calculation, I'm sure that TurboTax would produce the same result, so it's likely that the inputs are different. You'll likely find that the IRS indeed caught some other item of income that was missing from your tax return or disallowed some above-the-line deduction (Schedule 1 Adjustments to income) and the $155 tax difference is due to the increase in AGI caused by the combination of these effects. Without the details needed to perform the calculation, it's not possible to know why the results differ.

Also, the IRS letter should not be construed as indicating that the calculation method of the taxable amount of Social Security income is flawed, only that the taxable amount of Social Security income that the IRS calculated disagrees with what was reported on your tax return. The IRS refers to any disagreement as a "miscalculation." That disagreement is virtually always caused by some other change that the IRS made to your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

I entered the same number for both the TurboTax online and TurboTax CD versions. The TurboTax CD returned a $249 smaller deduction for Social Security than the online version. Of course, I can't see the actual online worksheets unless I pay for them. The CD version looks correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

If you think the calculation was not correct on your tax return, you can file an accuracy guarantee claim with TurboTaxs as follows:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

What do you mean a smaller deduction? The taxable SS is different for line 5b? Then another income line has to be different too. You have to compare each lines. It's easy to enter something different or answer a question differently between online and Desktop.

heres an idea......you can try downloading your online return tax file without paying for it. But first save your Desktop return with a different name. Then you can find what's different.

First download the .tax file from the Online version,

Then see, How to Switch to Desktop,

After you get the program installed the first thing to do before you open your tax return is to update the program and install any state programs you had. So you first might need to start a fake return to be able to download the state program (go to FILE - New)

Then you just OPEN the .tax2019 file, go up to File-Open. You don't import or transfer it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

I had the same problem with my 2019 return where the taxable SS amount was higher per the IRS vs the TurboTax calculation. I'll do the calculation manually and see where there is a difference in how it was calculated and post results. Seems that responses to customer's inquiry all point to operator error as though TT couldn't make a mistake.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

I've now determined the cause of the error. In an effort to determine estimated tax, I had created an initial estimated tax return which included the taxable SS income figure. When I modified this initial tax return to create the final return, the initial taxable SS figure was used (overridden) and I did not realize it nor do I recall the software app asking me to confirm that I wanted to use the overridden figure.

I should have reviewed the calculation worksheets as the overridden number is highlighted in red.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

I am aware of no case documented on this forum where either 2018 or 2019 TurboTax incorrectly calculated the taxable amount of Social Security benefits. Given the millions of tax returns prepared using TurboTax that include taxable Social Security benefits and the fact that the calculation method has not changed for many years, it's extremely unlikely that TurboTax makes any such calculation error.

The most common cause of a discrepancy between the amount of taxable Social Security benefits determined by TurboTax and the by the IRS is that the user made an error on their tax return that resulted in an incorrect amount of other income being reported and the IRS corrected that, causing a change to the taxable amount of Social Security benefits. Within a certain range, the taxable amount of Social Security benefits depends on the amount of other income on the tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

In the case of scubar's error of failing to remove an override, that would have been caught by TurboTax's Smart Check. For the tax return to be filed that way the tax return would have to have been mailed, ignoring or overlooking TurboTax's flagging of this error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

Yes dmertz, I would have expected the smartcheck to have caught it as it has questioned overrides in the past. Guess I just missed it as I always use the smartcheck feature. In any event, I'll be more careful in the future.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

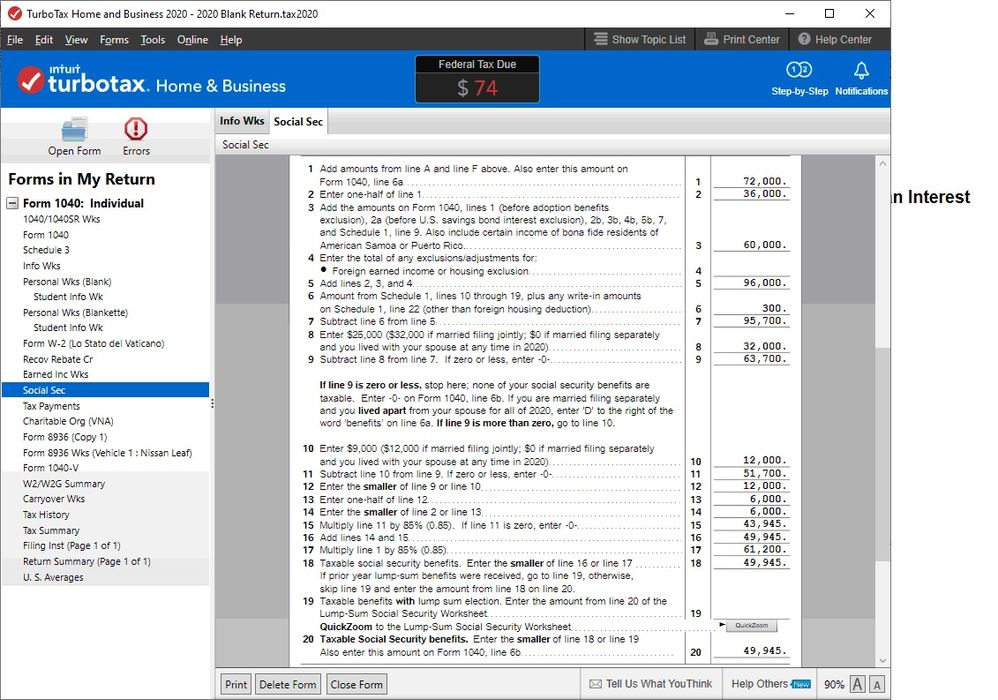

I have the same type of problem with my 2020 return. It placed my $300.00 Cash Charitable Contribution amount on line 6 of the TT Social Security Benefits Worksheet which reduced my taxable social security benefits.

When I go back and delete the $300.00 from "Deductions" section of where you input the figure, the amount then disappears from the SS Benefits Worksheet and the correct amount is displayed. Also, if I go and delete the $300.00 from the worksheet itself using the "Override" function then the correct taxable Social Security Benefit amount is displayed on the Worksheet. I verified the correct amount using the IRS Interactive Tax Assistant (ITA) program and both amounts were the same. TT has a problem and I have tried several times to explain the problem to TT to no avail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

Actually, this is correct. The confusion comes from the fact that when the IRS added the special above-the-line deduction for cash charitable contributions, that it did not update the wording in some of the forms and worksheets.

On the worksheet "Social Security Benefits Worksheet—Lines 6a and 6b" in the Instructions for the 1040, we see "Enter the total of the amounts from Form 1040 or 1040-SR, line 10b, Schedule 1, lines 10 through 19, plus any write-in adjustments you entered on the dotted line next to Schedule 1, line 22"

This language dates from the time that all adjustments to income were on lines 10-19 and on line 22 on Schedule 1.

But this new charitable contribution is also an adjustment to income - it's just not on Schedule 1, it's over on the 1040 itself.

But as an adjustment to income, it needs to be on line 6.

The Social Security worksheet in TurboTax is the same way. It says for line 6, "Amount from Schedule 1, lines 10-19, plus any write-in amounts on Schedule 1, line 22 (other than foreign housing deduction)", but as you see on the worksheet, the $300 contribution (if that's what you contributed) is included in line 6.

Here's how it looks on the TurboTax Social Security worksheet:

The problem would have been OK if the IRS had not added line 10b to form 1040, but instead told people to add the $300 to line 22 (Sch 1) as a write-in. Then the wording on the worksheets and the form would have matched.

But they didn't.

In any case, just realize that line 6 on the TurboTax worksheet and the IRS worksheet needs to include all adjustments to income (except, of course, for the foreign housing deduction).

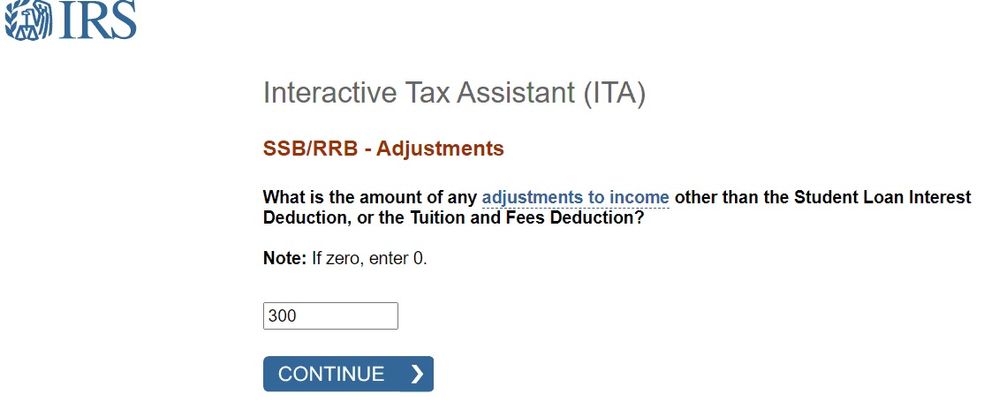

You can see this is you do this IRS Interactive Tax Assistant to determine how much of your Social Security is taxable. As you move through the interview, you will see this screen (near the end):

Since the $300 contribution is indeed an adjustment to income (it's included in line 10c ("total adjustments to income") on your 1040), you have to include here in the interview and on line 6 of the worksheets.

Make sense?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did turbo tax calculate the wrong social security taxable benefit amount for 2018?

BillM223, this makes no sense. Schedule A charitable deductions never affected the calculation of the taxable portion of Social Security benefits, so why should the deduction on Form 1040 line 10b do so? I think that the existing wording on line 6 of the IRS Social Security Benefits Worksheet in the instructions for Form 1040 is correct, no change needed, and your explanation is just rationalizing an actual bug in TurboTax.

Apparently someone at Intuit thought that because lines 10a and 10b get added together on Form 1040 that somehow the amount on line 6 of the worksheet that includes a subset of the items that contribute to the amount on Form 1040 line 10a should also include the amount from line 10b as well. That makes no sense; there is no justification for that.

"Adjustments to income" refers to specific items that are required to be entered directly on Schedule 1 line 22, not the amount on Form 1040 line 10b.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dsyhome0510

Level 3

godspropy

New Member

hjw77

Level 2

user17621839383

New Member

IronWomen

Returning Member