- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Actually, this is correct. The confusion comes from the fact that when the IRS added the special above-the-line deduction for cash charitable contributions, that it did not update the wording in some of the forms and worksheets.

On the worksheet "Social Security Benefits Worksheet—Lines 6a and 6b" in the Instructions for the 1040, we see "Enter the total of the amounts from Form 1040 or 1040-SR, line 10b, Schedule 1, lines 10 through 19, plus any write-in adjustments you entered on the dotted line next to Schedule 1, line 22"

This language dates from the time that all adjustments to income were on lines 10-19 and on line 22 on Schedule 1.

But this new charitable contribution is also an adjustment to income - it's just not on Schedule 1, it's over on the 1040 itself.

But as an adjustment to income, it needs to be on line 6.

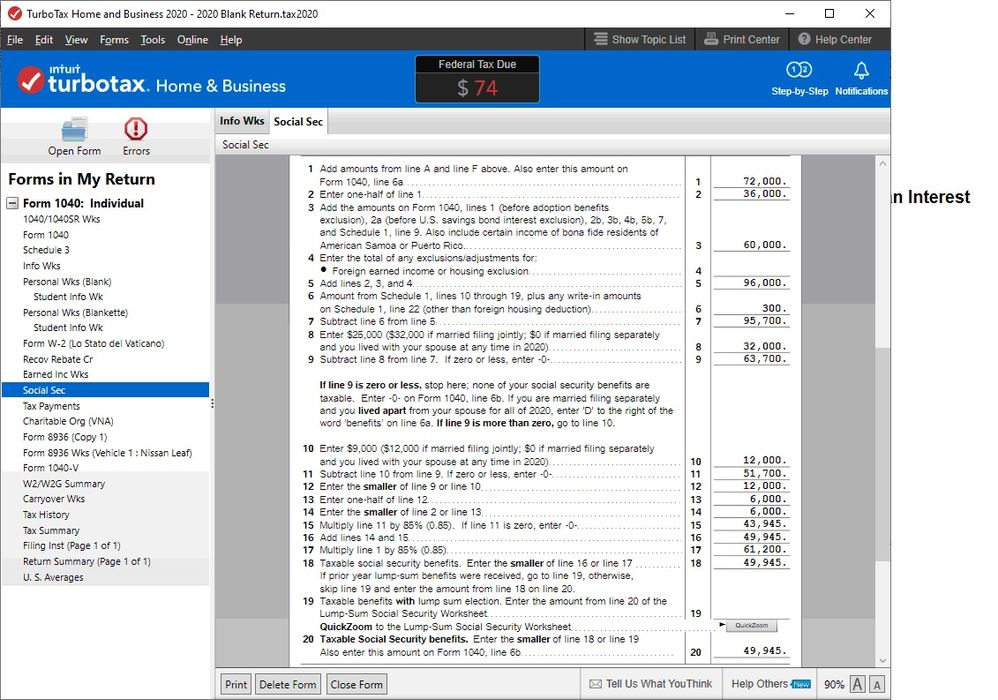

The Social Security worksheet in TurboTax is the same way. It says for line 6, "Amount from Schedule 1, lines 10-19, plus any write-in amounts on Schedule 1, line 22 (other than foreign housing deduction)", but as you see on the worksheet, the $300 contribution (if that's what you contributed) is included in line 6.

Here's how it looks on the TurboTax Social Security worksheet:

The problem would have been OK if the IRS had not added line 10b to form 1040, but instead told people to add the $300 to line 22 (Sch 1) as a write-in. Then the wording on the worksheets and the form would have matched.

But they didn't.

In any case, just realize that line 6 on the TurboTax worksheet and the IRS worksheet needs to include all adjustments to income (except, of course, for the foreign housing deduction).

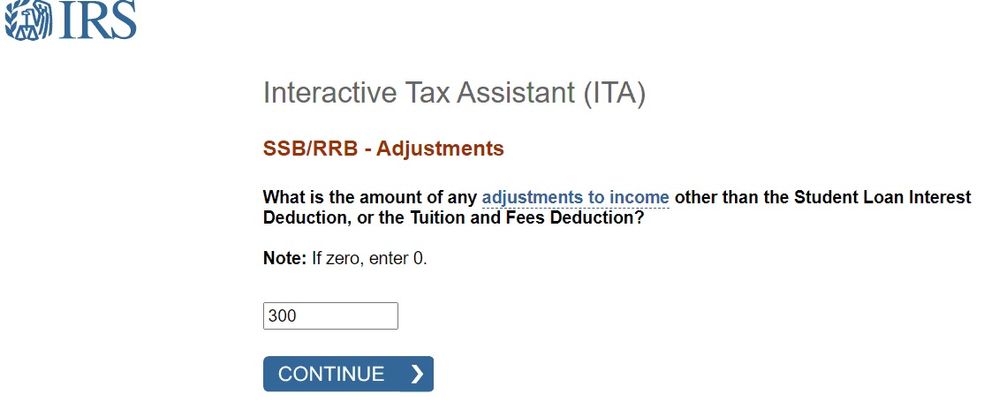

You can see this is you do this IRS Interactive Tax Assistant to determine how much of your Social Security is taxable. As you move through the interview, you will see this screen (near the end):

Since the $300 contribution is indeed an adjustment to income (it's included in line 10c ("total adjustments to income") on your 1040), you have to include here in the interview and on line 6 of the worksheets.

Make sense?

**Mark the post that answers your question by clicking on "Mark as Best Answer"