- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: How do I file a 1099-NEC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

Form 1099-NEC, Nonemployee Compensation, is currently only available as a draft IRS form.

It can't be filed yet.

Starting with payments made in 2020, non-employee compensation paid to independent contractors will need to be reported on Form 1099-NEC instead of in box 7 of

Form 1099-MISC.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

@ed_music_etc wrote:

This reply is untrue.

The reply was true on the date it was written.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

Form 1099-NEC, Nonemployee Compensation, is currently only available as a draft IRS form.

It can't be filed yet.

Starting with payments made in 2020, non-employee compensation paid to independent contractors will need to be reported on Form 1099-NEC instead of in box 7 of

Form 1099-MISC.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

This reply is untrue. The 1099-NEC is not a draft form. I've ordered them from the IRS, completed them, and administered them myself outside of Turbo Tax.

Your 1099-MISC form is the correct version, which was issued this year. A notice of this change was given in early 2020. This was no "draft" situation.

Moreover, the TurboTax Home and Business program CREATES them. How could your own product create a draft form?

So a better question: when will the product that we paid for be usable because it contains the correct 1099-NEC form? Or should I ask for a refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

@ed_music_etc wrote:

This reply is untrue.

The reply was true on the date it was written.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

I have installed Turbotax home and business and cannot find 1099 NEC. Where is it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

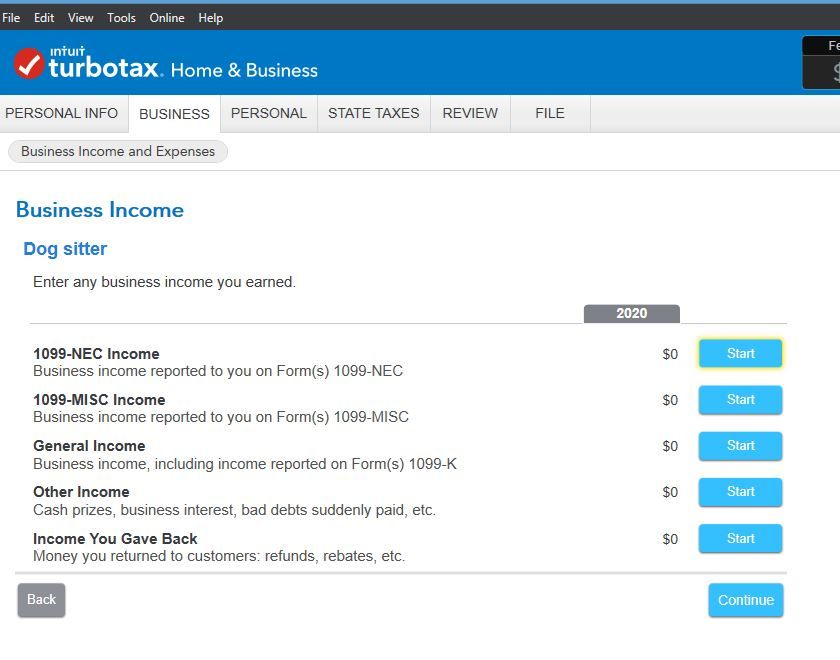

If you received a 1099-NEC, it is entered under Business Income and Expenses. You will need to enter your business information which will create your business profile. Once you have done that, you will find the entry under Business Income which will be within the Business Income and Expenses section. It goes in the same area as the 1099-MISC and 1099-K.

If you need to prepare 1099-NEC, you will see that option when you select ''Start New Tax Return''. @x1114804

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

If you are not showing 1099NEC income you need to update your program. It was just added on Jan 7. Are you on Windows? Go up to Online - Check for Updates. Or do you need to prepare a 1099NEC to give to someone you paid?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

FYI ... you NEVER have to enter all the individual 1099 forms in the Sch C income section ... doing so is for your use only and IMHO is a big waste of time since none of that info is sent to the IRS ... all they get on the Sch C is one total amount which you can enter yourself in the GENERAL income section as ONE entry and save yourself all the time and effort. If you enter your total annual income from your records you never have to wait for any 1099 forms to come in the mail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

I meant that I need to prepare 1099's. Sorry I wasn't clear.

Any help?

Please and thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

What version are you using Online or Desktop? Windows or Mac?

To prepare W2s or 1099NEC or 1099MISC you need to use the Online Self Employed version or buy the Desktop CD/Download Home & Business program or the separate Turbo Tax Business program.

How to prepare 1099NEC 1099Misc & W2

https://ttlc.intuit.com/community/forms/help/how-do-i-create-w-2-and-1099-forms-in-turbotax/00/25869

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

Oh, you said you do have the Desktop Home & Business program. For Windows or Mac? They work different. Have you updated the program?

You can do them 2 different ways from the Windows Desktop Home & Business program. Either Online using Quick Employer Forms (QEF) -or- directly on your computer with the built in W2/1099 Reporter.

In the Window's Home & Business Desktop program to Prepare W2s or 1099s, click the big blue button to Start a New Return or go up to File-New Tax Return.

Then on the next screen it asks What would you like to do?

If you get a screen with 2 choices, Check the second circle that says Prepare W-2s and 1099s for my employees or contractors. Then that will expand and give you a choice to prepare them online or on your computer.

If you get a screen that says Continue your Tax Return and a box listing your returns then go up to FILE - New Tax Return again and you should get a box to pick the type of return you need to prepare. Pick US Forms W-2/1099 Reporter

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

Why is there no way to file a 1099 NEC from TurboTax. When you finish the 1099's and hit continue, you get the print and save options, hit contnue adn then you get asked if you want to purchase Turbotax Advantage. I hit continue and it takes me to a Rate Turbotax page. Where is the file button? These are due tomorrow.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

@cas15531 Did you the Quick Employer Forms? If you used the Windows Home & Business program you could do them 2 ways, either online using Quick Employer Forms which efiles them or on your computer. If you did the forms on your computer you have to print and mail all the forms to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

Great question! HOW?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file a 1099-NEC

See this TurboTax support FAQ for Quick Employer Forms - https://ttlc.intuit.com/community/forms/help/how-do-i-create-w-2-and-1099-forms-in-turbotax/01/25869

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AsimAyyub

Level 2

allengootee

New Member

lionintexas

New Member

Ginxman681

New Member

amanda-ramsey96

New Member