- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 1099-R rollover from CARES Act is taxed when my spouse is selected

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

I am filing my taxes as Married Filing Jointly and my wife and I each took a distribution from our 401K this year and immediately rolled them over into IRAs with our financial advisor. Some of the distribution was Roth, and other was traditional so we each have 3 different 1099-Rs (6 total). I noticed the ones for my wife were being taxed, but mine were not. I compared them and noticed no differences; by a whim, I changed the question, "This Form 1099-R belongs to" from her name to mine and Turbo Tax treated all of the same information as not taxable, when my name was selected. Her 3 forms are the only ones that are showing as taxable and I don't know why... Is there something else I need to check or is there an issue with the software?

Thank you in advance for your help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

"That's interesting that the forms are different for Spouse." They shouldn't be. The developers simply goofed.

Since you were not permitted to take an in-service distribution to do a rollover in the normal fashion, it might be appropriate to report each as cashed-out (not rolled over), then report each as a CRD and a repayment. That should cause your tax return to include Forms 8915-E for both you and your spouse showing zero taxable. That would alleviate your concerns that the distributions were only permitted as CRDs.

Note, however, that each of you is permitted a maximum of $100,000 of CRDs.

I'm puzzled why you each received three Forms 1099-R instead of just two. I would have expected just one from the traditional account and just one from the Roth account for each of you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

I suggest deleting the 3 1099-R's and enter only one and see what is on the 1040 line 5b. If there is a taxable amount then what code in in box 7 on the 1099-R and what is in box 2a and box 5?

You need to establish which one is causing the problem and the reason for it.

If you rolled a 401(k) to a Roth IRA then that is a taxable conversion, not a rollover.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

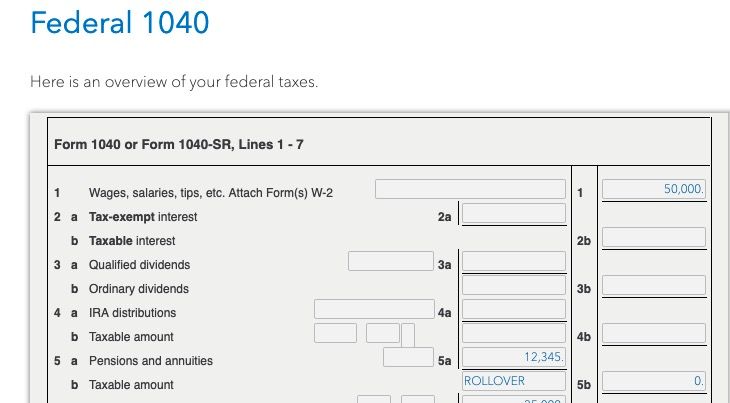

I deleted all 3 and then added one back to test it. You are correct that 1040 line 5b shows the taxable amount, only when my wife's name is selected - it does not appear when my name is selected.

Box 7 is distribution code 1 - Early distribution except Roth IRA, no known exception.

Box 2a shows the full amount that is in box 1, because this was a pre-tax 401k that was rolled into an IRA - no Roth conversion.

Box 5 shows 0.

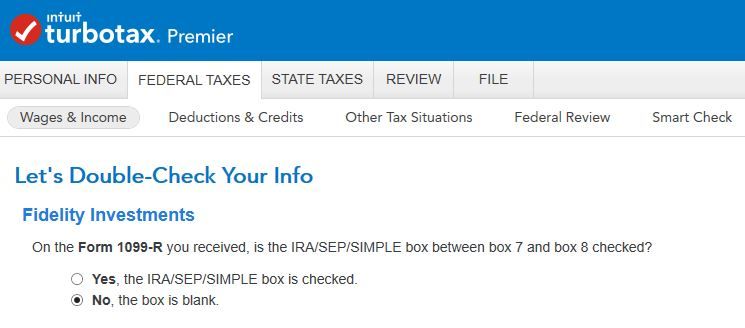

I have the same exact layout for my 1099-R distribution code 1, except mine are through Vanguard and hers are through Fidelity, which shouldn't make any difference. What I find really odd, is that I can uncheck the box on the 1099-R that says "If Spouse's 1099-R, check this box" and Turbo Tax does not tax it...

Thank you for your advise, but still stuck paying tax on hers when I shouldn't be.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

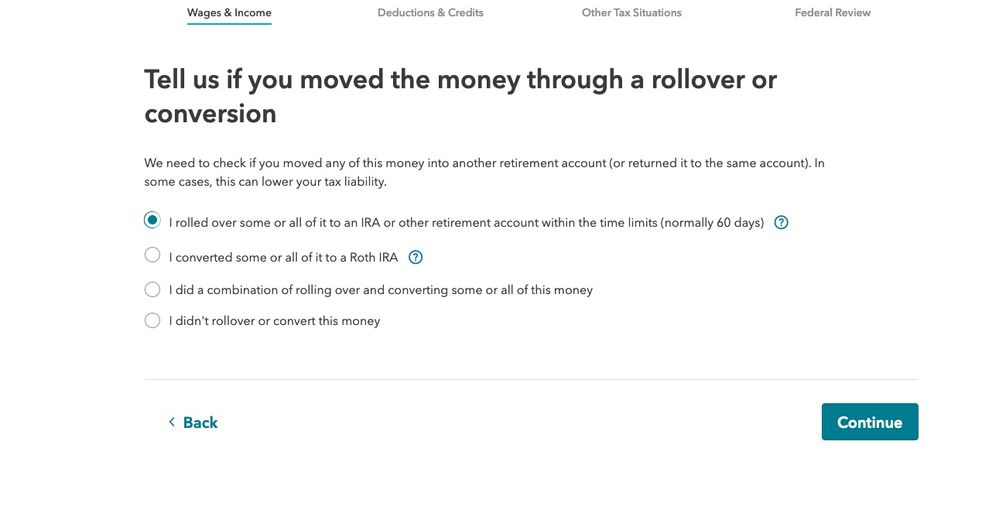

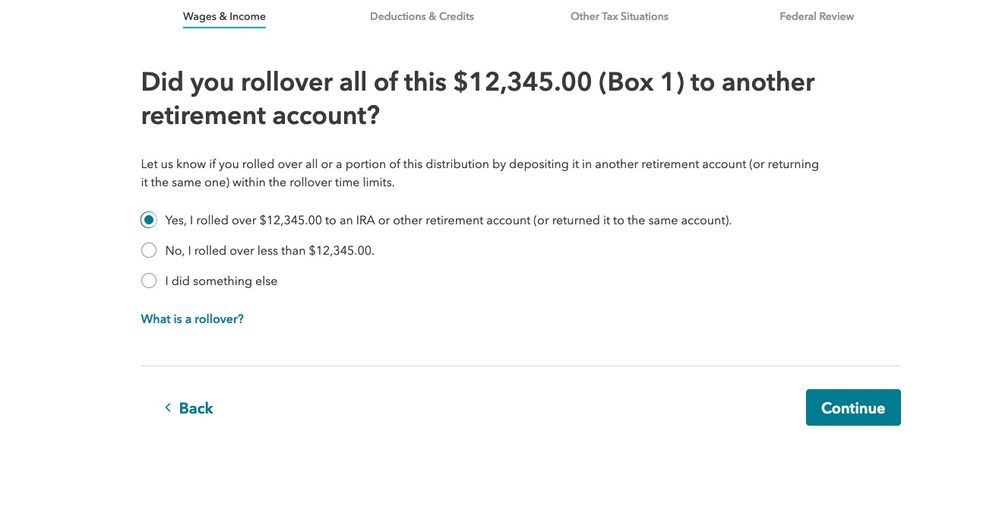

Then you did not answer the question yes to"Was is "moved" to another account" and then select that it was rolled over.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

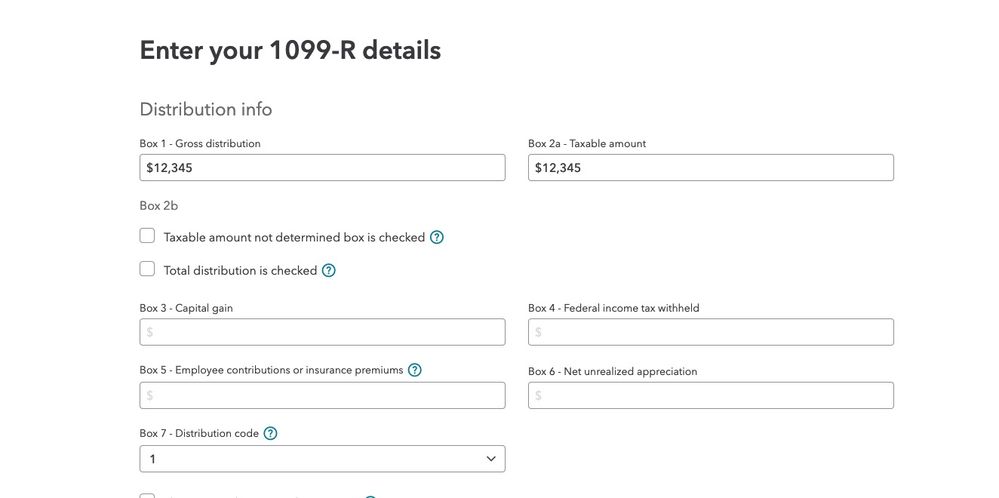

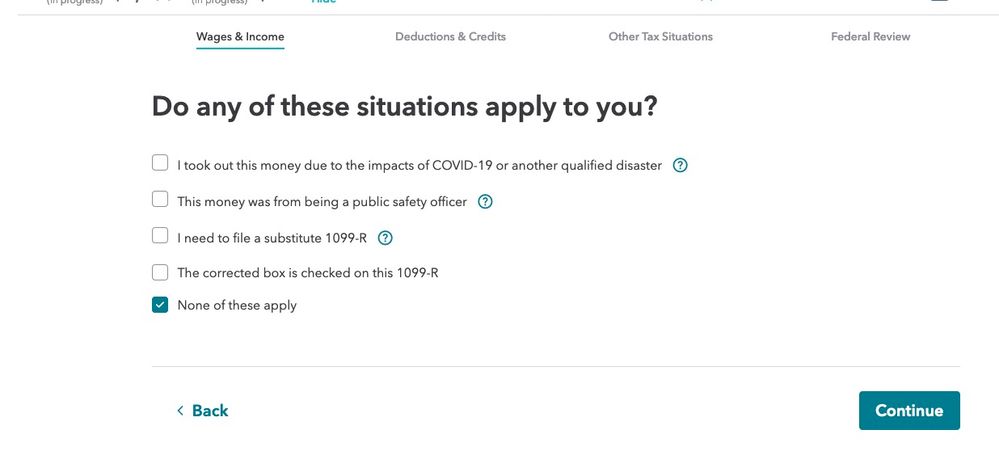

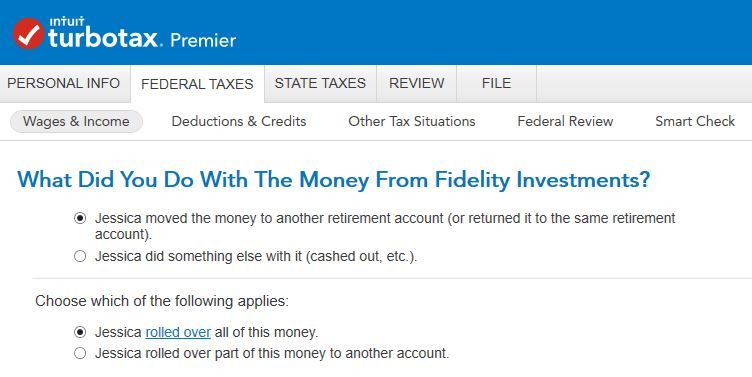

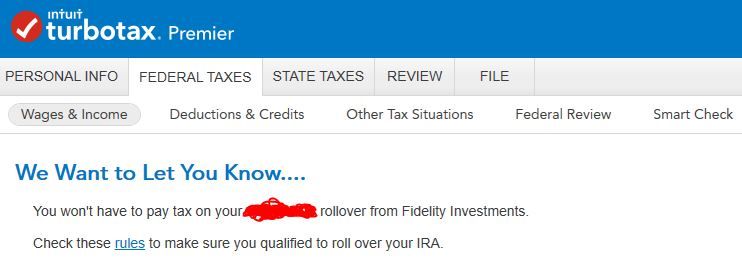

Your original post indicated you were using the online version or TurboTax so this is what it should look like.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

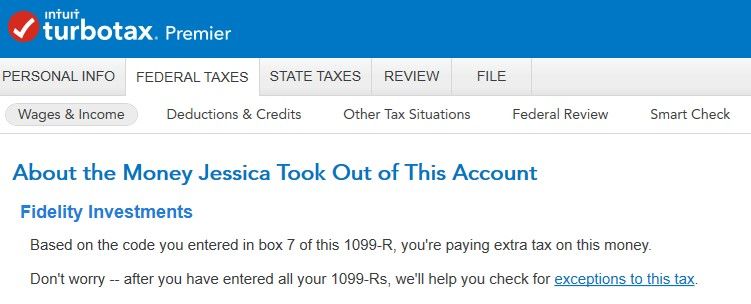

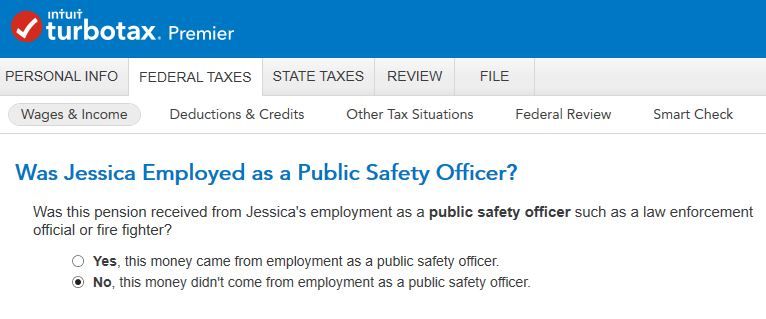

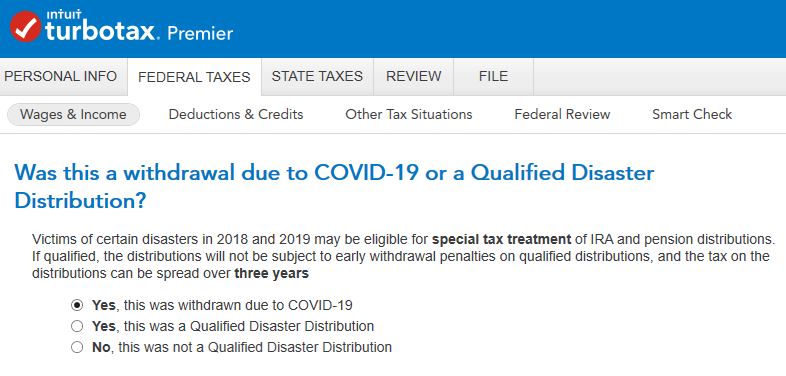

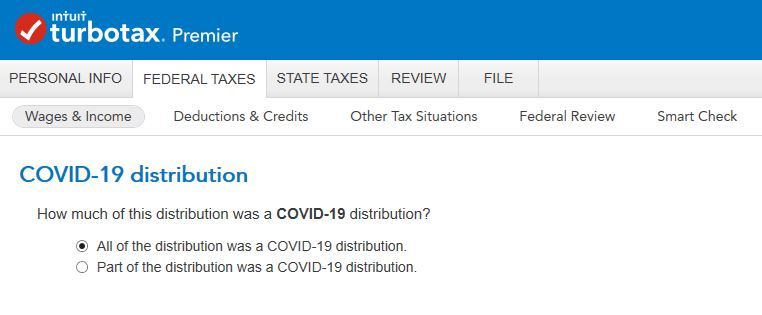

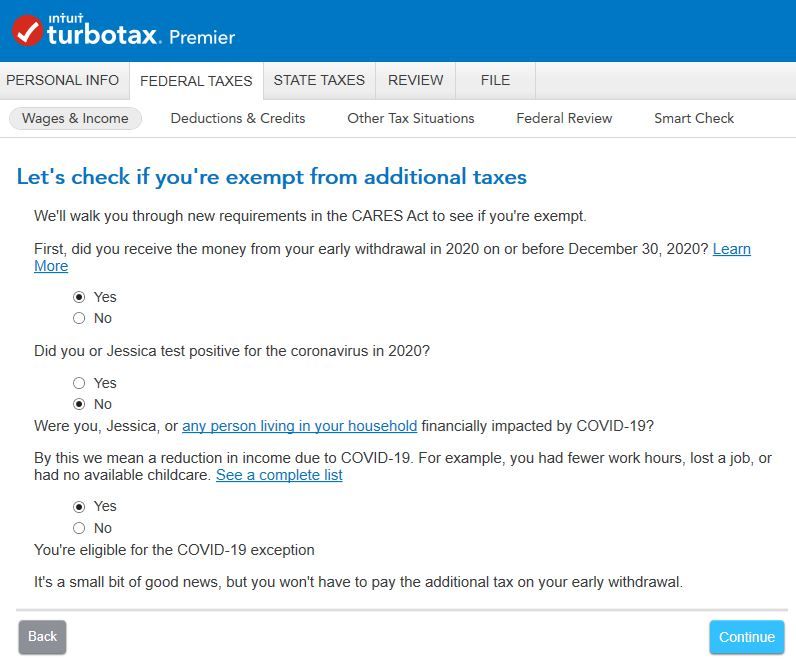

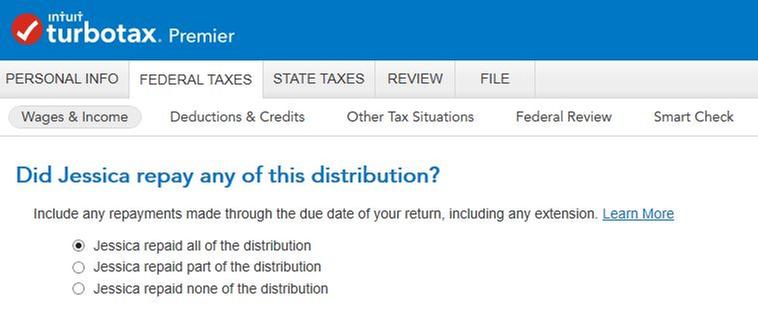

My mistake, I am not using the online version, I purchased online and downloaded it. Sorry for the confusion. Here are the screenshots of what I have entered. Let me know if I'm missing something.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

If you do a Rollover, there is no reason to indicate COVID-related.

COVID has nothing to do with it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

@fanfare wrote:

If you do a Rollover, there is no reason to indicate COVID-related.

COVID has nothing to do with it.

I agree answer the COViD question NO since a rollover is NOT a COVID related distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

fanfare identified the problem. Any portion of a distribution that is reported as rolled over (by an ordinary rollover) is not permitted to be reported as a Coronavirus-Related Distribution.

TurboTax developers apparently did fully not anticipate users making this mistake and ended up with slightly different implementations of Form 8915-E for Taxpayer and of Form 8915-E for Spouse. The implementation for Taxpayer recognizes that none of the distribution is actually a CRD and just treats it as an ordinary rollover but the implementation for Spouse does not entirely do so. For spouse it treats it as a taxable CRD but for the purpose of a repayment treats it as not a CRD and ignores the repayment. This is why switching the recipient changes the behavior.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

That's interesting that the forms are different for Spouse. The reason I selected COVID distribution is because my understanding from my financial advisor is that you cannot roll over a 401k if you are still employed with the company (which we both are) and the only reason we could initiate a rollover is because of the CARES Act and having been effected by COVID-19 financially allowed us to qualify.

I'm not sure if I would have any issued down the road if I don't select the COVID distribution as the reason for my wife, but at the same time, that CARES Act allowance was probably the only reason I could actually initiate a rollover from Fidelity and Vanguard so the hurdle is already passed. I'm definitely not paying taxes on a rollover that I did not convert to a Roth, haha.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

"That's interesting that the forms are different for Spouse." They shouldn't be. The developers simply goofed.

Since you were not permitted to take an in-service distribution to do a rollover in the normal fashion, it might be appropriate to report each as cashed-out (not rolled over), then report each as a CRD and a repayment. That should cause your tax return to include Forms 8915-E for both you and your spouse showing zero taxable. That would alleviate your concerns that the distributions were only permitted as CRDs.

Note, however, that each of you is permitted a maximum of $100,000 of CRDs.

I'm puzzled why you each received three Forms 1099-R instead of just two. I would have expected just one from the traditional account and just one from the Roth account for each of you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

Thank you for the advice! Our distributions were under $100k, so no issues on that.

My wife received 3 because she had one from another company she worked at part-time for a few months and had a 401k match (so no COVID claim there since she no longer works there). She had 2 with the code 1 on them.

I had 3 because on top of the pre-tax and roth distributions, I contributed to an After-Tax 401k during the year that was rolled into a Roth 401k to get more into a Roth position - Code G.

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

I suspected that one of the distributions might have been from an after-tax sub-account. This was a permissible distribution without being a CRD. Since it was done as a direct rollover, the code-G distribution needs to be reported as a rollover and not a CRD with repayment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

Agreed - that is how I filled out that 1099-R, distribution code-G.

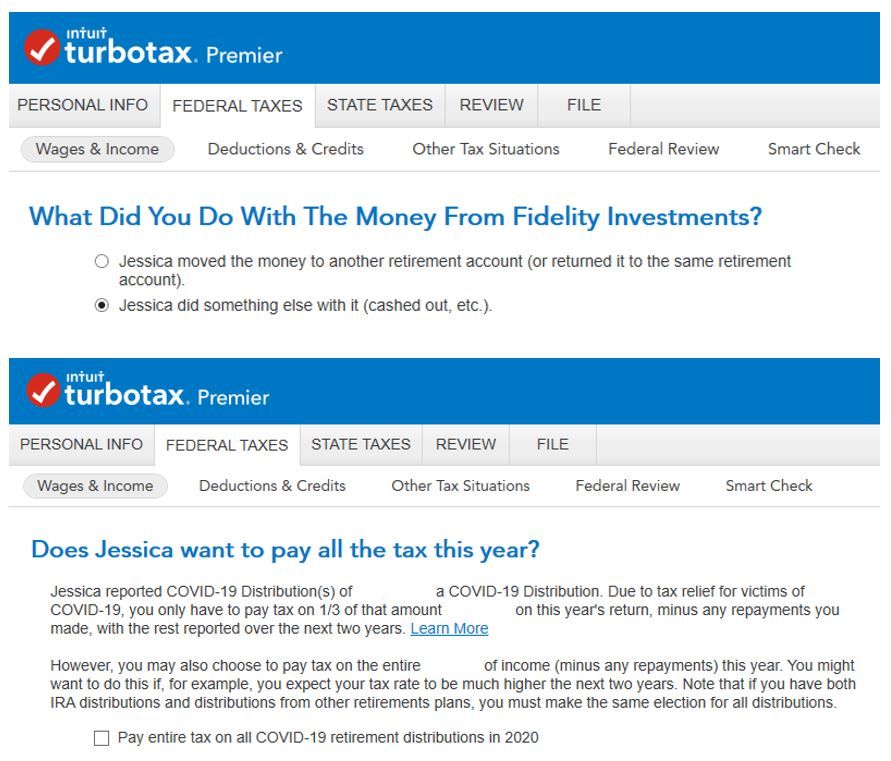

I was able to change my election to "Jessica did something else with it..." and that way did not tax me - along with still being able to designate the distribution as CRD. The only issue was when I finished entering all of the 1099-Rs, I received a question about all of her COVID-19 distributions being taxable and asked if I wanted to pay 1/3rd now, or all of it now. I selected all of it and nothing changed, so I think there is another bug in the software. Not sure if I should be worried about this later? At least it doesn't tax me now, which I shouldn't be taxed at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R rollover from CARES Act is taxed when my spouse is selected

You'll want to indicate that you choose to have all of the income included on your 2020 tax return, otherwise you'll needlessly have to include Forms 8915-E with your 2021 and 2022 tax returns to show the portions of income deferred to those years even though they've already been repaid, just to show the repayment again. By choosing to have all included on your 2020 tax return, nothing carries forward.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Engineer101

Level 2

adeanegol

New Member

chinyoung

New Member

basedday

New Member

StonecoldMike

Returning Member