- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Agreed - that is how I filled out that 1099-R, distribution code-G.

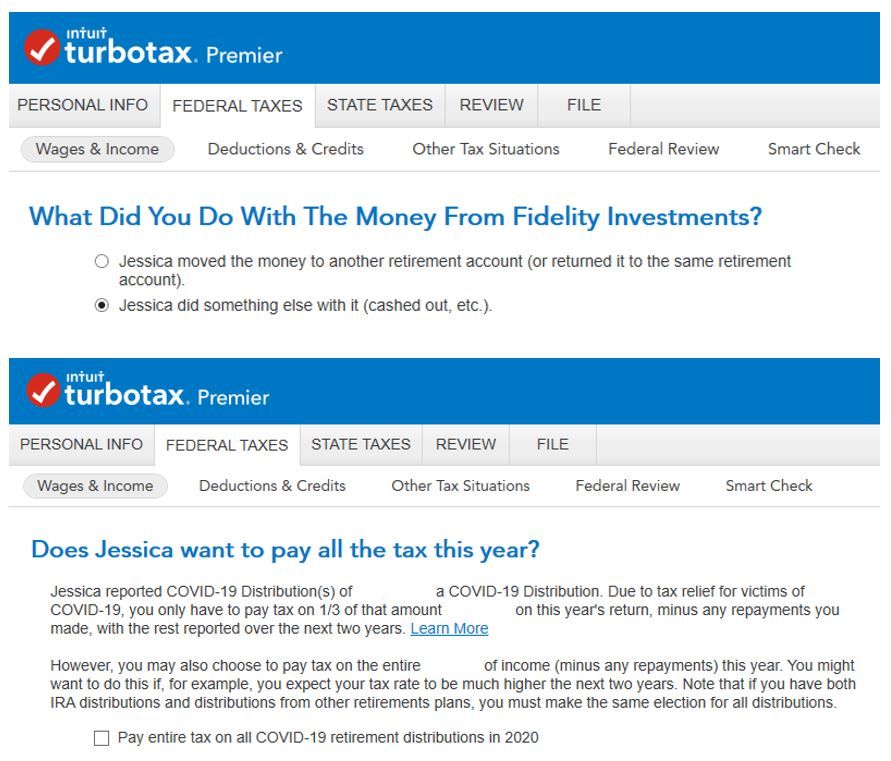

I was able to change my election to "Jessica did something else with it..." and that way did not tax me - along with still being able to designate the distribution as CRD. The only issue was when I finished entering all of the 1099-Rs, I received a question about all of her COVID-19 distributions being taxable and asked if I wanted to pay 1/3rd now, or all of it now. I selected all of it and nothing changed, so I think there is another bug in the software. Not sure if I should be worried about this later? At least it doesn't tax me now, which I shouldn't be taxed at all.

April 12, 2021

11:15 AM