- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

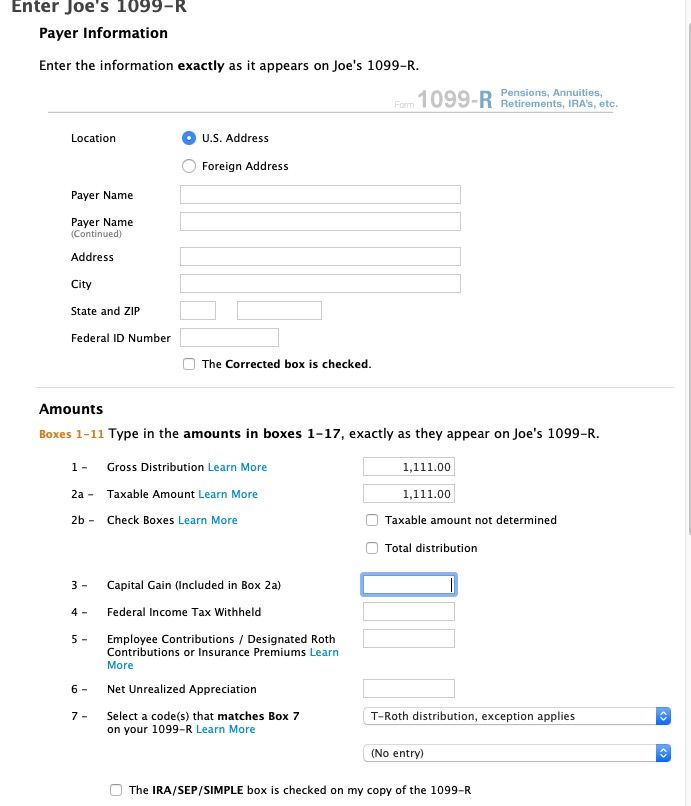

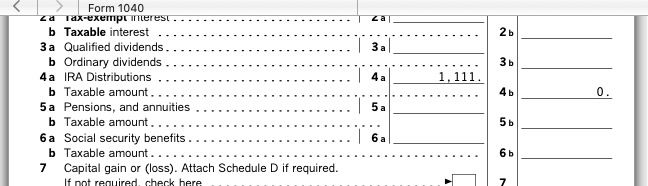

Code T indicates there is no penalty because an exception applies. Some financial companies use code T instead of code Q when reporting such distributions on Form 1099-R, but since you know that it has been more than 5 years since the Roth IRA was established, code T gets the same tax treatment as code Q, entirely nontaxable and reported only on Form 1040 line 4a. In TurboTax, the taxable amount of this distribution is $0.

TurboTax will walk you through this. You will need TurboTax Online Deluxe and the software will walk you through the change.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

Thanks @DianeW777!

I have another question regarding an inherited Traditional IRA. I inherited this IRA 8yrs ago and this is the first yr I was asked whether I need to fill out form 8606. And If the IRA had a basis? I was never asked this before. How would someone know if there was a basis? If there is no way to find out at this point what do you do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

The only way to know if there was a basis would be from old tax returns showing the 8606. Without that form, you can't prove basis. You can get a tax transcript and see if there is an 8606 in there. It will also show the distributions and tax return so you can see if there is a difference. Most people do not have a basis, but some do. See About Form 4506-T, Request for Transcript of Tax Return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

Thanks @AmyC!

If I am requesting a transcript I would have to ask for every yr that acct holder had the IRA. Is that correct?

Also, what would be a scenario where someone chooses to have a basis/8606?

And in the event I found out they did, I would then have to amend all the yrs I didn’t use the basis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

@t231 wrote:

Thanks @AmyC!

If I am requesting a transcript I would have to ask for every yr that acct holder had the IRA. Is that correct?

Also, what would be a scenario where someone chooses to have a basis/8606?

And in the event I found out they did, I would then have to amend all the yrs I didn’t use the basis?

1) You only need the last filed 8606, but an 8606 is only filed if there was a distribution from the IRA or a new non-deductible contribution was made.

2) Usually income too high to deduct when covered by a retirement plan at work. Otherwise there is little reason to make a nondeductible contribution to a Traditional IRA when a Roth IRA is always non deductible an has many other advantages.

3) Yes, if you had other distributions.

It is unusual for an inherited IRA to have any meaningful basis that would make more then a few dollars savings.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

Turbotax Premier certainly doesn't walk you through this bug in the software. I wasted hours trying to figure out why an obviously non-taxable, Roth distribution that I inherited 10 years ago even though Turbotax asked for the name of the deceased and the year I inherited it (2012). Apparently the software isn't smart enough to know that 2012 is more than 5 years ago. Eventually, I typed in a zero in box 2A of the imported 1099-R. I'm not sure what the IRS will think about tinkering with a downloaded 1099-R but it's the only way I found to fix the problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

@agent86 wrote:

Turbotax Premier certainly doesn't walk you through this bug in the software. I wasted hours trying to figure out why an obviously non-taxable, Roth distribution that I inherited 10 years ago even though Turbotax asked for the name of the deceased and the year I inherited it (2012). Apparently the software isn't smart enough to know that 2012 is more than 5 years ago. Eventually, I typed in a zero in box 2A of the imported 1099-R. I'm not sure what the IRS will think about tinkering with a downloaded 1099-R but it's the only way I found to fix the problem.

The code that the payer put in box 7 tells it how to do that. What code in in box 7 on your 1099-R and is the IRA/SEP/SIMPLE box checked or did you check it by mistake?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

@agent86 Yes exactly! It wasn’t asking the proper questions so that the return would reflect a non-taxable distribution.

Funny enough, the IRS FREE FILE version of yrs past asked whether the ROTH was held for 5yrs which made it non taxable but the paid deluxe version doesnt! Which is ridiculous.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

The code in box 7 is "T," and the IRA/SEP/SIMPLE box is NOT checked. I did see that the T code was probably causing a problem and I don't know why my broker used it so I will discuss this with them. However, I think the Turbotax questions following 1099-R entry should have resolved the problem.

On another note, I've been using Turbotax for many years while doing IRA/Roth contributions, rollovers, conversions, and distributions. Not once has this software generated a form 8606 so there is no way for me to go back now for the purpose of accurately determining the basis of my several accounts. In retrospect, I should have used a pro.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

@agent86 wrote:

The code in box 7 is "T," and the IRA/SEP/SIMPLE box is NOT checked. I did see that the T code was probably causing a problem and I don't know why my broker used it so I will discuss this with them. However, I think the Turbotax questions following 1099-R entry should have resolved the problem.

On another note, I've been using Turbotax for many years while doing IRA/Roth contributions, rollovers, conversions, and distributions. Not once has this software generated a form 8606 so there is no way for me to go back now for the purpose of accurately determining the basis of my several accounts. In retrospect, I should have used a pro.

Code T means that it is a qualified distribution but the 1099-R issuer does not know if the 5 year rule has been met so TurboTax must ask the questions. If you have owned the IRA for more then 5 years then the plan administrator must know that the 5 year rule has been met and the code should have been a "Q" (that means a qualified distribution and the 5 year rule has been met) . Complain to the plan administrator that issued the 1099-R with the wrong code.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

@macuser_22 I have had an inherited ROTH IRA for 8yrs. The plan administrator refuses to change the code. Most banks won’t and will use code “T” yr after yr. It’s on the person to make sure its not taxed and the software should ask the 5yr rule.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

[Edited]

@t231 , simply enter a zero in box 2a of TurboTax's 1099-R form to indicate that the distribution from the inherited Roth IRA is nontaxable. It's a TurboTax requirement that you explicitly indicate the taxable amount this way for a distribution from an inherited Roth IRA when there is code T in box 7.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

Per your advice, I complained to my broker and they said that they are not tax advisors and can not make a determination as to whether any distribution is taxable so they use code T rather than Q in box 7. It is up to me and my tax advisor (i.e. Turbotax) to make that determination. Turbotax is not asking the right questions to properly indicate that the distribution is non-taxable. Again, the only way to get the numbers right is to manipulate the 1099-R. That is clearly a bug in the software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

@agent86 wrote:

Per your advice, I complained to my broker and they said that they are not tax advisors and can not make a determination as to whether any distribution is taxable so they use code T rather than Q in box 7. It is up to me and my tax advisor (i.e. Turbotax) to make that determination. Turbotax is not asking the right questions to properly indicate that the distribution is non-taxable. Again, the only way to get the numbers right is to manipulate the 1099-R. That is clearly a bug in the software.

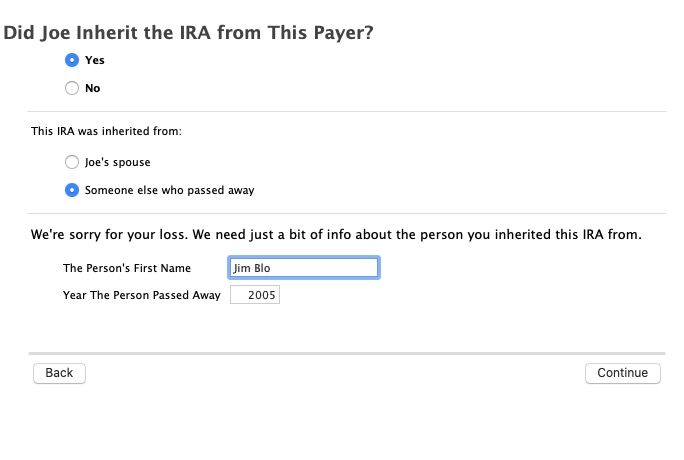

See @dmertz post about just entering zero in box 2a but when I do it and indicate the IRA owner died more then 5 years ago then the taxable amount is zero reguardless of the box 2a amount. TurboTax does seem to account for that. The 1040 line 4b is zero. See my screenshots - what are you doing that is different?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-R for my Roth IRA distribution shows the code " T " in box 7. What gives?

@t231 wrote:

@macuser_22 I have had an inherited ROTH IRA for 8yrs. The plan administrator refuses to change the code. Most banks won’t and will use code “T” yr after yr. It’s on the person to make sure its not taxed and the software should ask the 5yr rule.

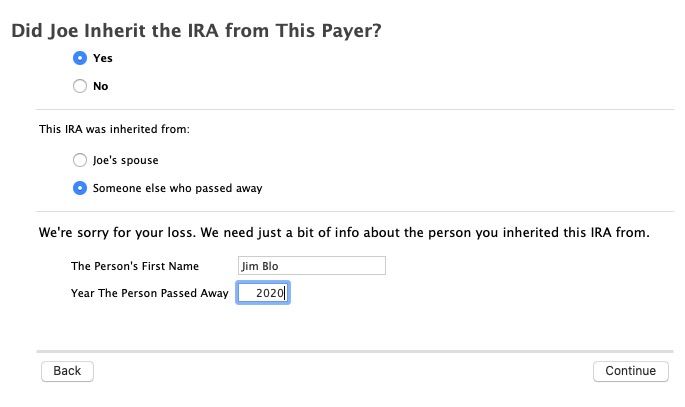

In addition to the screenshots I posted below, if you say the IRA owner dies less than 5 years then it does ask if the owner owned the IRA more then 5 years.

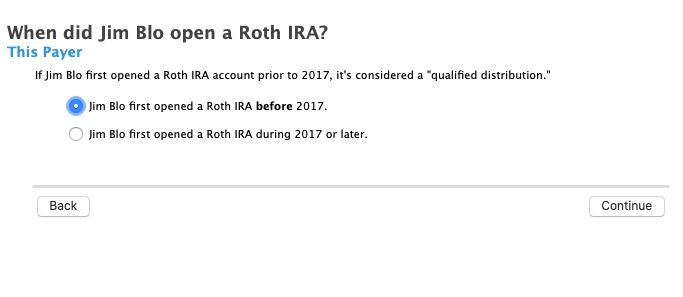

Here are screenshots for that. The 1099-R is the same as above and the 1040 line 4b is again zero. But when I say the owner died in 2020 then it asks of the owner opened an IRA before 2017 (5 years ago).

Code T triggers those questions so TurboTax does account for both cases.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tswilson

New Member

Soraya123

New Member

carijobailey8338

New Member

jlmarre

New Member

Lance31359

New Member