- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@t231 wrote:

@macuser_22 I have had an inherited ROTH IRA for 8yrs. The plan administrator refuses to change the code. Most banks won’t and will use code “T” yr after yr. It’s on the person to make sure its not taxed and the software should ask the 5yr rule.

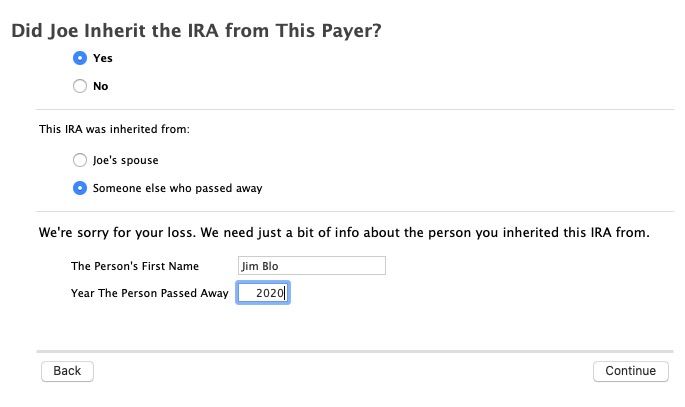

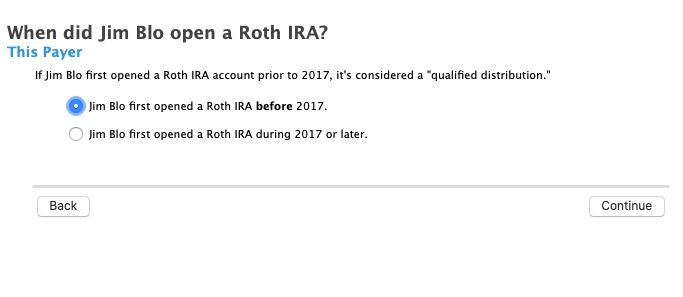

In addition to the screenshots I posted below, if you say the IRA owner dies less than 5 years then it does ask if the owner owned the IRA more then 5 years.

Here are screenshots for that. The 1099-R is the same as above and the 1040 line 4b is again zero. But when I say the owner died in 2020 then it asks of the owner opened an IRA before 2017 (5 years ago).

Code T triggers those questions so TurboTax does account for both cases.

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

March 21, 2022

8:52 AM