- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@agent86 wrote:

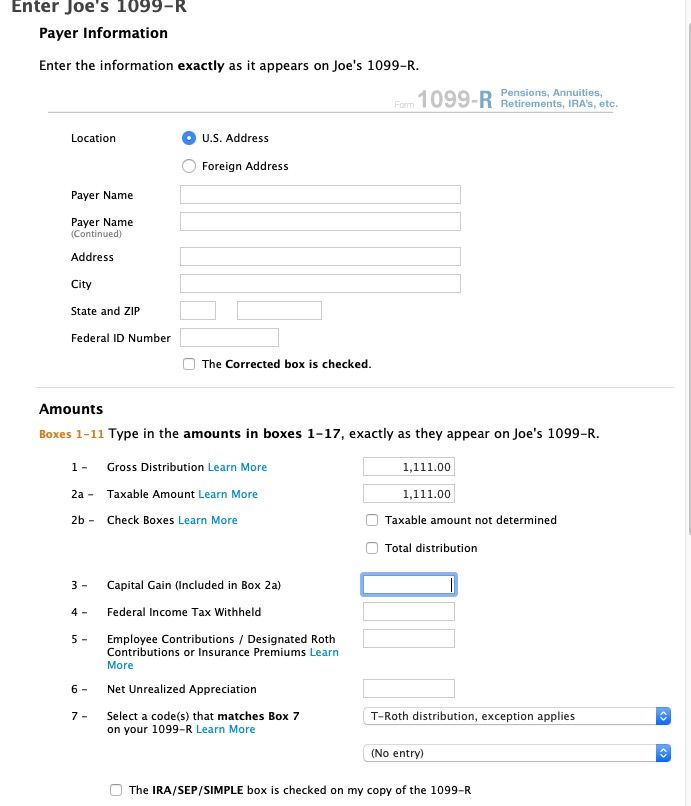

Per your advice, I complained to my broker and they said that they are not tax advisors and can not make a determination as to whether any distribution is taxable so they use code T rather than Q in box 7. It is up to me and my tax advisor (i.e. Turbotax) to make that determination. Turbotax is not asking the right questions to properly indicate that the distribution is non-taxable. Again, the only way to get the numbers right is to manipulate the 1099-R. That is clearly a bug in the software.

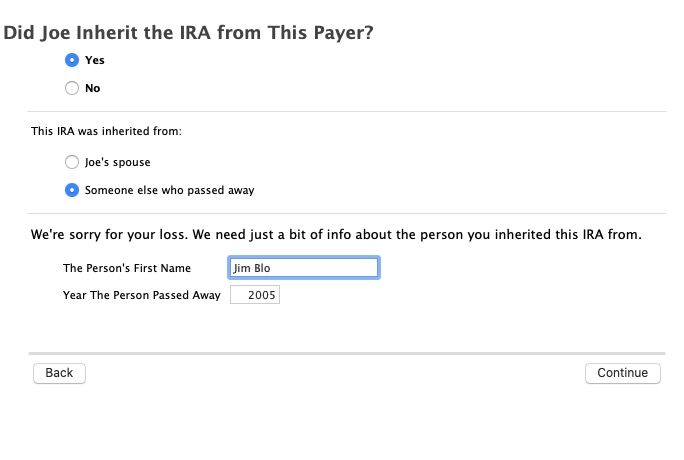

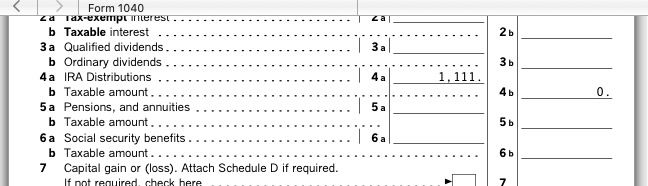

See @dmertz post about just entering zero in box 2a but when I do it and indicate the IRA owner died more then 5 years ago then the taxable amount is zero reguardless of the box 2a amount. TurboTax does seem to account for that. The 1040 line 4b is zero. See my screenshots - what are you doing that is different?