- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

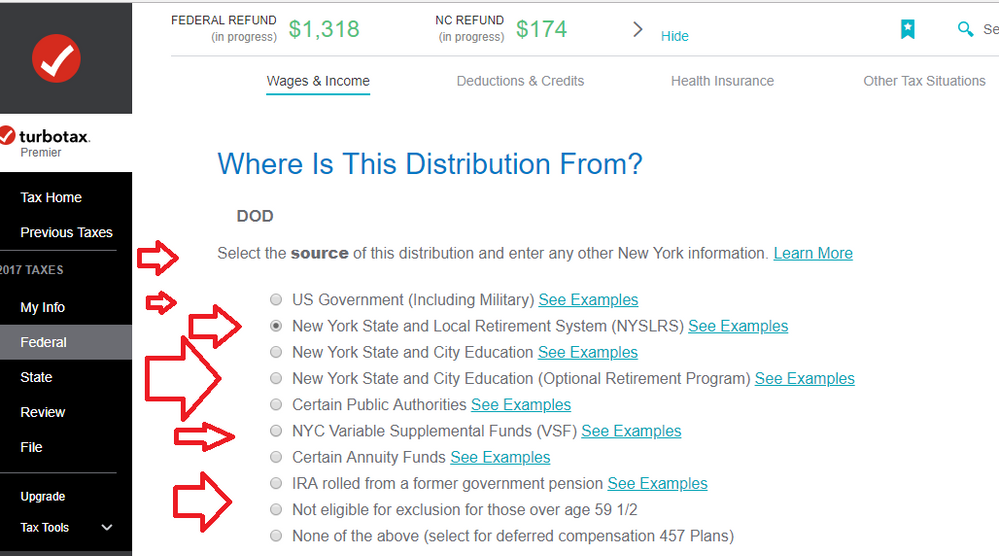

Now, if you DO have to file your state tax forms, but the state tax forms seem to be calculating a tax on your state-exempt pension...then you may not have tagged that 1099-R as being from a valid a state-exempt pension. You would need to tag it properly as your own state's pension either:

a) during the entry of the 1099-R as it is entered in the Federal section in the state section (example_1 for NY shown below)

...or

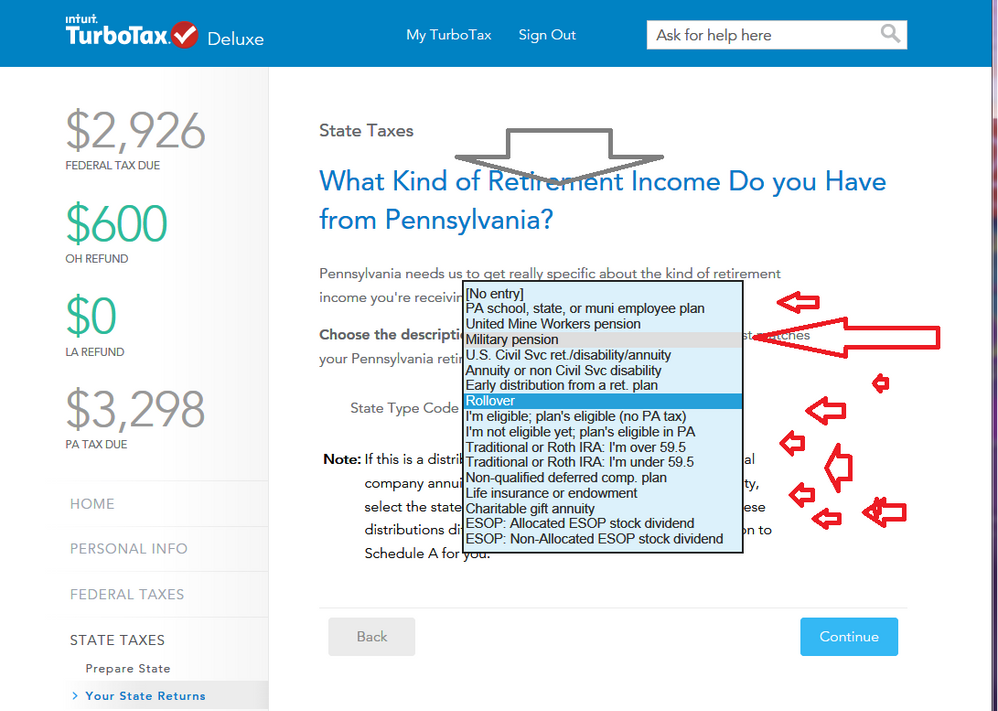

b) a few states, like PA, delay the tagging until you go thru the state interview (example 2 shown below):

______________________

Example 1

________________

Example 2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

Being retired from the state does not necessarily exempt you from "filing" state taxes. Many states that exempt their own former employees retirement income from being taxed by that same state, still require them to "File" the state forms if their Federal AGI is greater than some $$ amount,,,,,and the Federal AGI includes that retirement income.

Anyhow, you can delete the state forms in the state tax section, and then e-file the Federal without paying for the state. But if you do find you have to file your state later, you will have to pay for it then......or if too late (after October), you'll end up having to buy/use the desktop software

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

Thanks for the response. I should have made it clear that I retired from the state. Having been been a state employee, once retired, only Federal taxes are assessed on the retirement pay. Hence, only Federal taxes are filed. Also, I did e-file using Turbo Tax (TT) but could not get around deleting the state portion TT calculated and only pay the Federal taxes owed, file and be done. Any advice how to use TT free filing to e-file Federal Taxes only?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

You need to carefully re-read what I wrote

......You may still be required to "FILE" your state taxes, even if you don't owe the state for that state pension. Many states require their own retirees to "file" even if they don't tax that pension (even if you owe your state nothing) ... and that state filing requirement is usually based on your Federal AGI.. But you'd have to read the tax requirements again for your own state.

_______________________

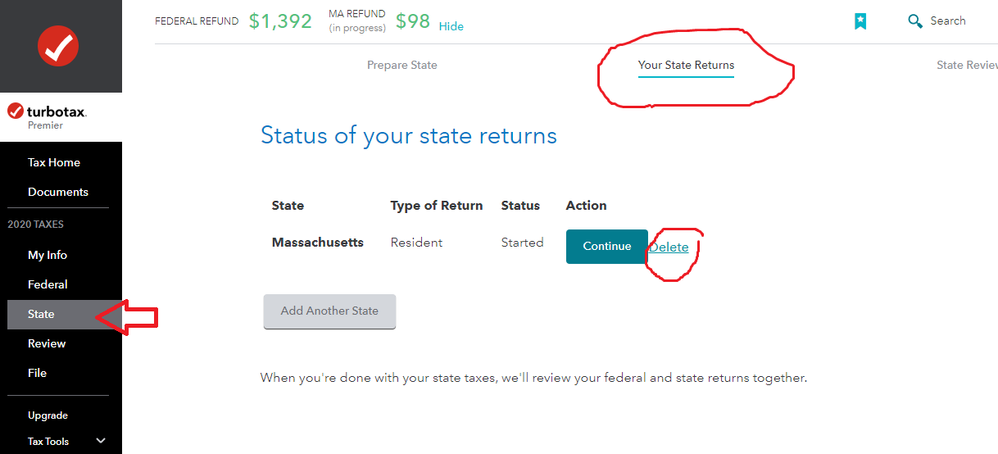

To get rid of the state forms, you first have to start going thru some of the state questions, then return to the beginning of the state area and delete the state....then proceed to file only the Federal.

But if you've already filed just the Federal part, without filing the state, you may not be able to delete the state forms......that must be done before you actually file anything.

______________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

Now, if you DO have to file your state tax forms, but the state tax forms seem to be calculating a tax on your state-exempt pension...then you may not have tagged that 1099-R as being from a valid a state-exempt pension. You would need to tag it properly as your own state's pension either:

a) during the entry of the 1099-R as it is entered in the Federal section in the state section (example_1 for NY shown below)

...or

b) a few states, like PA, delay the tagging until you go thru the state interview (example 2 shown below):

______________________

Example 1

________________

Example 2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

Thanks for the thorough replies and screenshots which I am sure will be helpful to others in my situation.

I'm afraid once going through the Free Option of Turbo Tax efile, I did not come across the steps where I would have been able to input the source of my retirement which would have then prompted the system to eliminate the State portion and allow me to complete and file my straight forward 1040 with standard deduction. I did not purchase purchase Turbo Tax Deluxe this year because I found my itemized deductions of last year and the year before did not exceed the standard deduction. Hence, I decided against purchasing the deluxe version which would have given me the flexibility to simply not file the state portion. I must point out that at some point during the filing, the system asked my AGI of last year. Even though, I had retained a pdf copy of my return from l last year on my PC, once I attempted to open the document done with the previously installed and validated Deluxe version, Turbo Tax much to my surprise, required the product key of the software which of course I did not have handy! The free efile version processed with information from a 1099 which is all I had, notwithstanding the promotional assistance offers during the filing, turned out uneventful in my case. However, I did end up printing out my completed 1040 processed via the free efile version and mailing it with my payment to IRS on time. Filling out a form and submitting the return via snail mail in a straight forward case like mine may prove to be less timely. That's how I used to do things--all by hand. I still try.

Best regards

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

I’m trying to use TurboTax but it quit. How to finish this and deduct medicsl expenses and religious contributions too

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

I’m retired and I receive ssa retirement I’m paying an overpayment how do I add that? Also how do I deduct religious contributions over 300$ and medical/dental expenses over 1,000$ a year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

@bwierdra You say that you are retired and that you collect Social Security. You do not mention whether you have any other income besides the Social Security. If the SS is your only income then you are not required to file a tax return.

If you have other income from which tax is being withheld then you might need to file in order to seek a refund---or to get the stimulus payments if you have not yet received them.

As for entering deductions for donations and/or medical expenses----itemized deductions do not have any effect unless you have enough to exceed your standard deduction. The medical deduction is especially difficult to use since you have to meet a very tough threshold. $1000 of medical/dental expenses will not have any effect.

If you gave $300 in contributions to your church you can enter that.

In order to take this above-the-line deduction, enter your donation(s) under Deductions & Credits > Charitable Donations > Donations to Charities in 2020. The deduction will be added above-the-line by TurboTax after you have completed the Wrap up tax breaks interview in TurboTax if you take the Standard deduction.

On your form 1040, this deduction appears on line 10b - Charitable contributions if you take the standard deduction.

STANDARD DEDUCTION

Many taxpayers are surprised because their itemized deductions are not having the same effect as they did on past tax returns. The new higher standard deduction and the elimination of certain deductions, as well as the cap on state and local taxes have had a major impact since the new tax laws went into effect beginning with 2018 returns.

Your itemized deductions have to be more than your standard deduction before you will see a change in your tax owed or tax refund. The deductions you enter do not necessarily count “dollar for dollar;” many of them are subject to meeting tough thresholds—medical expenses, for example, must meet a threshold that is pretty hard to reach. (Only the amount that is MORE than 7.5% of your AGI counts) The software program uses all the IRS rules that apply to the expenses you enter, and it tells you if you have enough to use your itemized deductions or if using the standard deduction is more advantageous for you. Under the new tax laws, some deductions have been capped—there is a $10,000 limit to the itemized deductions for state, local, property and sales taxes.

Your standard deduction lowers your taxable income. It is not a refund. You will see your standard or itemized deduction amount on line 12 of your 2020 Form 1040.

2020 Standard Deduction Amounts

Single $12,400 (+ $1650 65 or older)

Married Filing Separate $12,400 (+ $1300 if 65 or older)

Married Filing Jointly $24,800 (+ $1300 for each spouse 65 or older)

Head of Household $18,650 (+ $1650 for 65 or older)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

We are retired. ages 76 & 77. PA does require seniors over 70 to pay income tax. I have been using Turbotax for many years. This year has been a disaster. Had to call grandson to install program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

@sharon4526 You have not asked a question. Do you have a question about your tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

Pensions were not earned in PA. We lived in Maryland. My husband was a police officer .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

@sharon4526 Where the pension money is being sent from now is not relevant. You live in PA. You do not need to pay MD tax on the pension. You do need to enter the 1099R into your federal tax return, though.

To enter your retirement income, Go to Federal> Wages and Income>Retirement Plans and Social Security>IRA 401 k) Pension Plan Withdrawals to enter your 1099R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I do not pay state taxes, since I am retired from state. how do i finish filing by paying federal taxes?

We have been in PA for 5 years now. We have never paid PA income tax. I have been purchasing the TurboTax

CD for 10 yrs plus. Those over 70 are not require to pay income tax in PA, which is why we moved here. We are 76 & 77. However, they do charge us an enormous amount of School Tax. Amen

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sakilee0209

Level 2

bobfrazz1019

New Member

decoflair

Level 1

user17524531726

Level 1

YardDog1

Level 2