- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

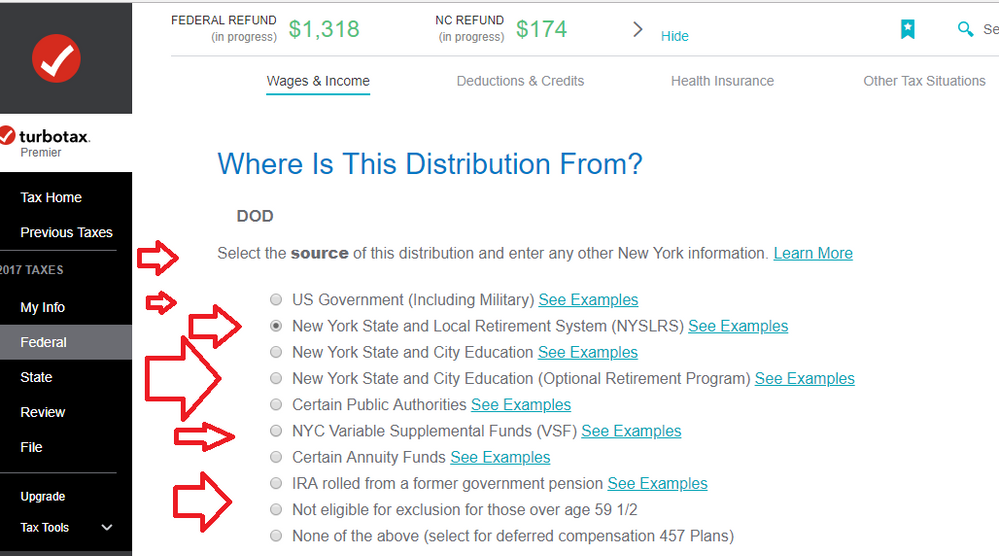

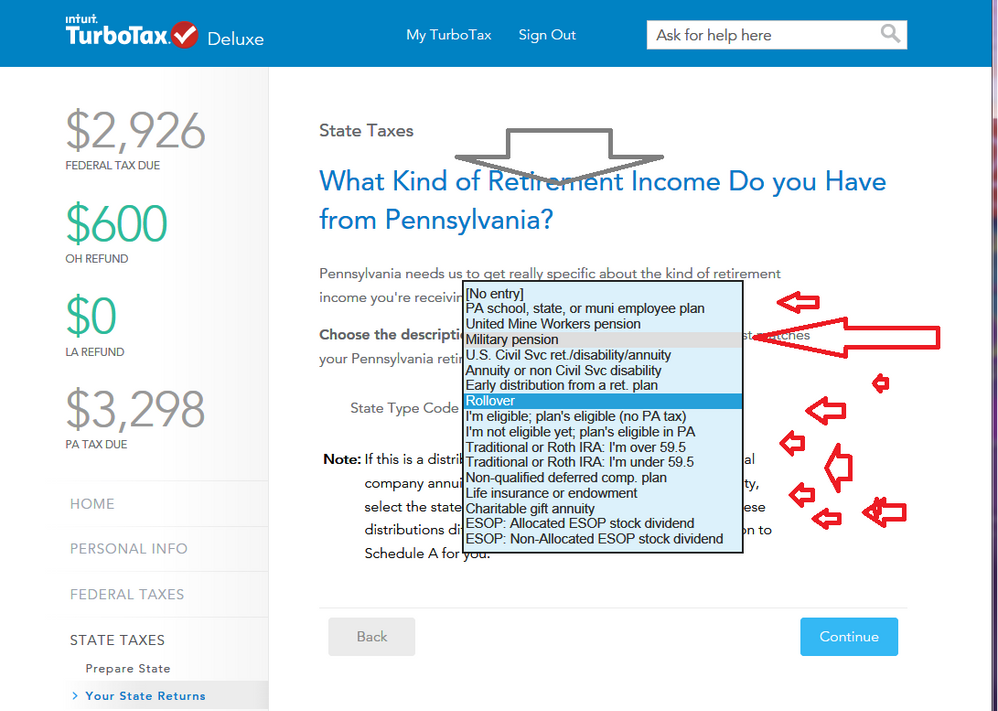

Now, if you DO have to file your state tax forms, but the state tax forms seem to be calculating a tax on your state-exempt pension...then you may not have tagged that 1099-R as being from a valid a state-exempt pension. You would need to tag it properly as your own state's pension either:

a) during the entry of the 1099-R as it is entered in the Federal section in the state section (example_1 for NY shown below)

...or

b) a few states, like PA, delay the tagging until you go thru the state interview (example 2 shown below):

______________________

Example 1

________________

Example 2

____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

May 14, 2021

7:13 AM