- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

You need to carefully re-read what I wrote

......You may still be required to "FILE" your state taxes, even if you don't owe the state for that state pension. Many states require their own retirees to "file" even if they don't tax that pension (even if you owe your state nothing) ... and that state filing requirement is usually based on your Federal AGI.. But you'd have to read the tax requirements again for your own state.

_______________________

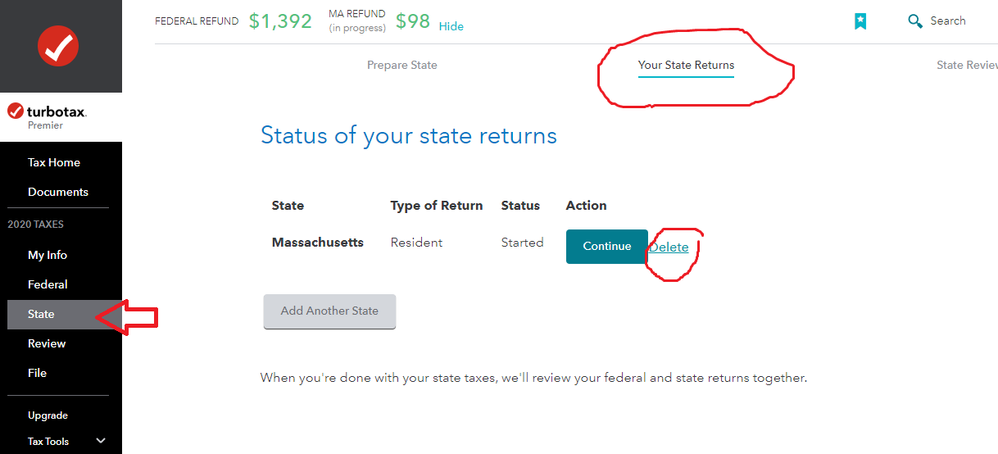

To get rid of the state forms, you first have to start going thru some of the state questions, then return to the beginning of the state area and delete the state....then proceed to file only the Federal.

But if you've already filed just the Federal part, without filing the state, you may not be able to delete the state forms......that must be done before you actually file anything.

______________________________________