- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How to Enter a CSA 1099-R annuity AND a CSF 1099-R annuity in Turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter a CSA 1099-R annuity AND a CSF 1099-R annuity in Turbo Tax?

How do I enter 2 OPM government retirement pensions in Turbo Tax? One is my own pension--a CSA 1099-R and the other is my survivor's CSF 1099-R pension from my deceased husband. Turbo Tax keeps knocking out one or the other. It won't let me put them both in. Help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter a CSA 1099-R annuity AND a CSF 1099-R annuity in Turbo Tax?

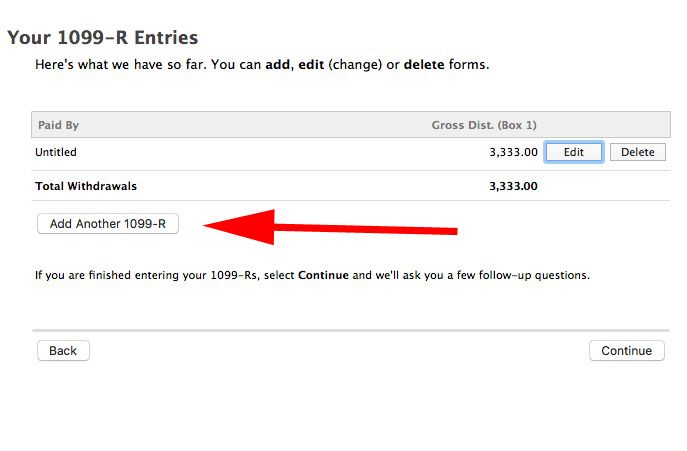

You can enter more than 1. Enter them separately. After you enter one, go all the way to the end of the 1099R section then start a new one.

ps.....If you edit or review a 1099R it does not keep your answers from before but resets them to the defaults. Then you have to go through and answer them all again. So be sure to go all the way to the end of the 1099R section. They are right unless you go back.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter a CSA 1099-R annuity AND a CSF 1099-R annuity in Turbo Tax?

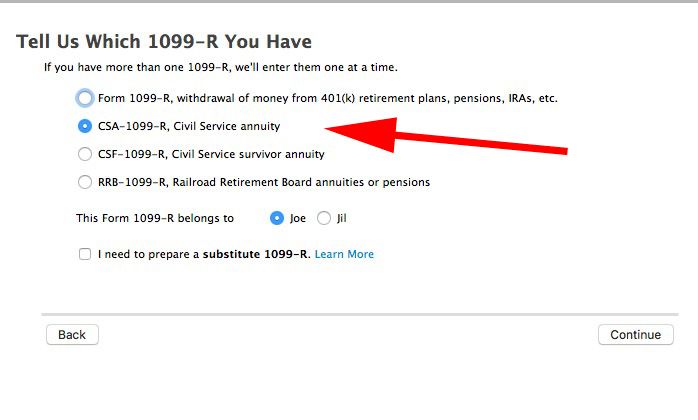

Enter another and choose the type this way:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter a CSA 1099-R annuity AND a CSF 1099-R annuity in Turbo Tax?

@GeorgiaPeech36 ( @macuser_22 @VolvoGirl )

If you did enter them separately....Interesting...you may need to call TTX Customer Support during their working hours, and let them work thru the problem to fix it (as long as you are not using the "Online" Free version):

https://ttlc.intuit.com/community/using-turbotax/help/what-is-the-turbotax-phone-number/00/25632

____________________

1) when using Online Premier, I entered a CSA-1099-R for $12,000 and a second separate CSF-1099-R for $1,200 (age 72, both code 7)...and it wouldn't allow the CSF to go thru the Reviews.....constantly showed a review error in the error checks, and no indication of what the problem was.

2) For Desktop Premier, I did the same , and the desktop software showed no errors or "review" problems thru the normal error checks up to the final filing steps.

_________________

Later: It had an unresolvable problem with the CSF-1099-R which I entered second. Don't know that if they were entered in the opposite order, whether the CSA might be the final hang-up.

Initially the Online software "Federal Review" showed a problem with both of the forms and I had to step thru them again during the review, but the first form reviewed (CSA) cleared...the second (CSF) did not.

Have no idea what the problem is, unless some of the data I entered was missing some box/field required on a CSA or a CSF....though the Desktop software didn't see an error .

___________________________________________________________

(Hmmmm, what's the proper box 7 code for the CSF-1099-R)...the Online review seems to be having a problem with the RMD question...for the way I set it up, but I tried a code 4 too, and indicated the deceased was over age 72 ...and all was an RMD....and still it wouldn't take. I'm just not sure if a CSF is always supposed to be a box 7 code 4 or not.....so I'm actually thrashing here and out of my experience base.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

XAM330

Level 3

MarkH421

New Member

davelubbe

New Member

MBBU88

Returning Member

trish2167

New Member