- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

I went through all the forums on TT and could not find answer thats why posting my question.

I sold rental property A on Feb 1 and did a 1031 exchange with rental property B using an intermediary. Property A was rental for 8 years and was vacant for Jan (waiting to be sold). I was able to find how to enter like kind exchange(search and jump to like kind) and process generated 8824 correctly. The numbers look correct, it calculated new cost basis for property B correctly. In the last page it asked if I want to link it to a property and I linked it to property A.

Ques 1) Property A has been reported as a rental property on my return for last 8 years, so it already exists on my return.

How do I report the sale of property A so that TT understands it is for this exchange.

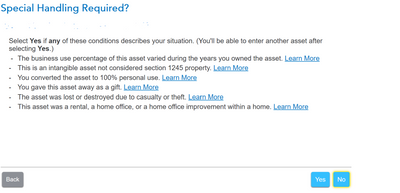

Following "Sale Of Property/Depreciation" -> "Tell us more about this rental asset" I selected "The item was sold, retired, stolen.....or given away" -> Confirm your prior depreciation -> "Special Handling required" does not include any option for like kind so clicked "No". Then it navigates to "Sale Information" with asset and land separately, and if I enter the numbers TT calculates tax on my gain which is incorrect.

What should I do for property A for TT to understand that the gain should not be taxed.

Ques 2) Property A was vacant for Jan 2022 before it was sold in Feb. I understand no deduction or depreciation can be taken for property A as a rental property for that time.

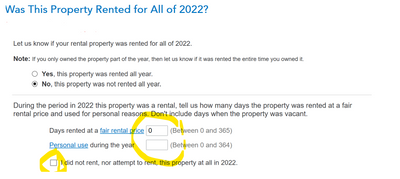

In "Property profile" -> I checked "I sold or disposed of this property in 2022" -> For "Was this property rented for All of 2022" I selected "No, this property was not rented all year". But if I select"checkbox "I did not rent..." then TT asks me to delete the property. Should I instead just add number of days as 0? In one of the older threads someone mentioned enter number of days rented as 1 so that a schedule E is generated, not sure if its still correct for 2022.

Ques 3) property A has unallowed passive losses from last year. How to transfer passive losses and remaining depreciation from property A to property B, does it have to be done manually when adding property B as a new rental property?

Thank you for any help!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

Starting with Question 3, you most likely have to enter the passive loss carryover manually (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

With respect to Questions 1 and 2, you need to make a decision as to whether you want to elect out of the like-kind exchange rule.

See https://kb.drakesoftware.com/Site/Browse/10160/8824-LikeKind-Exchange (scroll down since these are instructions for professional tax software).

If you do not want to continue depreciating the old asset, then you would have to indicate that you removed the old asset for personal use in the program (the linking in the program does not work very well). Doing so will stop depreciation of the old property and will remove it from the program when you transfer your 2022 return into your 2023 return next year.

Note that simply because the property was vacant does not necessarily mean it was unavailable for rental use. Therefore, if the property was vacant in January, but still available for rental, then you should so indicate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

@nirbhee wrote:How do I change it to opt-out? I don't see any screen anywhere which MikeP3 mentioned.

Forms Mode.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

Starting with Question 3, you most likely have to enter the passive loss carryover manually (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

With respect to Questions 1 and 2, you need to make a decision as to whether you want to elect out of the like-kind exchange rule.

See https://kb.drakesoftware.com/Site/Browse/10160/8824-LikeKind-Exchange (scroll down since these are instructions for professional tax software).

If you do not want to continue depreciating the old asset, then you would have to indicate that you removed the old asset for personal use in the program (the linking in the program does not work very well). Doing so will stop depreciation of the old property and will remove it from the program when you transfer your 2022 return into your 2023 return next year.

Note that simply because the property was vacant does not necessarily mean it was unavailable for rental use. Therefore, if the property was vacant in January, but still available for rental, then you should so indicate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

Thank you.

- Understanding the information you guided me for exchange rules, I think I would want to elect-out of like kind exchange rule, it seems simpler. I selected "Yes" for the screenshot below, it does not take me to entering sale information and doesn't show any taxable gain. Though, I don't understand why for exchange as "personal use" should be selected (Property was always a rental and sold, never used as a personal residence). Maybe "personal use" is a broader term than I understand? I don't see any other way to specify disposal of property as personal use other than this screen.

I should have clarified more about the vacant property. Property was vacant because it was listed for sale and was in contract for sale. Reading through earlier posts seemed like that time should be counted as non-rental, but could be incorrect.

What should I indicate in the screenshot below.

If I click the checkbox "I did not rent....." then TT wants me to delete the property. If I enter "Days rented" as 0 or >0 days then a schedule E is generated with deductible rental loss which includes depreciation, tax, mortgage interest etc for one month in 2022 (property sold on 1stFeb).

I don't know what is the correct way-> to take deduction for that month (when property was listed for sale before the date of sale), or not to take the deduction.

I am ok either way, just want to avoid any issues with IRS.

If I should not take deductions, then I don't know how to accomplish that (Given that TT calculated depreciation for one month and everything else automatically after I went through marking it as taken away for "personal use").

Options seem to either delete the property or apply the deductions through Schedule E.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

This is not easy, frankly, and TurboTax does not make it any less so.

The bottom line is you need to convert the relinquished property to personal use for no purpose other than to stop the program from calculating depreciation deductions throughout the rest of the tax year.

If you're electing out, you want the depreciation to stop on the date it was taken out of service (which should be the same date as the replacement property was placed in service).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

Understood, thanks!

Agreed, TT does not seem to have made much effort to make it easier.

Unfortunately I haven't had good experience with hiring CPAs either, so here I am.

Still don't know what to do with the "number of days as rental" stuff and deductions, I'll keep trying to figure it out and will post if I do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

Here are some notes and steps that may make the process easier for you to complete your 1031 exchange. Keep in mind that the property is available for rent up until you made the trade even though for one month in 2022 it was not rented.

- You should indicate it was rented all year just like you never gave it up. (You may want to return to the original asset(s) to rename it.)

The new property is treated like it was the old property, in other words nothing changes except that you may have a new asset to place in service (add as a new asset) for any buy up/added cash on the exchange. Below are instructions that should help you complete the process and/or review your own steps.

When you have your TurboTax return open you can use the following steps to update the original assets for the exchange.

- First use the Search (upper right) > Type rentals > Press enter > Click on the Jump to... link

- Scroll to Assets/Depreciation > Click Update > Select 'Edit' next to each asset

- Edit beside each asset > Continue to the Tell Us About This Rental Asset

- Select the checkbox beside 'This item was sold, retired, .... traded in ....etc. > enter the date it was traded (sold/retired)

- Answer the question about whether it was 100% business > Enter the date it was placed in service (may be purchase date or later depending on your circumstances)

- Continue to the screen 'Confirm Your Prior Depreciation'

- The amount displayed is only for prior years and does not include the current year.

- Continue until you see the current year amount displayed and make a note to add the two amounts together for the Section 1031 like kind exchange.

- This completes the asset portion of the trade.

Next you will complete the like kind exchange, Form 8824 (Section 1031 exchange):

- Use the Search (upper right) > Type like kind > Press enter > Click on the Jump to... link

- Select the checkbox beside 'Any additional like-kind exchanges (section 1031)' > Continue

- Complete the information for the 'Real estate given up' and 'Like-Kind Property Given Up' > Continue

- Name the event > Continue > Complete the information for the 'Like-kind property received'

- If you did not give unlike property in the exchange click 'No' and continue past these screens, if 'Yes' answer the questions.

- Enter any exchange expenses (sales expenses) > Continue to see your deferred gain.

Go back to your rental activity and then enter the new assets with the exact same information as the property given up with a new name, but with the same date placed in service as the old property, for all assets that are part of the exchange.

Enter a new asset for any buy up/added cash in the exchange including the purchase/selling expenses you paid in the trade. The new asset will begin depreciation on the completion date of the trade/like kind exchange.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

Thank you Diane for the detailed explanation.

I have corrected rental information as rented all year as per your advise.

For the steps to update the original assets for exchange, instructions mentioned skip exactly at the point where there is confusion and my initial question was.

6.Continue to the screen 'Confirm Your Prior Depreciation'

- The amount displayed is only for prior years and does not include the current year.

- Continue until you see the current year amount displayed and make a note to add the two amounts together for the Section 1031 like kind exchange.

- This completes the asset portion of the trade.

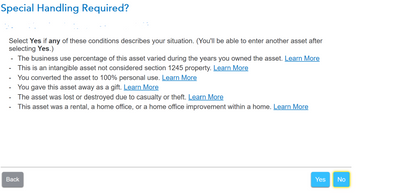

After "Confirming your prior depreciation", and before you see the current year amount displayed, there is a screen which is not mentioned in the instructions above, which was origin for confusion for me. Pasting it below :

If I clicked "NO" then TT would ask for sale information next and tax the gain.

If I clicked YES (also suggested by tagteam in this thread), then TT does not tax the gain. Although none of the options (includng "personal use") in this screen are intuitive for a YES for an exchange.

We do have to click "YES" for special handling required on this screen?

Your mention of treating new property as old property really helps.

To confirm - New assets (old assets with new names + new asset for any buyup/added cash) are to be added to the same relinquished rental property entry......

- meaning, I should NOT create a new rental property entry with "Add new rental property" for the new acquired property, correct?

- I should be using the same old entry(used on my return for the life of relinquished property) to report rental income/expenses for the new acquired property for 2022, correct?

If yes to above, should I change the address of the property in the property information to new acquired property too, or it doesn't matter?

I think it would make sense since unallowed losses from last year etc will automatically carry over in the same entry but making sure I am understanding correctly.

(I guess this way to do is what is called "opt-in" for exchange rules)

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

Yes, you should continue like the property was never traded.

Yes you can change the address of the original asset(s). The only new asset should be the additional fees paid to make the 1031 exchange. This buy-up, so to speak, is a new asset starting with the day the property became yours as the date placed in service.

Special Handling: be sure to answer "Yes" for Special Handling Required. This assumes those unsold assets were converted to personal use, and results in no gain or loss for the disposition. This is what you want for a 1031 like kind exchange.

@nirbhee

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

Thank you very much!!

Another follow up ques (hopefully last one) - I was taking QBI deduction on the relinquished property, I would assume that also continues as is without any changes (assuming eligibilty for the deduction has not changed with the new property).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

It depends. There are details about this in the link below with additional resources to compare the key points to your rental property. This is somewhat obscure and at the same time passive activity seems clear to not be active or materially participating in the activity. This will help you decide if your rental property might qualify.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

Since you are electing out, do not forget to follow the instructions and attach a statement, @nirbhee.

See https://www.irs.gov/instructions/i4562#en_US_2022_publink1000309310

A statement indicating “Election made under section 1.168(i)-6(i)” for each property involved in the exchange or involuntary conversion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

Thank you. I mentioned it that way before, but I think if I follow Diane directions then I am actually electing-in.

From her instructions -

"Go back to your rental activity and then enter the new assets with the exact same information as the property given up with a new name, but with the same date placed in service as the old property, for all assets that are part of the exchange."

"Enter a new asset for any buy up/added cash in the exchange including the purchase/selling expenses you paid in the trade. The new asset will begin depreciation on the completion date of the trade/like kind exchange."

For example, if value of old property was 200k and I have already claimed depreciation of 50k, carryover basis of 150k would be depreciated with the same date placed in service as the old property (as mentioned above).

If I added extra 5k for the purchase of new property, this excess basis would deprecate starting the date of exchange. I think separating deprecitation this way would be electing-in.

If I were to depreciate 150k + 5k (carryover basis + excess basis) like I disposed of the old property, and depreciate 155k starting date of exchange then I believe that would be election-out.

I don't think Diane instructions do this way, and I wouldn't know how to do election-out in TT.

I could be wrong though.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

@nirbhee wrote:

.....if I follow Diane directions then I am actually electing-in.

"Electing-in" is the default method per the IRS of reporting relinquished and replacement properties. The relinquished property continues on the same depreciation schedule while the "buy-up" is treated as a new asset (so you have two, essentially).

It is simple to determine if you elected out as you will only have one asset going forward after the exchange with the basis in the replacement property being a rollover plus any 1031 adjustment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property for a Like kind exchange (8824 generated properly but how to enter the sale completely)

Hi,

Sorry realized,

For - "Yes you can change the address of the original asset(s)"

I was asking if i should change the address of the property in the property profile to new acquired property, NOT in the assets(There is no address in original asset(s)).

Since "assets" is like a sub category of the property information itself, if new assets are created in old property profile, should the profile be revamped to look like new property.

Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MK3386

New Member

madkiwis

Level 3

BTownTiger

New Member

barb-loftus

New Member

LucyLiu5

Returning Member