- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Thank you Diane for the detailed explanation.

I have corrected rental information as rented all year as per your advise.

For the steps to update the original assets for exchange, instructions mentioned skip exactly at the point where there is confusion and my initial question was.

6.Continue to the screen 'Confirm Your Prior Depreciation'

- The amount displayed is only for prior years and does not include the current year.

- Continue until you see the current year amount displayed and make a note to add the two amounts together for the Section 1031 like kind exchange.

- This completes the asset portion of the trade.

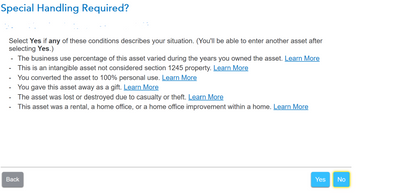

After "Confirming your prior depreciation", and before you see the current year amount displayed, there is a screen which is not mentioned in the instructions above, which was origin for confusion for me. Pasting it below :

If I clicked "NO" then TT would ask for sale information next and tax the gain.

If I clicked YES (also suggested by tagteam in this thread), then TT does not tax the gain. Although none of the options (includng "personal use") in this screen are intuitive for a YES for an exchange.

We do have to click "YES" for special handling required on this screen?

Your mention of treating new property as old property really helps.

To confirm - New assets (old assets with new names + new asset for any buyup/added cash) are to be added to the same relinquished rental property entry......

- meaning, I should NOT create a new rental property entry with "Add new rental property" for the new acquired property, correct?

- I should be using the same old entry(used on my return for the life of relinquished property) to report rental income/expenses for the new acquired property for 2022, correct?

If yes to above, should I change the address of the property in the property information to new acquired property too, or it doesn't matter?

I think it would make sense since unallowed losses from last year etc will automatically carry over in the same entry but making sure I am understanding correctly.

(I guess this way to do is what is called "opt-in" for exchange rules)

Thanks!