- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Thank you.

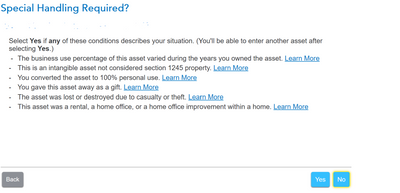

- Understanding the information you guided me for exchange rules, I think I would want to elect-out of like kind exchange rule, it seems simpler. I selected "Yes" for the screenshot below, it does not take me to entering sale information and doesn't show any taxable gain. Though, I don't understand why for exchange as "personal use" should be selected (Property was always a rental and sold, never used as a personal residence). Maybe "personal use" is a broader term than I understand? I don't see any other way to specify disposal of property as personal use other than this screen.

I should have clarified more about the vacant property. Property was vacant because it was listed for sale and was in contract for sale. Reading through earlier posts seemed like that time should be counted as non-rental, but could be incorrect.

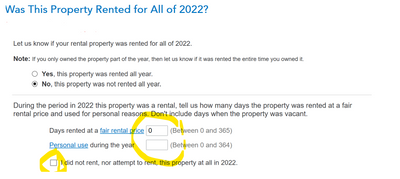

What should I indicate in the screenshot below.

If I click the checkbox "I did not rent....." then TT wants me to delete the property. If I enter "Days rented" as 0 or >0 days then a schedule E is generated with deductible rental loss which includes depreciation, tax, mortgage interest etc for one month in 2022 (property sold on 1stFeb).

I don't know what is the correct way-> to take deduction for that month (when property was listed for sale before the date of sale), or not to take the deduction.

I am ok either way, just want to avoid any issues with IRS.

If I should not take deductions, then I don't know how to accomplish that (Given that TT calculated depreciation for one month and everything else automatically after I went through marking it as taken away for "personal use").

Options seem to either delete the property or apply the deductions through Schedule E.

Thanks!