- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Inherited the land in 2022 and sold it in 2022, how do you report the sale proceeds received ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited the land in 2022 and sold it in 2022, how do you report the sale proceeds received and taxes paid in India at the sale?

Inherited the land in 2022 and sold it in 2022, how do you report the sale proceeds received and taxes paid in India at the sale?

The past posts for Tax Year 2019 suggested Turbo Tax selection does not match what we see in Turbo Tax for 2022.

What value is the cost basis for this land, as it was inheritance.,?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited the land in 2022 and sold it in 2022, how do you report the sale proceeds received and taxes paid in India at the sale?

The cost basis of inherited property is generally one of the following:

- The fair market value (FMV) of the property on the date of the decedent's death (whether or not the executor of the estate files an estate tax return (Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return)).

- The FMV of the property on the alternate valuation date, but only if the executor of the estate files an estate tax return (Form 706) and elects to use the alternate valuation on that return. See the Instructions for Form 706.

See Is money received from the sale of inherited property considered taxable income?

You can claim a foreign tax credit on income taxes paid.

- Type foreign tax credit in Search (magnifying glass) in the upper right corner

- Select Jump to foreign tax credit

- Complete the screens to claim either the credit or deduction

Transfer taxes are not deductible. You can add any of those taxes to your cost basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited the land in 2022 and sold it in 2022, how do you report the sale proceeds received and taxes paid in India at the sale?

Thank you ErnieS0

You answered my question and clarified the cost basis confusion I had.

Sincerely

Xz5tsq15

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited the land in 2022 and sold it in 2022, how do you report the sale proceeds received and taxes paid in India at the sale?

Hi ErnieS0

In TT 2022, when I jump to Foreign Tax credit, it only give me option to do this 1099-INT, 1099- OID or 1099 DIV or for sale of stocks or Mutual funds, but does not show me an option to enter taxes paid in India for sale of land. For this sale we do not get 1099, but we do get a Cert from the Indian Govt that say we paid so much in taxes. It is called TDS ( Tax Deduction at Source )

Is there a way to open a form 1116 and enter Foreign Taxes paid?

Thx

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited the land in 2022 and sold it in 2022, how do you report the sale proceeds received and taxes paid in India at the sale?

Yes. TurboTax gives you the option to claim a foreign tax credit on income other than interest and dividends.

- Type foreign tax credit in Search in the upper right

- Select Jump to foreign tax credit

- On “Tell Us About Your Foreign Taxes, select None of these apply, then Continue

- On “Do You Want the Deduction or the Credit?” select Take a Credit

- On “No Other Income or Expenses” select NO

- On “Choose the Income Type” select General category income

- On “Country Summary” select +Add a Country and choose India

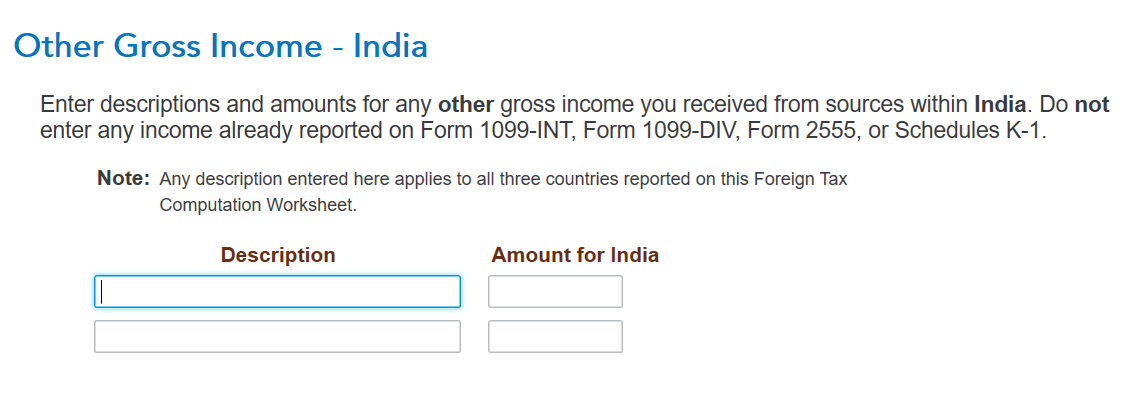

- On “Other Gross Income – India” enter Sale of Inherited Land and the amount in USD

- Continue through the rest of the screens

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited the land in 2022 and sold it in 2022, how do you report the sale proceeds received and taxes paid in India at the sale?

Hi ErnieS0

Thank you for your reply on how to add Form 1116.

I have TurboTax Deluxe : After I select "Take Credit." It is bringing up " Reporting Foreign Taxes Paid" Then I press Continues, it brings up " Where did you receive Dividend Income from ?" Under that it says " Select All countries to which you paid foreign taxes on dividends reported on Form 1099-DIV." If I add India and continues it brings up 1099-DIV That TT has added from Edward Jones that had $8 in Foreign Taxes.

I do not see these lines or options to select

- On “No Other Income or Expenses” select NO

- On “Choose the Income Type” select General category income

- On “Country Summary” select +Add a Country and choose India

- On “Other Gross Income – India” enter Sale of Inherited Land and the amount in USD

- Continue through the rest of the screens

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Inherited the land in 2022 and sold it in 2022, how do you report the sale proceeds received and taxes paid in India at the sale?

After the screen, Take the credit

then Reporting Foreign Taxes Paid

then Continue

then No Other Income or Expenses, click no

then Completing 1116, then continue, then

Foreign Tax Credit Worksheet, then continue

then; you'll get the screen Choose the Income Type

then Country Summary, here's where you'll add a country

And then here is where you will enter the Description Sale of Home and the amt in USD like this

I hope these directions lead you in the right path.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Aowens6972

New Member

Propeller2127

Returning Member

user17548719818

Level 2

Newby1116

Returning Member

Lukas1994

Level 2