- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Confused about entering K-1 Info

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

The section 199A information for box 20 code Z on several of my K-1 1065 forms has 5 apparently separate sections; one 'Rent' with one value and four 'Passthroughs' with three to four entries each (Rental Income, Other Deductions, W-2 Wages, and Unadjusted Basis of Assets). How do I enter all of these for each K-1? If I check "The income comes form another business" TurboTax only allows one Rent or Passthrough entry.

Also, what amount do I enter for the "Enter Box 20 Info Z - Section 199A Information"? I currently left it blank. Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

Because your K-1 is reporting Section 199A information generated by the partnership and Section 199A information generated by multiple passthrough entities, you'll need to "split" this K-1 into separate K-1s for entry into TurboTax. Enter one K-1 with only the "box" amounts generated by the "main" partnership, and additional K-1s for each passthrough entity with only the "box" amounts generated that particular passthrough entity.

For all these K-1s, when you begin the K-1 entry use the same identifying information for the "main" partnership that sent you the K-1 (e.g., name of partnership, address, EIN, etc).

If you can't figure (deduce) that "split" from the information you have, you will need to contact the preparer of the K-1 to get those amounts.

You answer the "Is the business that generated the Section 199-A income a separate business owned by the partnership?" question as it applies to each separate K-1 you enter. In other words, on the "main partnership" K-1 you enter you will answer that it is "from that business", and on the others you will enter that it is from "a separate business owned by the partnership". TurboTax will ask for the name and EIN of each passthrough entity.

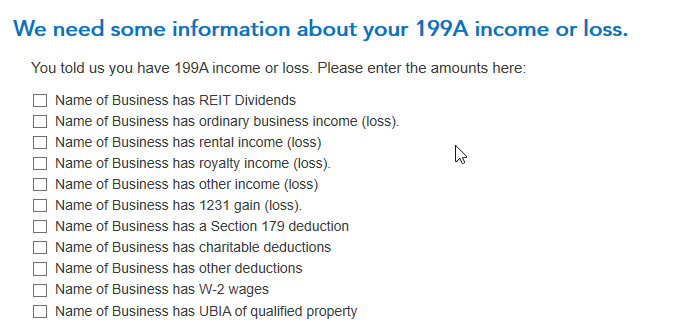

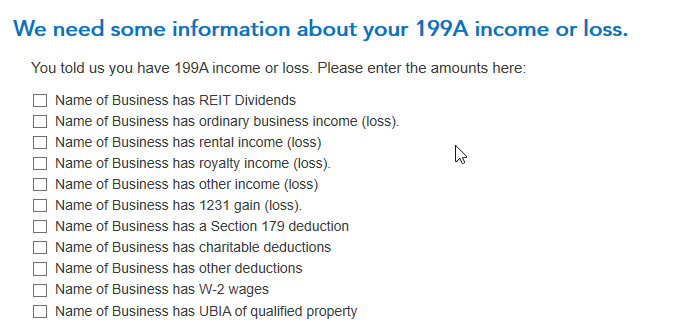

To enter the Section 199A Statement information for each K-1, enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Section 199A Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen to edit or add a K-1, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

Enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are screenshots of the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

The boxes 1-20 on the K-1 you received are the combined totals of the main entity and the passthrough entities. You must figure out how much of each box 1-20 is for the main entity versus each passthrough entity, and that is the "split" you use to enter the box 1-20 on the separate K-1s. The total each numbered box for your separate K-1 forms must equal the total for that box on the K-1 you actually received. For example, all box 1 amounts on the separate K-1s should add up to the box 1 amount for the actual K-1 you received.

The Section 199A Statement you received for box 20 code Z should already "split" the Section 199A amounts between the entities, so you enter the Section 199A amounts for each entity on the K-1 you've created for that entity.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

Because your K-1 is reporting Section 199A information generated by the partnership and Section 199A information generated by multiple passthrough entities, you'll need to "split" this K-1 into separate K-1s for entry into TurboTax. Enter one K-1 with only the "box" amounts generated by the "main" partnership, and additional K-1s for each passthrough entity with only the "box" amounts generated that particular passthrough entity.

For all these K-1s, when you begin the K-1 entry use the same identifying information for the "main" partnership that sent you the K-1 (e.g., name of partnership, address, EIN, etc).

If you can't figure (deduce) that "split" from the information you have, you will need to contact the preparer of the K-1 to get those amounts.

You answer the "Is the business that generated the Section 199-A income a separate business owned by the partnership?" question as it applies to each separate K-1 you enter. In other words, on the "main partnership" K-1 you enter you will answer that it is "from that business", and on the others you will enter that it is from "a separate business owned by the partnership". TurboTax will ask for the name and EIN of each passthrough entity.

To enter the Section 199A Statement information for each K-1, enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Section 199A Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen to edit or add a K-1, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

On my K-1, Box 20 says Z - *STMT"

On the explanation statement are included (1) Ordinary Income (Loss), (2) Self-employment earnings (Loss), Health insurance payments, W-2 Wages.

When I enter these items and amounts on the Code Z Section 199A worksheet, they add up properly and the total populates onto the return. However, the Code Box which says Code Z continues to be highlighted in pink (not yellow), and the amount is also pink. Obviously, I am doing something wrong as neither the Code info nor the total are being accepted. When I attempt to file the return, I am told that more information is needed and I end up right where as was before - i.e., at the screen where the Code is highlighted in pink and and also the total from the worksheet remains pink.

What the heck am I doing wrong???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

Thank you for that thorough answer. Just one quick clarification. When you say:

"Enter one K-1 with only the "box" amounts generated by the "main" partnership, and additional K-1s for each pass-through entity with only the "box" amounts generated that particular pass-through entity."

are the "box" amounts for both "main" and pass-through, from boxes 1 through 20 on the main title sheet or are the boxes for the pass-through entities the 3-4 items listed for each pass-through (checking the appropriate boxes for "We need some information about your 199A income")? Thanks again for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

Enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are screenshots of the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

The boxes 1-20 on the K-1 you received are the combined totals of the main entity and the passthrough entities. You must figure out how much of each box 1-20 is for the main entity versus each passthrough entity, and that is the "split" you use to enter the box 1-20 on the separate K-1s. The total each numbered box for your separate K-1 forms must equal the total for that box on the K-1 you actually received. For example, all box 1 amounts on the separate K-1s should add up to the box 1 amount for the actual K-1 you received.

The Section 199A Statement you received for box 20 code Z should already "split" the Section 199A amounts between the entities, so you enter the Section 199A amounts for each entity on the K-1 you've created for that entity.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

Hi @DavidS127 :

I am a bit confused by some seemingly conflicting information in a couple of your posts. It is probably my understanding of the instructions which is causing the confusion:

In one post, you note "The boxes 1-20 on the K-1 you received are the combined totals of the main entity and the passthrough entities. You must figure out how much of each box 1-20 is for the main entity versus each passthrough entity, and that is the "split" you use to enter the box 1-20 on the separate K-1s. The total each numbered box for your separate K-1 forms must equal the total for that box on the K-1 you actually received. For example, all box 1 amounts on the separate K-1s should add up to the box 1 amount for the actual K-1 you received."

From this, I assume that if the K-1 amount is $100 and the pass through entity is $20, I create two K-1s in Turbotax, one for $80 (main entity) and one for $20 (passthrough).

However, in another topic I saw that your guidance said "If there are multiple businesses to report, you will need to produce a K1's for each of those businesses:

- You will report the first K1 with the partnership information, EIN etc. Also you will record all the boxes that have income in them (1-20) Record code Z in the first K1 and report the income comes from another business. You will then be asked to record the name and EIN of that business and then fill in the remaining information regarding the 199A income."

From this instruction, (and using the same scenario above) I would assume that for the main entity K1 I would input the $100 directly as that is the amount shown on my K1 and for the pass through entity I would put $20.

Can you please clarify which of these two scenarios is correct?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

DavidS127 your information so far has helped a lot.

I have a similar case and there is only one remaining doubt I have. You say that we should split the K-1 into separate K-1s for entry into TurboTax. The statement attached with my K-1 has all the information I need to split boxes 1-20 between main and pass-through entities but I do not know whether I should also split the information in Part II, section L of the K-1. In TurboTax, this information is requested in the screen Enter Capital Account Information".

In my case, the aggregated fake numbers are:

| Capital Contributed During 20XX | 10,000 |

| Current Year Net Income (Loss) | 8,000 |

| Ending Capital Account | 2,000 |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

Same question here. Total amount on the main K-1 and then individual pass-through K-1s reporting their own, smaller amounts? Or due you subtract the sum of all the pass-throughs from the main K-1? (For my case, I have rental loss in box 2, lets say 5,000. If all is attributed to pass-throughs, would I report 0 or $5,000 on the main K-1 before entering all the individual pass-throughs?)

Alternatively, I just spoke with an expert through TT and was told to enter an amount in Box 2 on each K-1 that matches the passthrough amounts for the entity being entered for Box 20, Code Z, for that specific K-1 entry. So, again lets say the K-1 I received shows -$5,000 rental income in Box 2 and the 199A info for Code Z shows 5 separate pass-through entities, each with -$1,000 rental income. I would enter 5 K-1 entries, each showing -$1,000 in Box 2 and each listing a different pass-through in the Code Z detail. But I was told only the first one would have the other info from my K-1 in just the first entry (interest income, capital info, etc).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

@bstornelli : For what it's worth, I inquired with a friend who is a CPA, and they advised not to split the Box 2 section L information between the main entity and the pass through. Although this CPA doesn't use Turbo-tax (and thus this probably shouldn't be used as a definitive answer), her logic was that Turbotax should not be recording capital contributed via the pass through entity. The capital contributed is only counted from the main entity.

This passed the sniff check for me, so I'm going with it! Good luck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

@davidtoby : I am not a tax expert so please take this with a grain of salt.

My understanding of your example is as follows: The main entity issued a K-1 showing -$5,000 in Box 2. The pass-through entity is showing -$5,000 rental income in the 199A section of the K-1..

So in Turbotax, you create a first K-1 with the name, EIN, etc. of the main entity. For rental income you would put $0.

Then you create a second K-1 with the name, EIN, etc. of the main entity again (even though this will ultimately be the passthrough entity K-1). Leave Part 2 boxes J, K, L, etc. blank since you've already done this for the main entity. Then for rental income you put in $-5,000 and select the radio button a few screens later that indicates that the business that generated the Section 199-A income is a separate business owned by the partnership. This is where you will be asked for the name and EIN of the pass through entity.

It is confusing, because in your K-1 overview screen you'll have two identically named entities, but one is the main entity and one is the main entity with the ties to the pass through. I used lowercase letters to name my main entity and capital letters to name my main entity/pass through so that I could keep them straight!

Again, I am not an expert but this is what I have surmised from several sources on this forum, the Turbotax FAQ, and an informal consult with a CPA friend.

Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

This has some logic to it although for the pass-through entity the K-1 entries would have $0 capital contributed and -$7,XXX losses which in my mind raises the question of: how can you have losses from a business to which you contributed $0?

But I think the data in the capital contributed is ultimately not used at all by turbotax, or at least that's my impression because I was looking at the form 8995-a that they generate and the amount of capital contributed doesn't show up anywhere as far as I can tell so perhaps it doesn't even matter what I put there...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

I'm invested through a Schwab brokerage, and they have told me they will submit my K-1 forms and have already filed an Extension Request on my behalf because they are still collecting information from the issuer. This is a new experience; they claim it's due to a change in the tax law for 2020 returns. Does anyone else have this situation? I've already submitted my return with my two K-1 forms as they were sent to me. I'm not getting much clear info from Schwab or my broker.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

do i enter k-1 info (like from box 11) elsewhere on 1040 or does turbo tax do automatically

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

@kahnma For the most part, you just make the schedule K-1 entry once in TurboTax and the program then takes the entry and places it on the correct lines on your tax return. One exception would be if you sold your partnership or S corporation interest, in which case you may need to report that as an investment sale separately from your K-1 entry.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sam992116

Level 4

ddm_25

Level 2

HNKDZ

Returning Member

fkinnard

New Member

SeaLady321

Level 3