- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Confused about entering K-1 Info

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

Ren12, David gave a clear answer on how to split the Section 199A amounts between the "main k-1" and the "pass-through entity k-1", in another thread. I'll quote it here, because it helped me.

No, you must deduce the "split" of those box 1, 5, 7, and 14 amounts between the main entity and the passthroughs.

So, take a look at the Section 199A information reported for the passthrough entities, and compare that to the box 1, 5, and 7 amounts reported on the actual K-1. If the Section 199A for the passthrough entities is, say, $50 each of rental income for $100 of total "rental income" from both passthrough entities, and the box 7 net rental real estate income $100, then all the box 7 $100 goes on the passthrough entities' box 7 ($50 each) and none goes on the "main entity" K-1.

If the passthroughs report Section 199A ordinary income, you'll have to similarly "deduce" in which boxes that should be reported (box 1, box 5), and leave the "balance" on the "main entity K-1" box 1, box 5.

Box 14 is for investment income, and once you figure out the box 1 and box 5 you can hopefully deduce how much belongs on each passthrough K-1, with any "balance" on the "main entity K-1.

When you are finished, the box 1 for all three K-1s you entered should equal the box 1 amount on the actual K-1, and so forth.

If you can't determine the split for the information you have, you will need to contact the preparer of the K-1."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

I did what you suggested for a 2021 K-1. However, when running the end of return checks, an error comes up requesting an amount to be entered in the Code Z Section 199 A Information. Can this be left blank for filing purposes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

It depends.

IRS Form K-1 (1065) box 20 Code Z Section 199A Information may have been provided by the preparer of the K-1.

IRS Instructions page 17 states:

The partnership will provide the information you need to figure your deduction. Use one of these forms to figure your QBI deduction.....

If 199A information has been provided, report Code Z in box 20 to generate the qualified business income deduction.

If no 199A information has been provided, do not enter Code Z in box 20.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

I get that. The partnership has provided the 199A information and code Z was entered in TurboTax. However, TurboTax is asking for an amount to be inserted on the line for code Z, even apart from the additional information that it then requests. I don't know what amount to put in there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

You do not need to put an amount in that box specifically, but if you continue through the step-by-step interview process one of the following screens asks for the details of the Statement A - QBI Pass-through Entity that came with your K-1.

To ensure you have entered all the information from your Statement A please follow these steps in TurboTax Online:

- Within your tax return use the magnifying glass icon to search K-1.

- Click the Jump to link that appears in the results.

- Click Update for the type of K-1 you want to review.

- Click Edit for the K-1.

- Continue through the questions until you get to the We see you have Section 199A income screen.

- Check the box that applies to your K-1.

- The next screen, We need some information about your 199A income, needs to have all the information from your Statement A entered. Mark the boxes for the lines that have details your form and enter the amounts there

- Continue through the rest of the interview to ensure you have answered any follow up questions for the QBI

@Lawrence V

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

I've seen two different answers from experts on this now. Both say that when you have a K1 from a partnership that lists multiple pass-throughs in Box 20, code Z, you need to create multiple K1 entries to accommadate each individual pass-through.

But in this thread, expert @DavidS127 says that you need to split the box amounts up to align with each pass-through K1 you create. You need to figure that out. The 199A statement should give you the details for the pass-throughs, and I suppose the remainder - the main boxes minus the sum of the pass-throughs - gets attributed to the main partnership.

In a different thread here (https://ttlc.intuit.com/community/business-taxes/discussion/re-how-to-enter-multiple-sec-199-passthr...), expert @DaveF1006 says you can put the full box amounts on the first K1 with the main partnership, and then when you create the rest of the K1 entries, you put the main partnership info (name, address, etc), and then leave all the boxes blank except for box 20. Then go through the step of entering the pass-through info for each one. (and you can list one of the pass-throughs on the main K1).

Are these incompatible, or are they two different ways of entering info in Turbotax that result in the same, correct entry on the actual forms?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

These are two different ways of entering the info that result in the same correct entry of the forms. The end result needs to be that every dollar amount is reported in total from the K-1, but none are duplicated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

Thanks AliciaP1 and @DavidS127 . Upon reading your answers above I'm wondering if I entered 199A information incorrectly in TT for 2019 and 2020 and need to amend. This is for CRE LLC partnerships, some are funds holding many properties in different states, some only hold one property. In past years I had aggregated all the passthrough UBIAs and rental incomes together in TT. Is this completely wrong and require correction? The reason for my confusion is I"m noting different CRE partnerships report Section 199A information differently per below - please see my question for each:

1) RE LLC fund holds many properties, and list each property as passthroughs with separate EIN under Section 199A, Box 20, Code Z info - Q: Do I need to enter each passthroughs separately in TT?

2) RE LLC fund holds many properties (different states) but the passthrough listed in Section 199A, Box 20 Code Z info is the exact same LLC entity (same EIN as the main partnership). So in effect - its aggregated.

Q: Do I still need to list this same EIN as a passthrough?

3) RE LLC fund only had one property at the time. It listed multiple "passthroughs" but all for the same property. No separate EIN provided. Q: Can I aggregate all the UBIA/rental incomes into one since its for the same property?

4) RE LLC holds only one property, so no passthroughs listed. Q: Input into TT as is?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

1-Yes, list each separate EIN.

2-Yes, it is a passthrough.

3-Yes, you can aggregate

4-Yes

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

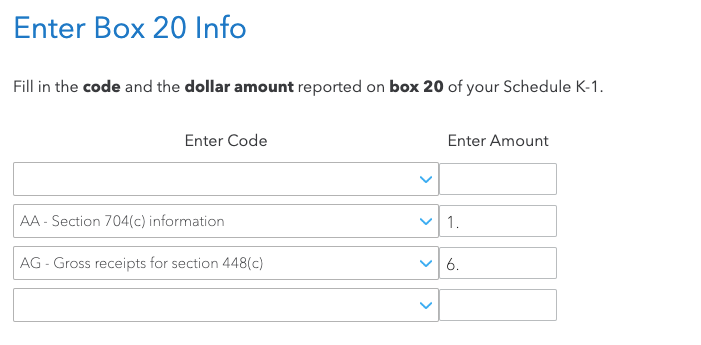

Hi, my K-1 shows two entities under Line 20 Z, but one of the two entities shows $0 for every line item; I'm assuming I don't need to enter this information. The 2nd entity show some data on two line items (see below). I'm assuming I would have to add these numbers (-$11 and 287). Does this mean I only file one K-1 line entry for this in the "Enter Box 20" info (2nd image below in turbotax online) ?

Also,

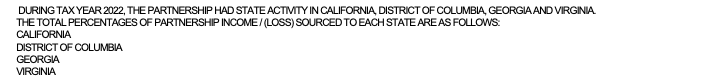

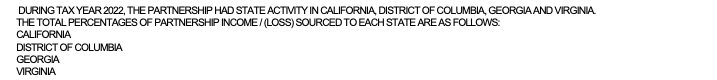

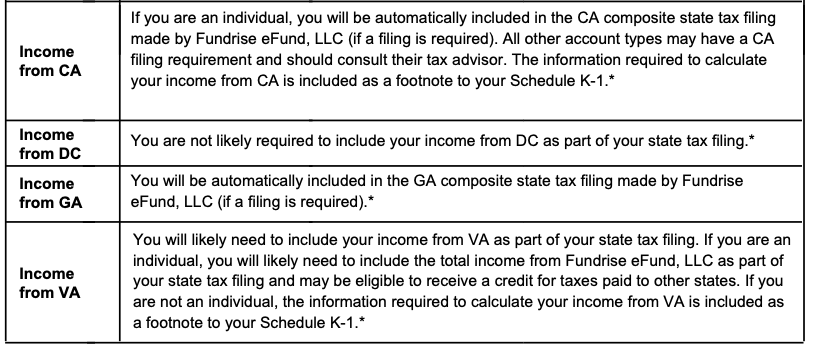

I see this note that lists several states with activity. Do I need to file a separate state tax filing for each of the states below?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

Also, to follow-up, I live in Virginia

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

The first entry, for -$11, you should enter in box 20 as code "Z" Section 199A information. Later on you will see a screen that says We see you have Section 199A income, and you would normally choose the The income comes from the partnership that generates this K-1, unless you know otherwise. On the next screen you will see We need some information about your 199A income, on which you will check the box Partnership has UBIA of qualified property, and the you will see where you can enter the $287 amount for UBIA of qualified property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

Thank you for the tip. Also, would I need to file state taxes for the following information noted on the K-1? I currently only live in Virginia, so also not sure if I need to note this in my Virginia filing if the partnership had some activity in this state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

this was the additional note on my k-1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confused about entering K-1 Info

Your additional note stated: "You will likely need to include your income from Virginia as part of your state tax filing"

If you are only filing a Federal 1040 tax return and a Virginia resident tax return, the K-1 partnership income should already be reported on the Virginia tax return.

Since no other state is involved, no credit for taxes paid will be available to you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

2022 Deluxe

Level 1

sam992116

Level 4

ddm_25

Level 2

HNKDZ

Returning Member

fkinnard

New Member