- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: No 1098T and Turbo Tax says my Scholarship money requires child to file

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

I have claimed as much as I can (diligent accounting on my part). Main issue was that money left the 529 in December and not processed until January, which creates the whole problem. If the December payment were to post in 2020, no issues, but now I have a disconnect (Lessons learned).

Anyway, based on the College 1098T (that we finally coaxed out of them), $10750 in Scholarships was dispensed and only $7220 in tuition/related expenses was received. I am assuming that that $7220 does not include room & Board, but I may have net positive number there due to refunds for R&B paid in December of 2019 for Spring 2020 (How does that factor in?). Additional personal educational expenses added up to $2030. 1099Q is reporting $11452 is gross distributions, earnings of $2429 and basis is $9023. State is MD. child attended a state university, lived on Campus Jan-Feb-Mar, and then was sent home in spring semester. Fall semester was on campus for 2 weeks before they sent everyone home.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

Right, the $7220 would only be tuition and qualified expenses. Any room and board refunds paid from a 529 should have been recontributed to the 529 to avoid an excess distribution.

A MD single filer, under age 65, does not file a return until income passes $12,400.

If all income is to child is this little bit of scholarship, there would not be a filing requirement for federal or state.

If you have a paper trail showing which year the expenses were actually spent, you can use that. Some colleges receive the money in December but don't process until January. The IRS understands that. You may have crossed into "deemed to have paid" territory. The following quote shows how the IRS thinks.

The IRS says in Publication 970 (2020), Tax Benefits for Education | IRS: When figuring an education credit or tuition and fees deduction, use only the amounts you paid and are deemed to have paid during the tax year for qualified education expenses.

The first year is a learning curve, each college is different. It sounds like you are in good shape at this point.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

Thanks so much! Just to confirm, if my childs total income is below $12,400 (which is true) then there are no filing requirements with the IRS and no filing requirements for the State of Maryland.

I do have expense logs since they began college, and expanded that to flag which tax year these expenses are being reported. I needed to do this when the college was declining (until I sent my spouse after them) to give us a 1098T.

This is actually the 2nd year of college, but first full (2 semester) year. Learned a lot... a lot that I wish I didn't have to know! 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

Q. Just to confirm, if my child's total income is below $12,400 then there are no filing requirements with the IRS?

A. Not exactly. It depends on the type of income.

If your dependent child is under age 19 (or under 24 if a full time student), he or she must file a tax return for 2020 if he had any of the following:

- Total income (wages, salaries, taxable scholarship etc.) of more than $12,400 (2020).

- Unearned income (interest, dividends, capital gains, unemployment, taxable portion of a 529 distribution) of more than $1100.

- Unearned income over $350 and gross income of more than $1100

- Household employee income (e.g. baby sitting, lawn mowing) over $2100 ($12,400 if under age 18)

- Other self employment income over $432, including money on a form 1099-NEC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

1. Only income is the PERCEIVED income from Scholarships ($10750-7220=$3530)

2. What defines taxable portion of 529? Probably my stumbling block requiring child to file since payments were made in December and not processed until January throwing everything out of balance. 1099Q shows $11451 gross distributions and based on the numbers above it is definitely above $1100. Does this mean I need to file in childs name for both Federal and state (MD)?

3. No unearned income, see #2

4. None.

5. None.

I keep running through the TurboTax screens and it is not telling me I need to file in child's name anymore, but that message has only appeared inconsistently and that was before I received the updated 1099Q. What screen could help me trigger that message?

New Questions:

A. When Turbo Taxes asks about Refunds of Educational expenses (implying dropped class), should I say yes since we got Room & Board Refund? I keep saying no.

B. 529 could not allocate first refund for Room & Board as a refund because the expense was paid in 2019, and the refund was not received until 2020. How do I allocate this in my college expenses or do I just label it as a 2020 "investment" and move on? If I put that in my Room & Board column, then I show I received more refunds than expenses in Room & Board since I paid Spring 2020 in December 2019, and the Spring 2021 payment was not processed until January 2021, although PAID from 529 in December 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

When Turbo Taxes asks about Refunds of Educational expenses (implying dropped class), should I say yes since we got Room & Board Refund? I keep saying no.

529 could not allocate first refund for Room & Board as a refund because the expense was paid in 2019, and the refund was not received until 2020. How do I allocate this in my college expenses or do I just label it as a 2020 "investment" and move on? If I put that in my Room & Board column, then I show I received more refunds than expenses in Room & Board since I paid Spring 2020 in December 2019, and the Spring 2021 payment was not processed until January 2021, although PAID from 529 in December 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

A. A refund on room and board is not a reduction in educational expenses, that does not need to be entered.

B. It sounds like room and board will become a zero, as in no expense paid due to refund. It would not become income.

You are working very hard to do this right. The IRS understands the way payments can straddle years. The refunds have never been an issue before nationwide. The IRS may end up in a court case and decide it isn't included. It is not considered income since after tax dollars were used for most people.

This is where your refund may be taxable as a 1099-Q distribution. It would not be double taxed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

What is the maximum amount of income can on receive and still get tuition credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

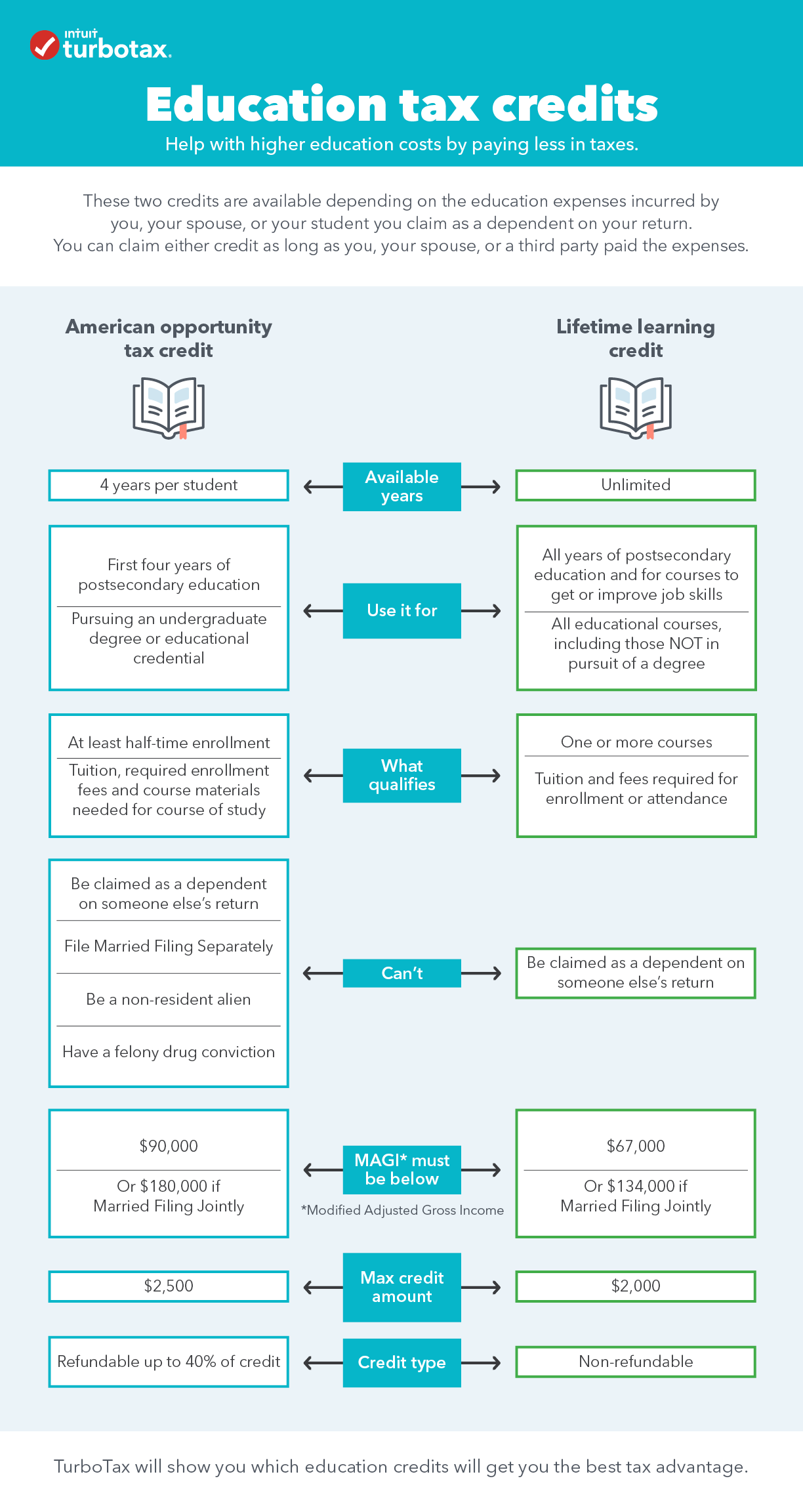

Education tax credits can help you with higher education costs by reducing the amount of tax you owe. There are two credits available, the American Opportunity Tax Credit and the Lifetime Learning Credit. We check both of them for you. See the chart below to see the income thresholds for each credit.

American Opportunity Tax Credit (AOTC)

You can use this credit for the first four years of college when working towards a degree.

- Maximum credit is $2,500 per eligible student.

- Must be enrolled at least half time for at least one semester during the tax year.

- Up to $1,000 can be refunded to you.

Lifetime Learning Credit

There is no limit on the number of years you can use this credit for undergraduate, graduate and professional degree courses, including ones to improve job skills.

- Maximum credit is $2,000 per tax return.

- Can be used when you're only taking one class.

- You don't need to be working towards a degree.

- None of the credit is refundable.

Related Information:

- Who is eligible to take the American Opportunity Tax Credit?

- What expenses qualify for the American Opportunity Tax Credit?

- Who is eligible for the Lifetime Learning Credit?

- What expenses qualify for the Lifetime Learning Credit?

- Can I claim my student loan?

- @Shirley Bullock

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

I didn’t get a 1098 T for 2021 because I wasn’t enrolled in 2021. But I did pay for tuition books and laptop in 2021 for semester beginning January 2022.

can I claim college expenses I paid in 2021 even when I didn’t get a f 1098?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

No. But when you file for 2022 you will be asked for the expenses you paid that were not included on your 1098. Save the receipts for the materials related to your 2022 semester and you will enter those next year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

I hope to save some others a bit of stress. Check to see if the school used your student's temporary school address on the form. If so, the form may have gone to them physically, and/or it has to be looked up online using that address.

I just went to look for my student's 1098-T and realized there wasn't one on the website to download. So, I found this post to see what to do. Then, I decided to call student accounts at the college, and they quickly asked me if my address had changed. I told them it hadn't, but they pressed and asked if my child had moved. Yes, they had moved off campus, but I didn't think they would have changed their address from our permanent one. They told me that I should try using the temporary mailing address to look up the form online - and that was the issue!!!! Because the 1098-T had a new address, I had to look it up with that address.

So, I hope others might benefit from this discovery.

I asked the school if it will be okay to file my taxes with the new address not being the same on the 1098-T as our tax return filing address, and they told me that would not be an issues. I hope they are correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

Yes, they are correct. Having your child's temporary address on the 1098-T will not cause a problem when you file your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

Thank you, Vanessa! I appreciate your reassurance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No 1098T and Turbo Tax says my Scholarship money requires child to file

I have a variation:

Received 1098-T for daughter

Block 1 was $4,261 (amount we paid out of pocket)

Block 2 was 0

Block 3 was $5,500 (scholarship paid directly to the school)

Actual Tuition paid for Spring 21 and Fall 21 semesters was $9,761 (which is the sum of Block 1 and Block 3).

Turbo Tax now states my daughter needs to count the difference of Block 3 and Block 1, $1,239, as income and has to file a tax return. Doesn't make since that this is income.

Did the school error in filling out Block 1 and I need to request an amended 1098-T? Or does the Turbo Tax program have an error in this case

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

postman8905

New Member

Vermillionnnnn

Returning Member

in Education

ssptdpt

New Member

in Education

Taxes_Are_Fun

Level 2

Taxes_Are_Fun

Level 2