- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

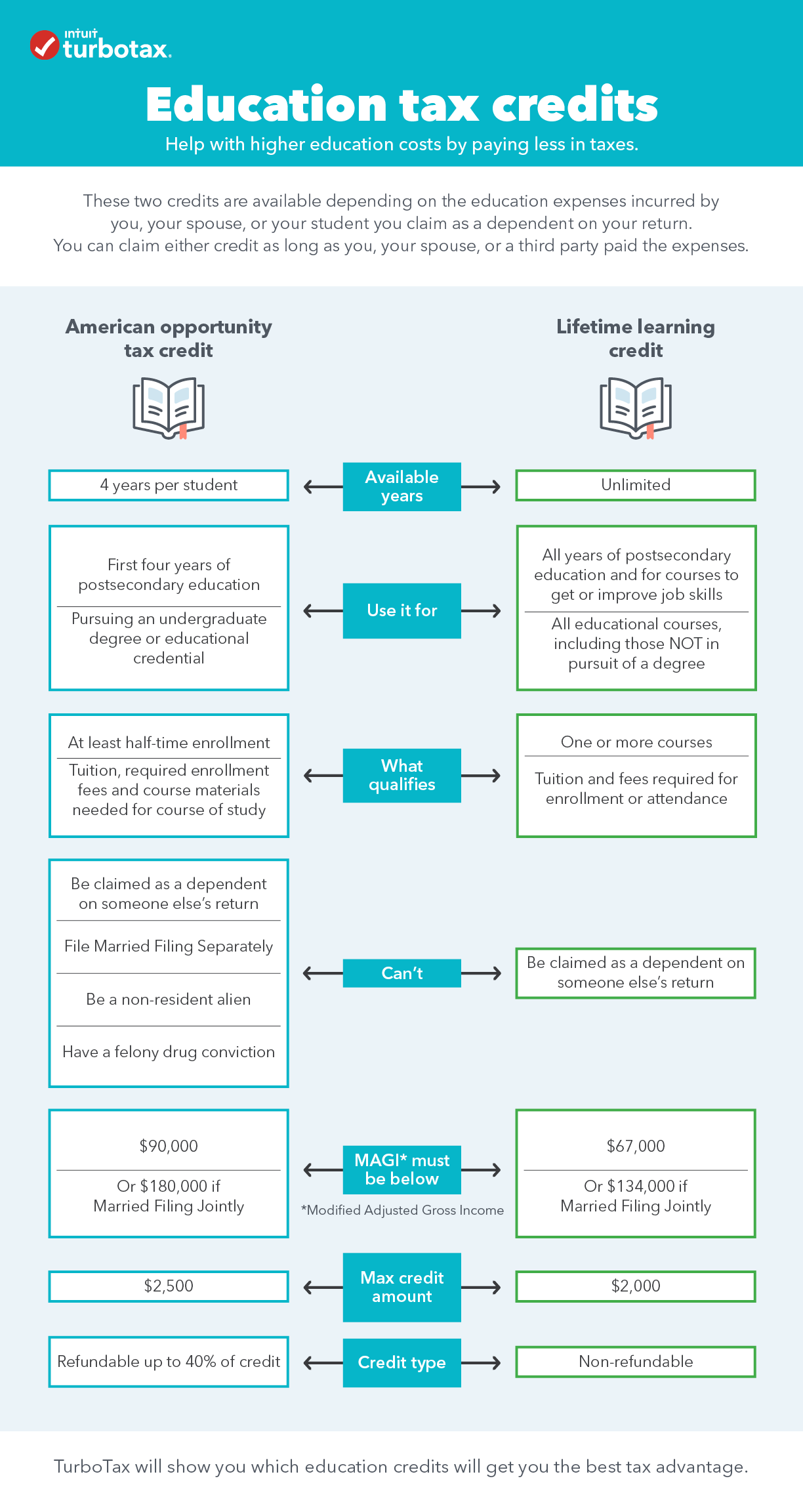

Education tax credits can help you with higher education costs by reducing the amount of tax you owe. There are two credits available, the American Opportunity Tax Credit and the Lifetime Learning Credit. We check both of them for you. See the chart below to see the income thresholds for each credit.

American Opportunity Tax Credit (AOTC)

You can use this credit for the first four years of college when working towards a degree.

- Maximum credit is $2,500 per eligible student.

- Must be enrolled at least half time for at least one semester during the tax year.

- Up to $1,000 can be refunded to you.

Lifetime Learning Credit

There is no limit on the number of years you can use this credit for undergraduate, graduate and professional degree courses, including ones to improve job skills.

- Maximum credit is $2,000 per tax return.

- Can be used when you're only taking one class.

- You don't need to be working towards a degree.

- None of the credit is refundable.

Related Information:

- Who is eligible to take the American Opportunity Tax Credit?

- What expenses qualify for the American Opportunity Tax Credit?

- Who is eligible for the Lifetime Learning Credit?

- What expenses qualify for the Lifetime Learning Credit?

- Can I claim my student loan?

- @Shirley Bullock

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

May 3, 2021

4:04 PM