- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: I am done filling out my return and on my 1099-nec it is telling me I need to fill in informa...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

If your return does not include a Schedule C, then that is the problem that TurboTax is trying to get you to fix.

Income reported on Form 1099-NEC is not reportable directly on your tax return. Just entering the information on that form is only the first step. Since it is self-employment or 'non-employee compensation' it must be associated with a Schedule C, even if there are no expenses being claimed.

The information required for the Schedule C will include the type of business, the business name (or your name if there is no specific business name), the business address (or your address), etc.

See the following TurboTax article for guidance to enter a Schedule C so that the Form 1099-NEC can be linked to it:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

Thank you for your response.

I paid extra for the small business package where it allows you to outline your expenses. At the end it is asking me to confirm my schedule C.

My wife and I have the exact same type of 1099-nec and it is not asking her for this.

I have tried deleting my 1099-nec and re- entering just in case I made a mistake.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

Since you and your wife both have a 1099-NEC - you are going to need to create 2 separate Schedule Cs. One for you and your business expense. And then a second one for your wife's 1099-nec and her expenses. You should have 2 'lines of work' - your self-employment and her self-employment. This way, your social security and Medicare taxes get credited to each of you instead of all going to one and the other getting nothing.

When you enter the 1099-NECs - it will ask you ''who/which Schedule C this form belongs to'' - hers should be linked to her Schedule C or your should be linked to yours.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

On the 1099-nec we entered both of them separately and itemized out each of our expenses. For some reason after filling it out TurboTax is asking me to confirm my schedule C. I am very novice (as you can probably tell), what do I enter for my schedule C?

My wife's did not require her to enter anything, it is just mine that is asking to confirm and I have no idea what to put.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

@aaron_boyd2 I have a question. Is this the first year you and your wife have had these new businesses? If so, were you ever prompted in the TurboTax program to enter information to create a Business Profile for each of your businesses?

A Business Profile would include the name and address of your business, type of business, etc. You should have been asked a number of questions to set up the profile(s) for each separate business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

@VolvoGirl Well, that's so helpful. I haven't seen that one yet. Thanks so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

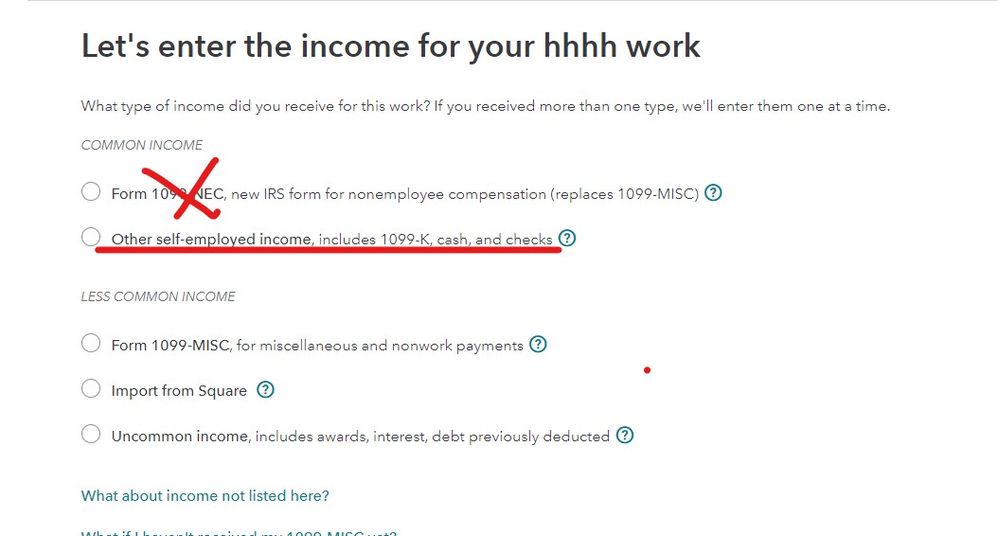

Optional work around ... DON"T use the 1099 entry section ... delete it from there and enter your total annual income in the next OTHER income section of the Sch C interview ... this will not change what the IRS sees on the Sch C and is perfectly legal ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

Yes, that is what I am getting!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

I tried that, but it resulted in the same issue. :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

That article has a little green button to the left that reads "SOLVED". Does that mean the issue has been resolved? I'm still unable to submit due to this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

@telypeek Please see this TurboTax FAQ linked below. You'll see the opportunity to sign up to be notified when this issue is resolved.

Why am I not able to link my 1099-NEC in TurboTax ... (intuit.com)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

@Kat I did do that yesterday, but noticed the 'SOLVED' button to the left of it this evening, so I wondered if there had been a resolution to the issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am done filling out my return and on my 1099-nec it is telling me I need to fill in information on the Schedule C line. What do I need to put here?

Yes, @telypeek , I see that! I've heard nothing about the issue being resolved, but that green box is curious. I'll ask, but since you still haven't been able to file, I'd say it's still an issue.

I'll let you know what I find out.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

relativecirclemusic-com

New Member

Muffyduffy42

Level 1

Muffyduffy42

Level 1

crochetypeg

New Member

cd76

New Member