- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Can’t e-file schedule C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

@CrazyKZ A software update is now available

Click on Online at the top of the desktop program screen

Click on Check for Updates

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

s. Click Review to see if you are missing some forms needed in order to e-file.

Many federal and state forms are not yet available. Check here for form availability. The dates are subject to change.

No hurry to e-file since the IRS will not begin to accept/reject 2023 e-files until January 29. And….a state return cannot be accepted until after the IRS accepts your federal return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

Thank you for responding. I checked the review and it doesn’t show me which forms. When I deleted my schedule C information then I am able to e-file, but according to the tax availability tool Schedule C is available. I even tried to update the disc but it says it’s up to date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

To call TurboTax customer support

https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

Out of curiosity, why does it matter which form can't be filed? One or more can't be filed yet, so you need to wait.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

Because according to TurboTax the forms that I am using are available and ready to e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

I am having the same issue. You are the first person to post about it. So glad it's not just me. Still don't know when this will be resolved.

Thanks for posting

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

Thank you!! Now I know I’m not the only one as well. Hopefully it will get resolved soon for the both of us

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

You are not the only one. I am having problem with schedule C and when I delete the information on one of the lines it will file it. They must have a glitch in the system or have not issued the update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

Thank you. Please post any useful update to this issue that you find and I will do the same.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

I might also add that I am using the HOME & BUSINESS version , not DELUXE. This would suggest that the issue is not exclusive to only the DELUXE version. Just FYI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

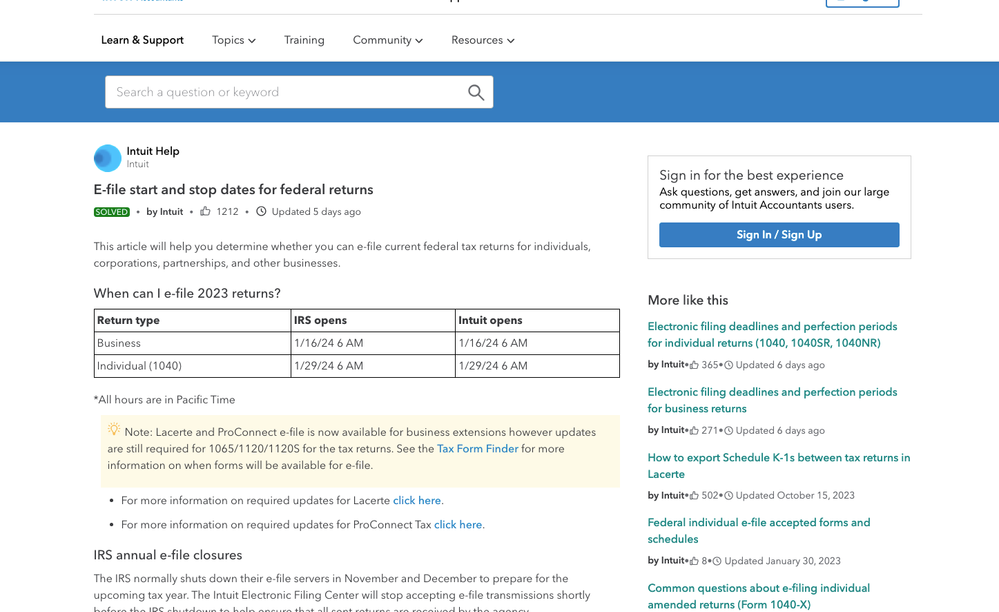

I have been combing through the internet and the only thing I can find is that e-fiing for individual tax through intuit does not start until Jan. 29th. My only issue with this is that when I delete the Sch C file it looks as if it will let me e-file now which is confusing. I will post a screen shot (web link did not work) below to the page that seems to confirm the Jan.29th date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

The screenshot you posted is for the PROFESSIONAL tax programs which have different dates then the TT program.

In TT click on the REVIEW tab to see what is holding you up and when it may be released.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

I have the same problem. I am self employed and I am not able to efile. Although everything is correct. Do I just need to wait? Is there a fix to this. I had Turbo Tax basic, I upgraded to deluxe for $30 more dollars. It does not work. As long as I have the schedule c attached it will not allow me to efile. In the rev iew tab it does not show anything and nothing has been over ridden. This is a problem with your software that needs to be fixed soon so that I can efile my taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can’t e-file schedule C

Maybe you are waiting for some forms. Click Review to see if you are missing some forms needed in order to e-file.

Many federal and state forms are not yet available. Check here for form availability. The dates are subject to change.

No hurry to e-file since the IRS will not begin to accept/reject 2023 e-files until January 29. And….a state return cannot be accepted until after the IRS accepts your federal return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17717554713

Level 1

anthony3180

New Member

gma2003

New Member

univ0298

Level 2

sbui102

New Member