- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- What does this mean?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

My Amended return received on April 6th 2020 and its not yet processed, but I received a letter 4364C on March 26th 2021 saying "We have adjusted the account as requested", so not sure will that mean i will get a refund, Btw i filed my 2020 taxes on Feb 22 2021 but even those taxes are still being processed. So not sure anyone else is on the same boat as mine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

letter 4364C just means your Amended return had a few (or one) corrections made on it. Nothing to worry about as far as the letter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

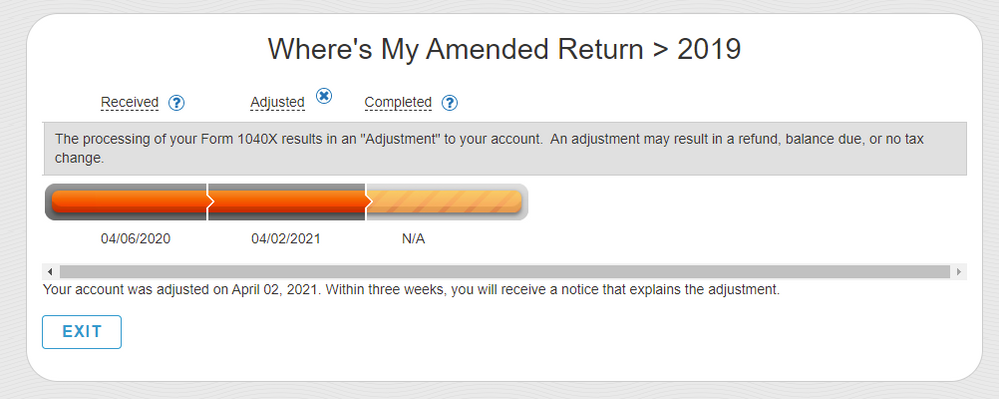

Amended return status for 2019, what does this mean and so am i getting a refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

@pxk338 That means your return is currently being processed by the IRS. You will continue to receive updates from the IRS until the process is complete. Keep checking back with the IRS for new information. If a refund is to be issued, the IRS will notify you in writing.

Here's an IRS FAQ link for amended returns.

https://www.irs.gov/filing/amended-return-frequently-asked-questions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

What do you mean by Already adjusted?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

"Already adjusted" means the IRS has reviewed the return and made their determinations. The IRS will then notify you by mail of any adjustments and let you know why any changes were made. You will be given an opportunity to reply if you feel there was an error and you will be able to provide proof to substantiate your position. The notice will give you more information on how to reply if you disagree.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

Mailed my 1040x in September 2020 just now showing up as received but not processed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

Sadly not a surprise this year ... they still have millions of prior year returns that have not yet been processed. The IRS is understaffed, over tasked and burdened by the limitations of older computer equipment so until congress properly funds this department they will continue to do less with less.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

My amended return said the same thing except it was received January 11, 2021. When I called the IRS they said that my amended return case had been closed, it wasn’t rejected just closed and they couldn’t tell me why. They said I needed to resubmit my amended return to start the entire process all over. 🥺

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

Thank you! You saved me a lot of consternation and frustration.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

Have you received your refund yet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

Not yet, IRS received my 1040X in April.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

The whole process took about 10 months. Here's my timeline:

- March 10, 2021: Mailed 1040X for 2019

- April 15, 2021: IRS website says they've received my return

- August, 2021: the dreaded "Your amended return was received on April 15, 2021. However, it has not been processed. We apologize for any inconvenience. Please call XXX-XXX-XXXX extension 623, between the hours of 7 a.m. and 7 p.m., Monday through Friday. You will need a copy of your amended return."

- August, 2021: I called the number and after about 2 hours an agent actually answered. She checked my account and said they just started processing my return, ignore the error message, and don't call again.

- January 7, 2022: "Your account was adjusted on January 07, 2022. Within three weeks, you will receive a notice that explains the adjustment."

- January 10, 2022: We're getting something in the mail from the IRS today. I hope it's a check!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

Thanks for sharing. I saw the same message in my ammendment.

"Your amended return was received on October 02, 2021. However, it has not been processed. We apologize for any inconvenience.

Please call [phone number removed], extension 623, between the hours of 7 a.m. and 7 p.m., Monday through Friday. You will need a copy of your amended return. "

I'm not sure when it was posted but I will follow what you did.

I wonder If you received your money from your Amendment 1040X?

If yes, when? Is it a check or is it a direct deposit?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does this mean?

Even during “normal” times it takes about four months for the IRS to process an amended return. During the pandemic and due to the severe backlog at the IRS it is taking much longer—six months or more for many amended returns. Do not expect quick results from amending. When the IRS issues a refund for an amended return it will be by check. They do not make direct deposits for refunds for amended returns. You can watch for information here:

https://www.irs.gov/Filing/Individuals/Amended-Returns-(Form-1040-X)/Wheres-My-Amended-Return-1

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mrmarquar

New Member

Trev3700

New Member

John47

New Member

andu89

New Member

DarthVaderKamp

New Member