- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Youre only entering the federal refund amount, right? No...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

It depends.

The IRS issues a lot of refunds within 21 days, but it could take longer.

The online link is your best option to track your refund. I have attached a link with more answers from the IRS as to why your refund may be taking longer to process.

Also, be aware, the IRS operations are limited during the Covid-19 pandemic. Attached is a link with more information as to what departments are available to contact at the moment.

The payment of the stimulus funds can be tracked at the following website:

Check status of economic payment

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

How do I track my 2019 tax refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

@Robertblunt wrote:How do I track my 2019 tax refund

The IRS says 9 out of 10 filers who efile and choose direct deposit will get their Federal refunds within 21 days after being accepted. Some returns are processed fairly quickly, while others require additional processing due to specific items in the return. Some are pulled at random for more thorough investigation.

Did you efile, or did you choose to print and mail the return? If you filed a paper return by mail, even in "normal times" it can take about 6 weeks to get a Federal refund. But with the Coronavirus emergency, however, paper returns are currently not being processed for the time being.

If you efiled, you should double-check to be sure the return was efiled successfully and accepted.

If you used Online TurboTax, you can sign into your Online Account and check the efile status at the Tax Home.

If that showed it was accepted, you can use the "Where's My Refund" tool at the IRS website below to monitor the status of your Federal refund. If you only recently efiled, then be sure to wait at least 24 hours after being accepted before trying the tool.

https://www.irs.gov/Refunds

NOTE: When using that tool, use only the Federal refund amount, and not any total refund amount that includes a state refund.

The amount to use is on your Federal Form 1040, Line 21a.

To track a state refund:

https://ttlc.intuit.com/community/refund-status/help/how-do-i-track-my-state-refund/00/25571

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

I filed and was accepted on January 27th 2022 and I still have not received my taxes. And now its saying that my info does not match their records. It looks like TurboTax would update you considering they charge a bundle for doing nothing. Thanks again TurboTax for nothing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

Checking the IRS site … no record found can be shown from time to time even if you enter everything correctly and this is normal as your return proceeds thru the processing pipeline. It will also be this way if you try unsuccessfully too many times in a row … then you are locked out for a day.

Sometimes people get confused by the “summary” given by TurboTax and use the wrong amount for the federal refund. Make sure you are only using the federal refund amount, and not an amount that combined your federal and state refunds.

Your federal refund amount is on line 35a of your Form 1040

https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

When I put my information in ig tells me that my information is incorrect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

@ blreaves wrote:When I put my information in it tells me that my information is incorrect.

I assume you are asking about the IRS "Where's My Refund" tool. How did you file--did you efile, or did you print the return and mailed it to the IRS? How long has it been?

If you efiled, was your efiled return accepted by the IRS for processing? If you used Online TurboTax, you can check the efile status at the Tax Home of your online account.

Here are some tips when using the IRS "Where's My Refund" tool.

- If you efiled, be sure you have waited at least 24 hours after acceptance before using the IRS WMR tool.

- NOTE: If you mailed a paper return, the IRS website says it can take 6 months or more just to show up in that tool.

- Be sure you enter the correct SSN, filing status, and tax year.

- Be sure you are using only the Federal refund amount. Do not include any state refund or any total refund or net refund (Fed and State) that TurboTax may have provided on a screen.

- Look at your actual Federal return to get the Federal refund amount to use, i.e., your Form 1040, Line 35a.

You can also try phoning the IRS refund hotline. I've seen it work for some users when the WMR tool didn't. 800-829-1954.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

There is no line 20a. Did you mean line 35a?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

The tax forms do change from year to year so the lines will also change. Since this post is over 2 years old, assuming you are trying to locate the refund amount on your tax return, you are correct and will look for the amount on line 35a.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

Thank you for this tip! It worked after only entering my federal.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

Yes only the fed amount my refund say records don't match and it's been 6 weeks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

Yes been 6 weeks no information found records dint match

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

@ Annwright wrote: Yes only the fed amount my refund say records don't match and it's been 6 weeks

Yes been 6 weeks no information found records dint match

You didn't say how you filed--by efile or by printing and mailing. If the IRS "Where's My Refund" tool is not finding your information, here are some things you should check before phoning the IRS customer service.

First, you need to be sure the return was successfully filed. It depends on how you chose to file the return.

If you filed a paper return by mail, TurboTax does not mail it for you. If you chose that method, you would have had to print it, sign it, date it, and mail it yourself. It takes at least 4 weeks for a mailed return to show up in the IRS WMR tool.

If you efiled, double-check to be sure the return was efiled successfully and accepted. If you used Online TurboTax, you can sign into your Online Account and check the efile status at the Tax Home. If you used desktop software, you can check from within the software. Also, if you efiled, you should have gotten emails--the first that the return had been transmitted, followed by a later email on whether the efile was accepted or rejected.

If that showed the efile was accepted, (or if you mailed a paper return), you can use the "Where's My Refund" tool at the IRS website below to monitor the status of your Federal refund.

https://www.irs.gov/wheres-my-refund

If that IRS tool says it's not finding your information, here are some tips:

- If you efiled, be sure you have waited at least 24 hours after acceptance before using the IRS WMR tool. If you mailed a paper return, it won't show up in the tool for at least 4 weeks or longer.

- Be sure you enter the correct tax year, SSN, and filing status.

- Be sure you are using only the Federal refund amount. Do not include any state refund or any total refund or net refund (Fed and State) that TurboTax may have provided on a summary screen.

- Look at your actual Federal return to get the Federal refund amount, i.e., your Form 1040, Line 35a.

If the IRS WMR tool is still not finding your information, you can also try phoning the IRS refund hotline, again using the figure from Form 1040, Line 35a. I've seen it work for some users when the WMR tool didn't. 800-829-1954

If still no luck after that, we can tell you how to phone the IRS to inquire.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant track my refund, irs page says info does not match records.

Did you get emails from TurboTax saying your return had been Filed and Accepted? Did you use TurboTax Desktop or TurboTax Online?

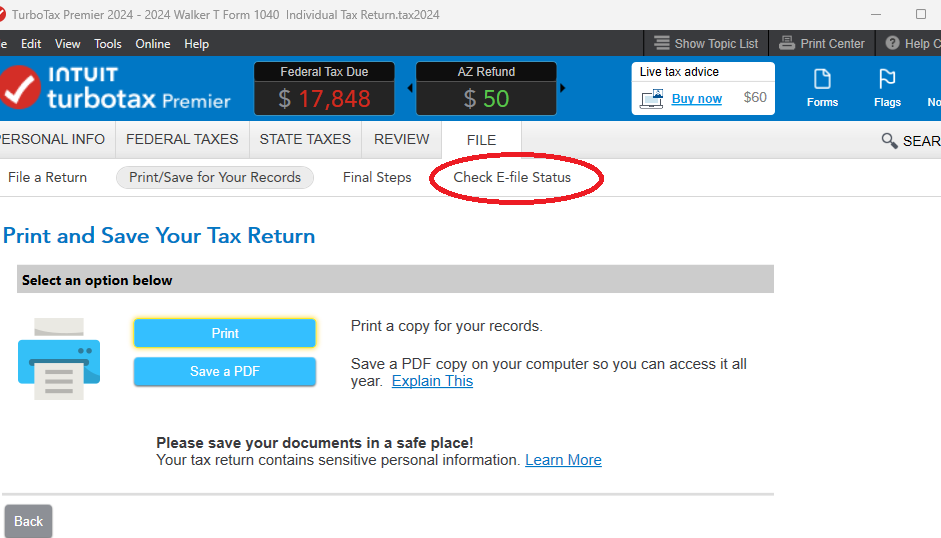

If you used TurboTax Desktop, when you open the program, click on 'Check Efile Status' under the FILE tab.

If you used TurboTax Online, Sign In to your account. You should have a page indicating you Filed, with a link to for 'IRS Refund Tracker'.

When you check the Where's My Refund? link, make sure you enter the Refund Amount shown on your Form 1040, Line 35a.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JustmeBG

New Member

jeezerz

Returning Member

gjgogol

Level 5

bertkesj

New Member

mwchoh

New Member