To track your state refund, select the link for your state below. If you’re looking for your federal refund instead, the IRS can help you.

Important: To help establish your identity, many states will ask for the exact amount of your expected refund in whole dollars. You can find this by signing in to TurboTax, and it'll be on the first screen. If you're using the mobile app, you may need to scroll down to find your refund amount.

Other helpful info

Each state handles its own refunds.

Keep in mind that most dates are estimates and refunds can be delayed for many reasons.

If you're concerned, contact your state's Department of Revenue at the links given.

State tax webpages may be slow to respond during tax season. If a link doesn't appear to work, try again during off-hours.

My state shows no record of my tax return

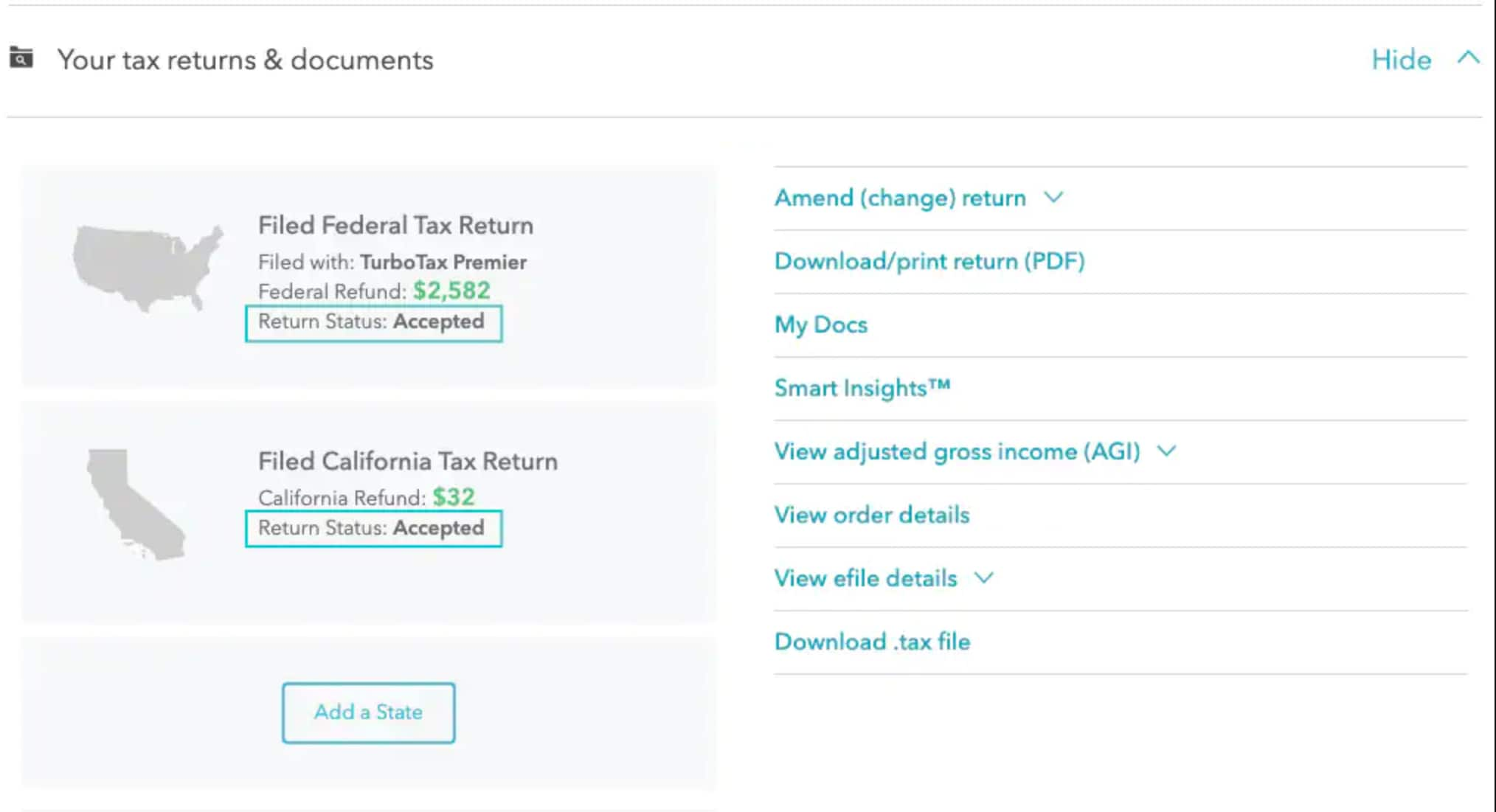

If you e-filed but your state website shows no record of your state return, you may not have actually transmitted it. Sign in to your Intuit Account and open Your tax returns & documents on the Tax Home screen. Your state return for 2025 should be listed as Filed, and your Return Status should say Accepted. If it says Started instead, you'll need to file your state tax return.