- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: What can I submit for proof that my kids lived with us all year last year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

Who is asking for proof? Did you receive some sort of letter from the IRS or state? What exactly does it say?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

The IRS does random audits to "keep us all accountable" so you probably did nothing wrong except being unlucky.

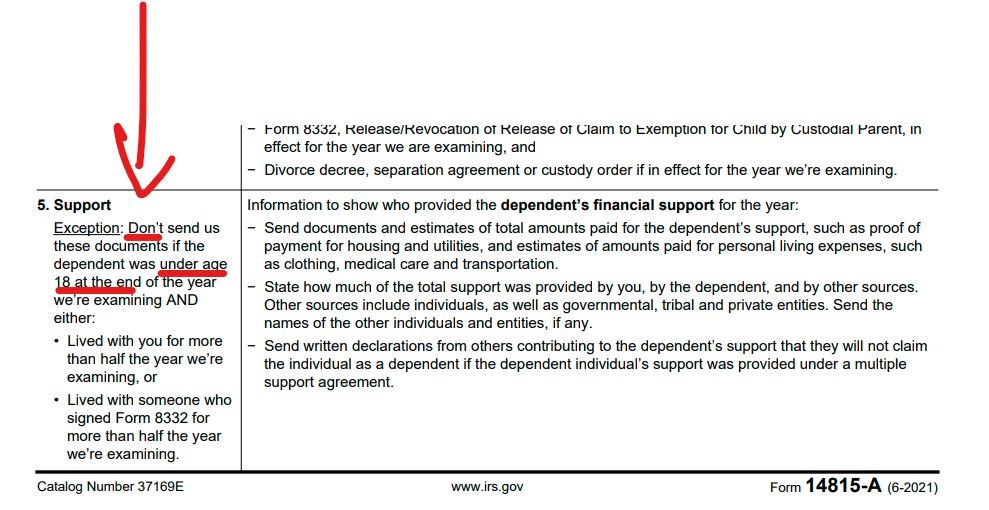

See IRS Form 14815-A here

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

if it is the IRS (unlikely to be your state) asking for proof then things like pictures of their room with you and your husband in the picture with them, medical bills (even 2020 and 2022) you paid for them or a letter from their doctor, signed affidavits of neighbors that the kids live with you, birth certificates, etc. the notice should contain these suggetions so if it does not be wary.

you may want to file an identity theft affidavit for each of your kids. the scenario I'm thinking of is that someone got hold of their IDs (SSN) and filed a return claiming them. you also filed claiming them. thus the IRS has two returns claiming the same kids.

could both you and your spouse have filed tax returns for the same year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

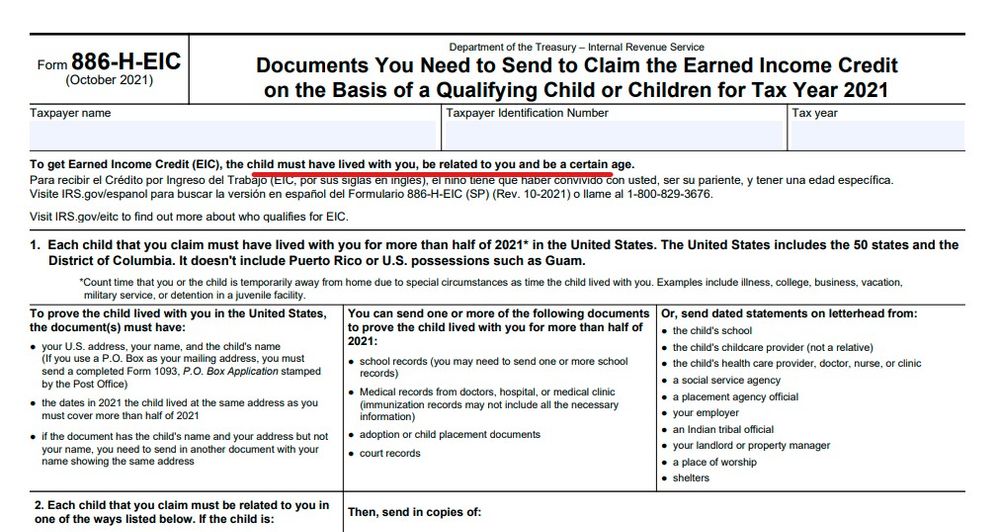

Yes, it's the IRS. I had called a couple weeks ago since we still hadn't gotten our return (sent in February) and they said we would be receiving this letter but didn't say what they were auditing. I assumed it would just be my small business, which is no big deal, I keep detailed records. However, they sent Form 14815-A (Request for Supporting Docs to Prove the CTC) and form 886-H-DEP (Request for Supporting Docs for Dependents) and form 886-H-EIC (Request for Documents you need to claim EIC based on Qualifying Child). As for what the Letters are requesting, it's very specific. It needs their SSN cards AND their birth certificates AND proof of residency (that we all lived together) AND proof that my husband and I paid for things for them AND some type of documentation on official letterhead from like a school or court or something.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

Yep ... I call that the scavenger hunt notice so do the best you can. The IRS has the right to question anything on any return at anytime. Respond as if this was a "word question" on a final exam ... give short consise answers and refer the attached documents for instance 1) see attached SS cards (remember only send copies ... never originals as they will not be returned).

If you filed a joint return then the entire support situation is immaterial if this was your child who lived with you ... do your best.

Even home schooling has some kind of records as you have to follow some kind of curriculum and testing schedule.

Read those forms carefully ... watch for the little words ... note that some proof is on all the lists ... you so not need to send them multiple times.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

What ended up happening? I'd be in the same boat if this happened to me because we also homeschool. We do go to church and my kids see the doctor, but we changed churches mid year last year. My kids also only saw the doctor one time for annual wellness exams. I see that you can use a statement from your employer or health insurance. Not sure what type of statement this would be.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

@Boombaby99 You are posting to an old thread that has had no activity since 2022. We can be more helpful if you explain your own situation or issue here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

@xmasbaby0 @I don't currently have an issue, but this is good to know for the future in case of an audit. My husband and I file jointly every year and claim our 4 children as dependents for the EITC and the CTC. We homeschool them, so there are no school records really to prove their residency. I do have to file an affidavit every year with the school that has their names, my name, and address listed. They do see a PCP, but usually only for an annual wellness exam. We currently attend a church, but have changed churches several times. I see that online it lists health insurance documents or employer statements as proof of residency. I'm just not sure what those statements would have to include.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

If your children don't have other relatives who are likely to try to claim them as dependents, it's very unlikely that the IRS would question whether they live with you.

For examples of the types of documentation that the IRS would request in the event of an audit of dependents claimed, see IRS Form 14815.

See this TurboTax tips article for more information regarding the rules for claiming dependents.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

@MonikaK1 None of my relatives would. However, all of my children have been a part of a healthcare data breach leaving them susceptible to identify theft. I thought about getting them IP pins, but the IRS will only mail these pins out for minors. If they are lost in the mail, they do not resend them and then you have to file a paper return. My husband and I both already have IP pins because my husband was a victim of identity theft already.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

Hi! I'm curious as to what documents you submitted for your children?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What can I submit for proof that my kids lived with us all year last year?

Assuming you are trying to determine what the IRS needs to show proof of residency, this link from the IRS indicates the following documents are accepted as proof:

- Rental agreement listing residents

- Any of the following documents which list the address for you and your dependent

- School enrollment records

- Health insurance or medical coverage records

- Government benefits records

- Legal or financial information

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Tchelo

Returning Member

Dawn20

Level 2

95jolinda

New Member

bobdenny

New Member

wesley-km-ng

New Member