- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

Unfortunately this did not solve my issue. The number provided is the phone number for “Live Tax Advice” for which you must be a paying member of their services.

I am not looking for advice. I identified an error in their programming and am trying to be helpful. Turbo tax advertises “Maximum Refund Guarantee”.... well, the mathematical error I identified would cost the company a significant amount of money to live up to the guarantee, as this error would impact the majority of the people whom file New York State taxes through their services.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

Would you mind sending a "scrubbed" data file to us so that we can take a look and send to the appropriate department to resolve the error in programming?

We may be able to troubleshoot a workaround for you here in the short run (sometimes this is possible depending on the nature of the issue, though not always). However, the data file is invaluable to us in helping to show the programmers exactly what needs to be fixed.

If you are willing to help us out with this by sending the file, here is how to do so:

- Login to TurboTax and continue to any screen of your tax return.

- Click on Tax Tools in the menu on the left.

- Click on Tools.

- In the box that pops up select "Send File to Agent".

- Write down the six digit code that pops up and post it back here on this thread.

This data file removes all personally identifiable information before sending the data file to a secure server, where we can retrieve it with the code provided. The code is not useful to the public in any way.

Thank you!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

I can tell you specifically the error resides within the new tax law that allows people utilizing the standard deduction to be able to also claim a small amount of Charitable Contributions. (Line 10b on the Federal form 1040). The program works perfectly for the federal form, however the formula is specifically messed up when filing the New York State IT-201 form:

The Software correctly takes the value which would be entered on line 18 of IT-201 2020 (which is a value copied from the Federal 1040 form line 10b). The programming also correctly subtracts this value from line 17 of IT-201 to come up with the correct Adjusted Gross Income on line 19. The Mathematical mistake happens when calculating the Taxable Income on the NYS From IT-201, line item 37. The program subtracted the Standard Deduction (line 34) from line 17....[This is the error] when it should have subtracted the Standard deduction from the AGI (Line 19). This results in a Taxable Income value that is an incorrect dollar amount. (Specifically greater by a value equal to the Charitable Contributions claimed, aka line 18). This in turn uses this incorrect value to calculate the amount of NYS tax owed (line 46) making this value too high.... and results in an error in the total refund amount (line 77) causing any NYS customer whom claimed Charitable Contributions along with the Standard Deduction to receive a refund that is lower than the value they should actually receive.

The token # you requested is 847913.

I hope this information proves to be useful to your programmers. (and subsequently all New York customers utilizing your software that would have a similar situation).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

Thank you very much for your detailed explanation and the token!

I will get to work on this and hopefully we can have it resolved soon. If we can find any workaround that may work for you in the short-term, we will let you know in this thread.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

So far, I am not finding a workaround, particularly in the online program, so this has been escalated. Thank you again!

[Post edited May 11, 2021 8:30 PM PDT]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

After looking more closely today and digging into the TurboTax worksheets, I can see that the program is functioning properly today. (May 12, 2021)

Although it takes a bit of a circuitous route to get there, the program ultimately does what NY law requires, which is adds back in the $300 charitable contribution deduction, which is per New York State law (this is a federal deduction, but not a state deduction).

The program is doing this with a worksheet that sometimes adds back other items of income as well, from Form IT-201 as well as with the add-back on Line 18, so it looks a little strange but the end result is correct.

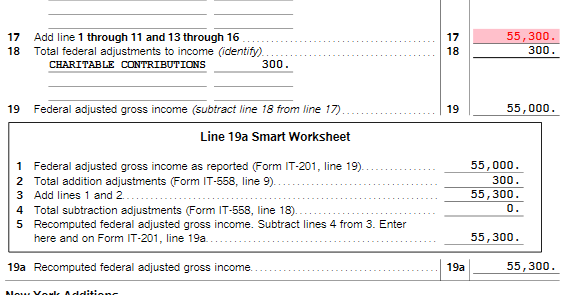

In the screenshots below you can see where the $300 is shown in two places. It first appears on Line 18 as a federal adjustment to income, where it is subtracted just as it is on the federal return. This appears to just be a breakdown of federal income and adjustments here, not a place where any new adjustments are taking place.

Next, the "Line 19a Smart Worksheet" details out the state adjustments made to the federal adjusted gross income. This can include subtractions, additions, or neither if the state law and the federal law are in agreement with the adjustments on Line 18 (or their are none).

In this worksheet below the $300 that was subtracted to get the result on Line 19 is added back (per NY law - with the explanation residing on Form IT-558) to create Line 19a. Line 19a can be a bit hard to see, stuck below that worksheet.

The NY taxable income ultimately includes the Line 19a amount (see the instruction at Line 24) to arrive at the number on Line 33. Line 33 is the final result of these items used before deductions and exemptions are applied to arrive at the taxable income on Line 37.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

using turbo tax home and business. having a mathematical problem. adjusted gross income is different on forms than step by step due to charitable contributions…. Ahhhh. any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

The Adjusted Gross Income (AGI) is calculated before charitable contributions are taken into account.

When you look at Form 1040, the AGI is reported on line 11. This number is then adjusted by the itemized deductions, standard deduction, or standard deduction plus Cares Act charitable contributions along with the Qualified Business Income (QBI) deduction (if applicable) to determine the taxable income shown on line 15.

If you still feel there is a mathematical issue, please provide a few more details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

I'm very new to TT, and working on my return. I've "Piggybacked" this incident because although I've scanned

many many incidents, I've not been able to begin a fresh incident. I chose this incident because it was closely

related to my problem. And that is:

Doing my return recently, using your TT Premier version, I was real close to completion. However, I wanted to

verify a generated worksheet construction before continuing. So, I walked through the "Qualified Dividends

and Capital Gains" worksheet. I could see that my DIY QDCGW was disagreeing with the TT version. So, I

just started stepping through with an A:B comparison.

Shortly, I reached the following text where the simple math problem went astray. (paraphrased replacement)

Line 7 ...... 80,000

Line 8 ...... -34,168

Line 9 ...... 46,632

Of course, that answer should be 45,832. Remaining(following) calculations seem to be correct, but after this

error, everything is pretty well downhill. Having done these taxes for years, I can make the correction, but I'm

somewhat afraid I might overlook other related areas, or overlook other unrelated errors.

Sorry, for the incident interruption !! - [email address removed]

Gary

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

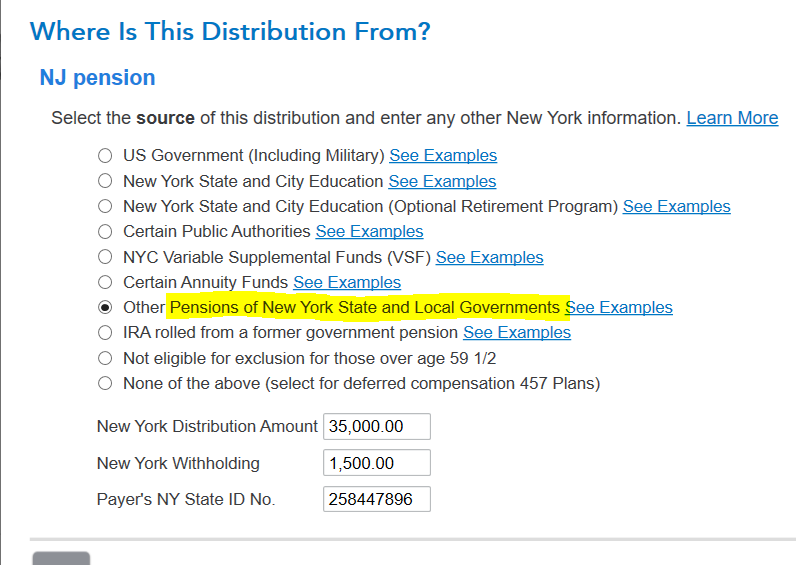

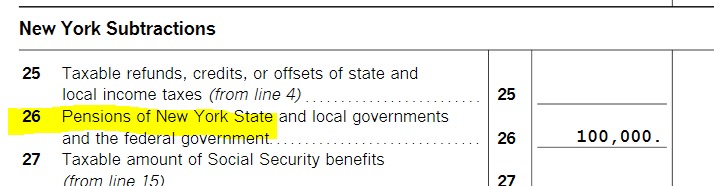

Turbo Tax programming has incorrectly entered the $20,000 exclusion on Lince 29 of Form IT-201 NY State Resident Income Tax Return. " Line 26, Pensions of NYS and local governments and the federal government" are subtraction items. Both my husband and I have NYS pensions, but it only subtracted his and as noted above took the $20,00 exclusion on Line 29. I am trying to amend my 2021 state return on which I had to pay taxes unlike past years. How do I proceed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The turbo tax programming has an error in which it makes a mathematical (subtraction) mistake that it will not let me override/correct. How do I talk to someone to fix?

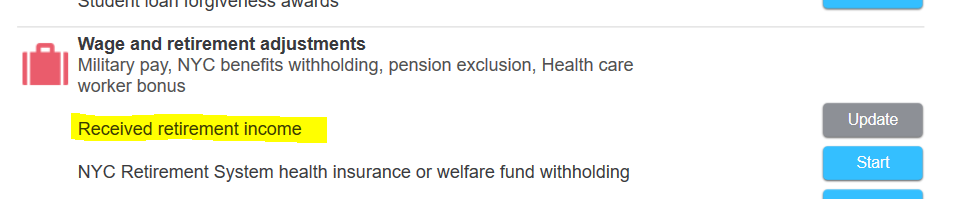

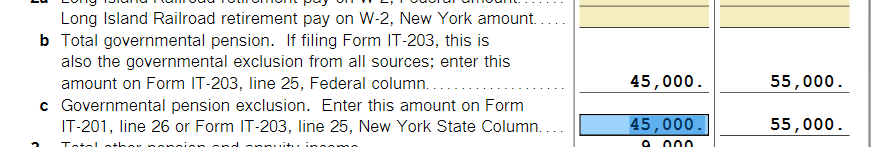

Since only one of you is showing anything, please review your 1099-R entry and make sure the correct owner is marked for each pension. I made up John and Jane Doe with NY pensions, one $45,000 and one $55,000. Please follow these steps:

- While going through the 1099-R entries:

- double check that you selected state and local government for the pension.

- After the selection, select the NY box.

- Be sure to mark from a Qualified Plan.

- You can also go through the state return and verify no additional information is needed in the Received Retirement Income section. You should not need to do anything here.

- Finally, review your forms and line 26 will show your pension exclusion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jmallard

New Member

Itty211

New Member

carolynmkendall509

New Member

jtomeldan

Level 1

dgurreri

New Member