- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

After looking more closely today and digging into the TurboTax worksheets, I can see that the program is functioning properly today. (May 12, 2021)

Although it takes a bit of a circuitous route to get there, the program ultimately does what NY law requires, which is adds back in the $300 charitable contribution deduction, which is per New York State law (this is a federal deduction, but not a state deduction).

The program is doing this with a worksheet that sometimes adds back other items of income as well, from Form IT-201 as well as with the add-back on Line 18, so it looks a little strange but the end result is correct.

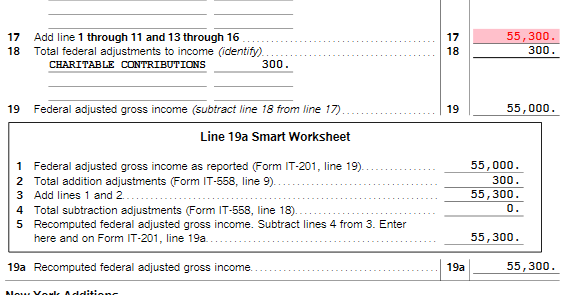

In the screenshots below you can see where the $300 is shown in two places. It first appears on Line 18 as a federal adjustment to income, where it is subtracted just as it is on the federal return. This appears to just be a breakdown of federal income and adjustments here, not a place where any new adjustments are taking place.

Next, the "Line 19a Smart Worksheet" details out the state adjustments made to the federal adjusted gross income. This can include subtractions, additions, or neither if the state law and the federal law are in agreement with the adjustments on Line 18 (or their are none).

In this worksheet below the $300 that was subtracted to get the result on Line 19 is added back (per NY law - with the explanation residing on Form IT-558) to create Line 19a. Line 19a can be a bit hard to see, stuck below that worksheet.

The NY taxable income ultimately includes the Line 19a amount (see the instruction at Line 24) to arrive at the number on Line 33. Line 33 is the final result of these items used before deductions and exemptions are applied to arrive at the taxable income on Line 37.

**Mark the post that answers your question by clicking on "Mark as Best Answer"