- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

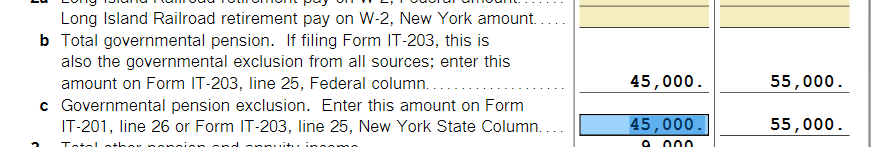

Since only one of you is showing anything, please review your 1099-R entry and make sure the correct owner is marked for each pension. I made up John and Jane Doe with NY pensions, one $45,000 and one $55,000. Please follow these steps:

- While going through the 1099-R entries:

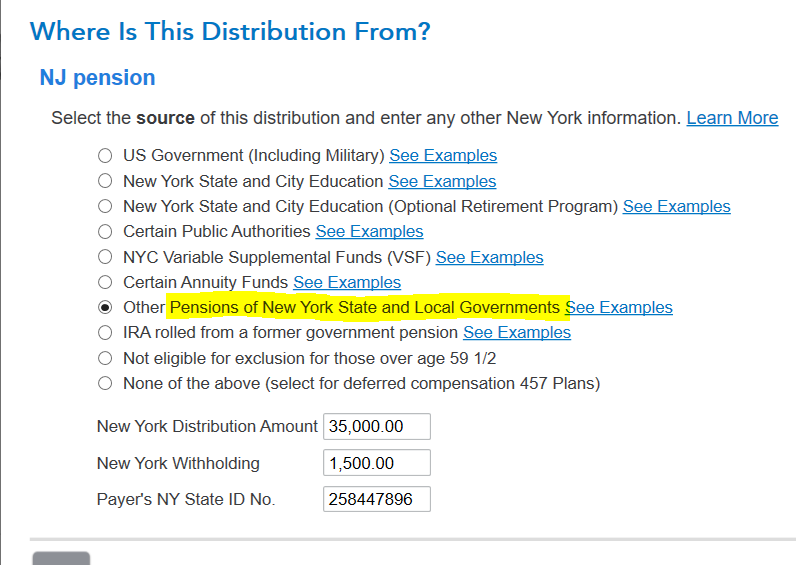

- double check that you selected state and local government for the pension.

- After the selection, select the NY box.

- Be sure to mark from a Qualified Plan.

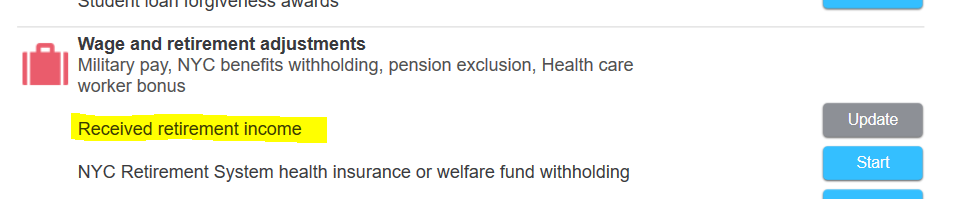

- You can also go through the state return and verify no additional information is needed in the Received Retirement Income section. You should not need to do anything here.

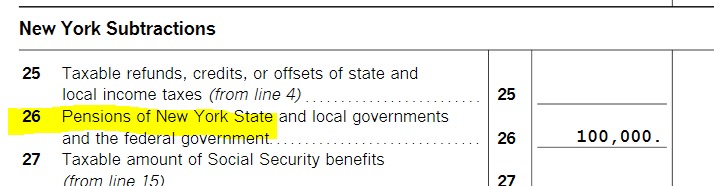

- Finally, review your forms and line 26 will show your pension exclusion.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 22, 2023

12:59 PM