- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Taxes

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

@Griffd Each state handles it's own refunds and therefore the processing times can vary. Please select your state from the TurboTax FAQ: How do I track my state refund? for tracking instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

I got a letter from irs stating they need a form 1095 A I never received the form it prevented me on getting a stimulus package what do I do

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

Your 1095-A should be available in your HealthCare.gov account. Log into your healthcare account and follow these steps.

- Under "Your Existing Applications," select your 2019 application — not your 2020 application.

- Select “Tax Forms” from the menu on the left.

- Download all 1095-As shown on the screen.

If you can't find your 1095-A in your Marketplace account contact the Marketplace call center.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

I keep getting denied

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

I filed my taxes and they got accepted by the IRS. And processed. It says they get mailed out before the may 1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

How can I track my return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

I filed in January and never got my taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

I file my with tubo and the IRS say I owe why when I never owe them

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

We cannot see your tax return so we do not know why you owe federal tax this year. The usual reason would be that you did not have enough tax withheld from your paychecks during the year.

No one in this user forum can see your tax return or your screen. There were major tax law changes that began with the 2018 tax year that seem to continue to surprise some people. Personal exemptions of over $4000 per person were removed beginning with 2018 returns.

One thing that may be affecting your refund is that employers began withholding less tax when the new tax law passed. Your paychecks were more, but that means a smaller refund now.

There are a lot of variables that affect your refund or tax due including how much you earned, how much tax you had withheld, your filing status, the number of dependents you claim, your deductions and credits, etc. You may have lost Earned Income Credit or the Child Tax Credit— did a child turn 17? If you received the EIC last year, remember that changes in the amount you earn have a big effect on the amount of EIC you can get. (Sometimes earning more money means less EIC) Are you 65 or older ? If so, your standard deduction is higher. Everyone has a higher standard deduction now so it is harder to use itemized deductions.

And of course, always check your own data entries, looking for errors such as misplaced decimals or extra zeros.

https://ttlc.intuit.com/questions/1901008-why-did-my-refund-go-down-compared-to-last-year-s

Print out 2018 and 2019 and compare them side by side to see what is different.

https://turbotax.intuit.com/tax-tips/tax-payments/video-why-would-i-owe-federal-taxes/L3VXudPiN

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

2020 taxes yesterday

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

Change AGI on federal and state

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

@Chloe31 We do not have access to your TurboTax account in this public internet forum, so we are not able to change your AGI. Are you trying to locate a previous year's AGI?

Please click How do I find last year’s AGI? to learn more.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

Look I didn't get all my taxes I don't think I got the first or the second stimulus and I haven't gotten the 3rd one either

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes

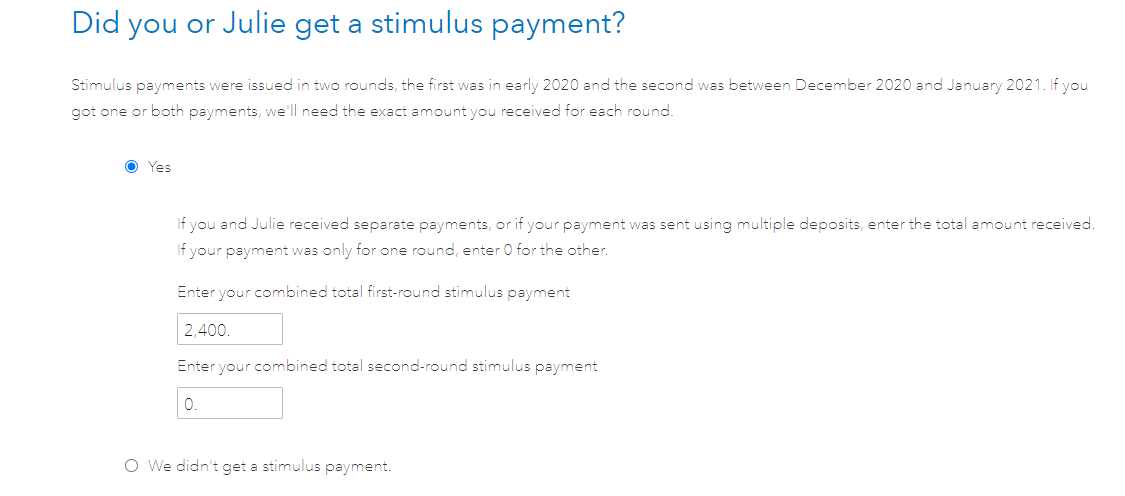

You will need to file a tax return for 2020, even if you did not have a filing requirement.

The stimulus payment amounts issued in 2019 or in January 2020 were based upon your 2018 or 2019 income tax returns filed.

The amount of the Rebate Recovery Credit is based upon your actual 2020 income tax return you file. Therefore, if you meet the criteria for the credit, you will receive it when you prepare your 2020 income tax return. The credit is intended to give those who should have received a stimulus payment but never did a tax credit on their tax returns. Any excess credit is then refunded to you if there is an overpayment on your tax return.

Please see the attached link for more information on who can claim the credit.

Recovery Rebate Credit eligibility

When you prepare your 2020 income tax return, be sure to do the following to ensure the credit is calculated correctly on your income tax return.

In the Federal section, select the Federal Review interview section at the top of the screen.

This will take you to the input section for the Recovery Rebate credit.

Be sure to indicate the actual amount of each stimulus payment you received on the page that asks if you received a stimulus payment.

There will be two boxes and both need to be completed. If you did not receive any stimulus payments, please indicate We didn't get a stimulus payment by checking that box.

Once you file your 2020 income tax return, the IRS will process your third stimulus payment if you meet all of the requirements to claim it.

How will the 3rd stimulus affect me

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

GRVanderpool

New Member

donnalsan

New Member

shannondebi

New Member

grafrebecca

New Member

Rtucker0925

New Member