- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

Hey Everyone,

We never received the 2nd Stimulus payment of $1200.

So we filed with TurboTax, Married Filing Jointly, with a tax Federal refund of $167 and claimed the $1200 rebate credit for a total of $1367.

We filed and it was accepted on 13 February. After a month we figured something had gone wrong.

Almost 2 months later on April 08, we finally received a CP12 Adjusted Refund Letter stating our refund will only be $167 with the reasons being either:

- The Social Security number of one or more individuals claimed as a qualifying dependent was missing or incomplete (We have no dependents and our SSN was correct on the 1040)

- The last name of one or more individuals claimed as a qualifying dependent does not match our records. (We have no dependents and our last names were correct on the 1040)

- One or more individuals claimed as a qualifying dependent exceeds the age limit. Your adjusted gross income exceeds $75,000 ($150,000 if married filing jointly, $112,500 if head of household) (Our AGI was only $26,276 and all of our calculations matched the CP12 notice)

- The amount was computed incorrectly (Used Turbotax so it should have been correct but double checked with the 1040 Rebate Credit worksheet and it adds up to the $1200)

I checked my IRS account and it shows the $1200 for the 1st Stimulus and $0 for the 2nd.

I have tried calling several different numbers (including the [phone number removed] number included on the CP12) to no avail. It always says something about call volumes are too high and disconnects. We don't know what to do.

Thanks in advance

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

Hey everyone, thanks for the replies. We finally got our 2nd stimulus payment in October!

TLDR: We moved which really confused everyone involved. The 2nd payment got returned to sender and lost in the abyss that is the IRS. After months of calling we finally got an in person appointment at a local IRS center who figured everything out and got us paid about 6 weeks later.

Here's what happened:

- We moved in late 2019 and when I filed our 2020 taxes, I selected a written check refund and the IRS sent payment to the old address we lived in during 2019.

- The 1st payment was sent to the old address but our mail forwarding got it to us.

- I should've updated our mailing address for the 2nd payment, but didn't. The 2nd payment sent out right when our USPS mail forwarding ended and was returned to sender.

- I found this out after calling for months. *Pro-Tip* I used the IRS appointment number (844) 545-5640. Option 1, 1. If I called before 10am EST I had a good chance of contacting a real person. Most days you will get "We're sorry...". Keep trying. The appointment agents CAN resolve some issues to help avoid in-person appointments. They looked at my account and told me how the 2nd payment had been returned and could not be reissued because of the 3rd party involved in payments.

- While on the phone, I updated our address and direct deposit and the 3rd payment was deposited later on without issue.

- They told us to wait on the 2nd payment to be issued. We waited and kept calling and finally, we got an in person appointment reserved which was not until September.

- At the appointment, we showed the agents what had happened. They verified everything on their end and told us they would fix it. About 6 weeks later payment was issued.

Lessons learned: update your address, use direct deposit, call the IRS appointment number with questions, make an appointment at a local IRS center.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

Im having the same problem and Im not paying TurboTax because they aren't any help i hired a tax professional and my return now says accepted so get off TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

The first stimulus payment, EIP1, was $1,200 for each taxpayer plus $500 for each eligible dependent and issued in early 2020. The second stimulus payment, EIP2, was $600 for each taxpayer plus $600 for each eligible dependent and issued 12/2020 thru 02/2021.

If you received both payments you should have indicated that on your 2020 federal tax return and No credit would have been entered on Form 1040 Line 30.

If you did Not receive one or both of these payments you should have indicated that on your 2020 federal tax return and the Recovery Rebate Credit would have been entered on the Form 1040 Line 30.

The IRS notice you received means the IRS has records showing that the IRS sent you the stimulus payment and has removed the Credit from your tax return.

Look at your tax account on the IRS website for the stimulus payments sent to you by the IRS - https://www.irs.gov/payments/view-your-tax-account

If you never received the stimulus payment then you need to start a trace on the payment with the IRS. Go to this IRS website for how to start a trace - https://www.irs.gov/newsroom/questions-and-answers-about-the-first-economic-impact-payment-topic-f-p...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

I have exactly the same issue.

Received CP12 stating:

"We changed the amount claimed as Recovery Rebate Credit on your tax return. The

error was in one or more of the following:

- The Social Security number of one or more individuals claimed as a qualifying dependent was missing or incomplete.

- The last name of one or more individuals claimed as a qualifying dependent does not match our records.

- One or more individuals claimed as a qualifying dependent exceeds the age limit.

- Your adjusted gross income exceeds $75,000 ($150,000 if married filing jointly, $112,500 if head of household).

- The amount was computed incorrectly.(683D)"

I think this is just a generic text, as none of those apply to me. I am MFJ, 2 dependents, income well below the $150k limit) and I received both EIP-1 and EIP-2 payments correctly for all.

Completing my tax return with Turbotax, I did not understand how it got to a $2,900 on line 30 - "Recovery rebate credit".

I believe this is what IRS is rejecting and adjusting with the CP12 they sent me.

What I need to understand now is how to get in touch with Turbotax to receive some information on how that portion of my tax return was completed, as I clearly recall I have tracked and entered both EIP payments correctly and validating them against the number of dependents I can claim on my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

TurboTax cant help you and I have no dependents and I make well below 75,000. I called and hit option 3 not 1 and talked to a lady about getting it done and she kept her word and I will never use TurboTax again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

@Aendil No one might ever know how you got 2900 on line 30. But you know you already got both the first 2 stimulus checks so line 30 should have been blank. The IRS knows they already sent it to you but you tried to claim it again on your tax return. There's nothing you can do about it now. Did you get the right amount for the 3rd stimulus in 2021? Make sure you don't try to claim it again. Better check your return over close before you file next time.

Did you get the full $4,600 for the first 2 EIP? How old were your dependents?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

@VolvoGirl Thank you for your answer.

3rd stimulus is 2021 tax event, correct? I received the correct amount for MFJ plus 2 dependents of $5,600 total. EIP-1 was correct with $3,400 (2,400 for MFJ, plus 2x$500 for each dependent). EIP-2 was also correct with $2,400 (2x$600 for MFJ, plus 2x$600 for two dependents). Both are under 5 at year end.

I agree with you, I should've looked it closer, that's right, but not being able to go back to my interview answers, defeats the purpose of using a service such as TT in the future. One relies on the interview questions to produce a correct output on the tax return. And if we all error, we should be able to go back and see when, where and why we took the wrong turn.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

Oh you're right. I added it up wrong. The first two should be 5,800 (3,400+2,400).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

So, backtracking what I did with the TT interview, the only possible answer might have been that EIP-2 was received in 2021, which is what happened in fact. I received the EIP-2 on 01/04/2021. Doesn't that make it 2021 tax event? It is on the computation tax worksheet, but since this is received in 2021 do I need to include it there, in 2020, and not on the 2021 one? The 2021 worksheet doesn't note anything about EIP-2, only EIP-3.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

The payment you got in January or February 2021 is an Advance and based on your 2020 return. Enter the second Stimulus payment on your 2020 return. The year you got it doesn't matter. If you don't report it Turbo Tax will give it to you again, which would be wrong and double and delay your refund. The Stimulus entry screen even says the second one is between Dec 2020 and Jan 2021 so you should include any payments you received in January and February.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

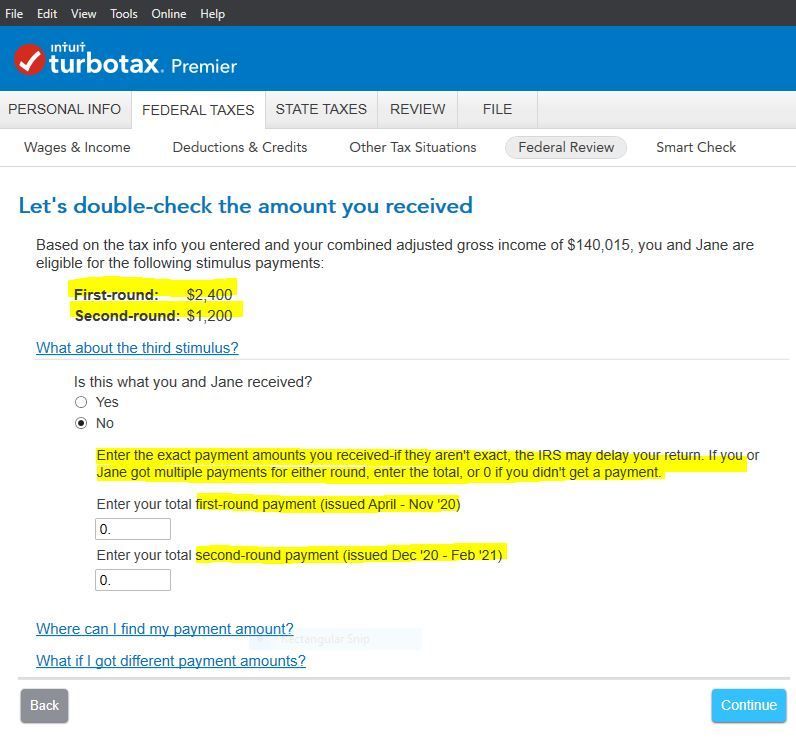

NO ... the first 2 stimulus payments were advances on the 2020 credit (no matter when you got them) and are reconciled on the 2020 return ... the program told you this if you read the screen :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

Huh, now I see where I may have overthink things and entered something wrong.

Thank you for clarifying that for me.

Still, it would've been nice if I was able to see the same thing. Good job guys, thanks for being on top of the questions here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please Help: 1040 Adjustment (CP12) for claiming Recovery Rebate Credit but we qualify

Hey everyone, thanks for the replies. We finally got our 2nd stimulus payment in October!

TLDR: We moved which really confused everyone involved. The 2nd payment got returned to sender and lost in the abyss that is the IRS. After months of calling we finally got an in person appointment at a local IRS center who figured everything out and got us paid about 6 weeks later.

Here's what happened:

- We moved in late 2019 and when I filed our 2020 taxes, I selected a written check refund and the IRS sent payment to the old address we lived in during 2019.

- The 1st payment was sent to the old address but our mail forwarding got it to us.

- I should've updated our mailing address for the 2nd payment, but didn't. The 2nd payment sent out right when our USPS mail forwarding ended and was returned to sender.

- I found this out after calling for months. *Pro-Tip* I used the IRS appointment number (844) 545-5640. Option 1, 1. If I called before 10am EST I had a good chance of contacting a real person. Most days you will get "We're sorry...". Keep trying. The appointment agents CAN resolve some issues to help avoid in-person appointments. They looked at my account and told me how the 2nd payment had been returned and could not be reissued because of the 3rd party involved in payments.

- While on the phone, I updated our address and direct deposit and the 3rd payment was deposited later on without issue.

- They told us to wait on the 2nd payment to be issued. We waited and kept calling and finally, we got an in person appointment reserved which was not until September.

- At the appointment, we showed the agents what had happened. They verified everything on their end and told us they would fix it. About 6 weeks later payment was issued.

Lessons learned: update your address, use direct deposit, call the IRS appointment number with questions, make an appointment at a local IRS center.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17604719363

Returning Member

t4stetson

New Member

N_Br0wn

Level 2

juliembriney

New Member

phyllis-lilly

New Member