- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: On my 2020 return I put that I didn't receive my second stimulus check. I got it today and ne...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

You don't need to amend your income tax return for the stimulus change. If you've already e-filed your tax return but need to make some changes to the Stimulus amount, we would like to give you the opportunity to review and update the Recovery Rebate Credit portion of your 2020 tax return before the IRS opens on February 12th.

If you want to review and update your 2020 return:

- Please enter your information here by February 6, to have your 2020 tax return sent back to you.

- You will then receive an email from TurboTax on February 8, letting you know that your return is available and providing you with detailed instructions on how to review, update and re-file your tax return without the Recovery Rebate Credit.

To quickly get to the stimulus section of TurboTax:

- Search for stimulus and select the jump-to link at the top of the search results to return back to the section.

- Enter your updated info and Continue.

Note: Stimulus payments were advances on the Recovery Rebate Credit. Stimulus payments are not taxable income to you so you won't be taxed on the amount you receive. It won’t reduce your refund or increase what you owe when you file your taxes this year. It’s also not considered income, so it won’t affect your eligibility for any federal government assistance or benefits. To review the TurboTax FAQ, click here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

Im have simulair issue..i signed up for it few times but didnt recieve any kind of confirmation are we still able to add the stimulus to the tax return??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

I also forgot to ask when i e filed i set up dates for my owe taxes to come out is there a way to change those dates...im down and out with covid and wanted to see if i could push them back farther..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

Follow the directions above from HelenC12. When you get your return back you can change the day that your taxes owed come out. It has to be by April 15, 2021.

To add your stimulus to the return:

The IRS will continue to make stimulus payments until February 5. Continue to check the IRS Get My Payment website to see if a bank deposit is made or if a check or debit card is issued. After February 12, if these is still no payment made then follow these steps to add the payment to your 2020 tax refund.

At the top of your tax return select Federal Review

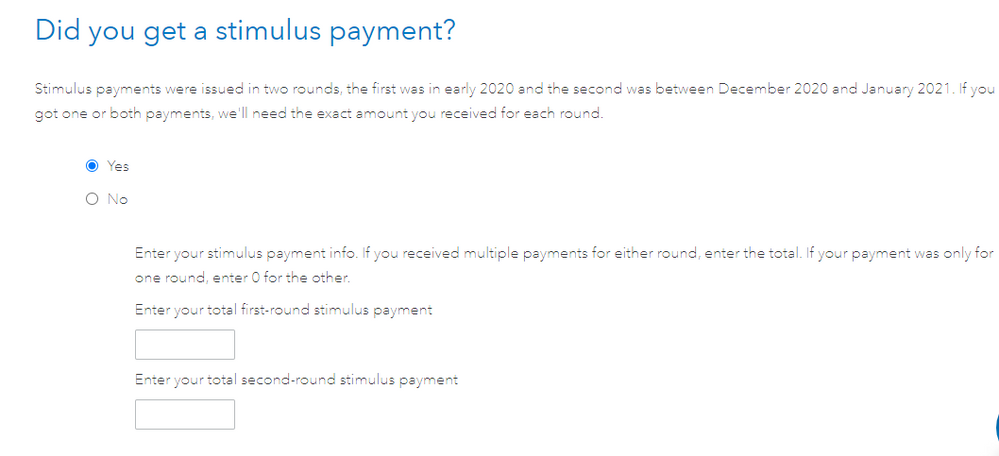

That will take you to this screen where it asks if you have already received your stimulus payments. If you received the first or second payment already, then select Yes and fill in the information. If you did not receive any payment select No. If you received the first payment only, fill in that amount and put zero (0) for the second payment.

When the screen is correct, you refund will be adjusted for the amount of stimulus payment that will be added to your 2020 refund.

@ Krajofdoubt13

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

Thank you for the fast replie i have already filed my tax returns so i submited the form above so i should be all good when i get my tax forms back?? Thanks again..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

When you get your return back, just make any changes needed and file it again. Everything should be good then.

@ Krajofdoubt13

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

So the very thing i was asking abiut happend i filled.That form above as helenc posted and i have not recieved my tax returns back today..why i was asking if i didnt get any kind of confirmation if i was gonna get them back..i called and got told to wait and see if they get rejected...cant that have some kind of penality attached to it?? Plus i still need yo change the dates the owe taxes come out...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

If you signed up, by February 6 via the TurboTax link, to have your tax return sent back to you, you will receive an email with further instruction per this link.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

I did sign up multiple times and still have not recieved the email..again why i asked that very day if i didnt recieve some kinda confirmation from the sign up link if i was gonna recieve the email to fix the return..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

The information about what the IRS has sent you in stimulus money can be confirmed using the link shown next. This year has been packed with changes and the IRS is allowing some latitude trying to help everyone. Since TurboTax planned to send emails today, give it more time if you signed up for the email notification and you want to change your tax return before it goes to the IRS.

-

Get My Payment - Select the button Get My Payment to see if your information is current based on the payments you did receive. If so, then it's another confirmation the IRS will not release the funds a second time.

When your return does get released back to you, and you can make the changes, you will know that your information matches the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

Been 2 days now anyone else not get there returns back to put returns on there e-file???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

This year has been packed with changes and the IRS is allowing some latitude trying to help everyone. The link below will show you what the IRS has on file for your stimulus payments.

- Get My Payment - Select the button Get My Payment to see if your information is current based on the payments you did receive. If so, then it's another confirmation the IRS will not release the funds a second time.

The IRS will compare the amounts in their system to the returns that are file and then there are two possible outcomes.

- The IRS will reject the return in which case you can correct it and immediately resubmit.

- The IRS accepts the return and automatically makes the adjustment.

It would seem they have a system already in place to make the necessary adjustments or an automatic reject if your return doesn't match their records. Do not amend until you know the results of your tax return after e-file opens on February 12th. If for any reason you do have to amend, which is unlikely, remember it can now be e-filed and currently the form is scheduled to be available February 18th.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

So my return was accept but now i cant change the date i wanted the owed taxes out..partly why i was asking for them to be returned and so i could the stimulus check to it...now what am i just out of luck cause the system did not send the return back loke i filed the form for..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my 2020 return I put that I didn't receive my second stimulus check. I got it today and need to know how to amend my return in the turbotax app?

Ok ... when did you ask for the debit to happen ??? If it is more than a week from now you can cancel the payment and make other payment arrangements.

Per the IRS:

Cancellations, Errors and Questions:

- In the event Treasury causes an incorrect amount of funds to be withdrawn from a bank account, Treasury will return any improperly transferred funds.

- Once your return is accepted, information pertaining to your payment, such as account information, payment date, or amount, cannot be changed. If changes are needed, the only option is to cancel the payment and choose another payment method.

- Call IRS e-file Payment Services 24/7 at 1-888-353-4537 to inquire about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling.

- Cancellation requests must be received no later than 11:59 p.m. ET two business days prior to the scheduled payment date.

- If a payment is returned by your financial institution (e.g., due to insufficient funds, incorrect account information, closed account, etc.) the IRS will mail a Letter 4870 to the address we have on file for you, explaining why the payment could not be processed, and providing alternate payment options.

- In the event your financial institution is unable to process your payment request, you will be responsible for making other payment arrangements, and for any penalties and interest incurred.

- Contact your financial institution immediately if there is an error in the amount withdrawn.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nestog33

New Member

regena767lott

New Member

gjgogol

Level 5

Mike9241

Level 15

M-blankenship

New Member