- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: IRS refused our online return. We missed the deadline, filed paper in Aug. No refund yet. Calling IRS turns on Robot that says "can not provide info". What do we do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS refused our online return. We missed the deadline, filed paper in Aug. No refund yet. Calling IRS turns on Robot that says "can not provide info". What do we do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS refused our online return. We missed the deadline, filed paper in Aug. No refund yet. Calling IRS turns on Robot that says "can not provide info". What do we do?

If you have a refund there is no penalty for filing late. You have 3 years to file to get a refund. So no worries about that. The IRS is taking a lot longer this year especially for mailed returns, People who filed in February are still waiting.

You are not alone. Millions are still waiting. Turbo Tax only gives you an estimated date. The IRS usually pays most refunds within 21 days. But these are not normal times. This year is taking the IRS longer to send the refunds. There are millions more people filing returns to get the Stimulus payment.

See this news article on Refunds being delayed

https://www.msn.com/en-us/money/personalfinance/where-is-my-damn-irs-tax-refund-new-answers-emerge-a...

Only the IRS can tell you. If your return was Accepted then check IRS Where's my refund

https://www.irs.gov/refunds/

When will you get your refund?

https://ttlc.intuit.com/community/refund-status/help/when-will-i-get-my-irs-tax-refund/01/25589

IRS - Questions about Refunds

https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS refused our online return. We missed the deadline, filed paper in Aug. No refund yet. Calling IRS turns on Robot that says "can not provide info". What do we do?

a paper-filed return could easily, based on various reports, take 4 to 6 months to process. your only option is to wait. some taxpayers that filed in February have not yet gotten their refunds.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS refused our online return. We missed the deadline, filed paper in Aug. No refund yet. Calling IRS turns on Robot that says "can not provide info". What do we do?

Every year in January the IRS will issue you a IP PIN to use for any returns filed during that tax year so watch your mail box every year for that number or you will need to paper file and wait forever.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS refused our online return. We missed the deadline, filed paper in Aug. No refund yet. Calling IRS turns on Robot that says "can not provide info". What do we do?

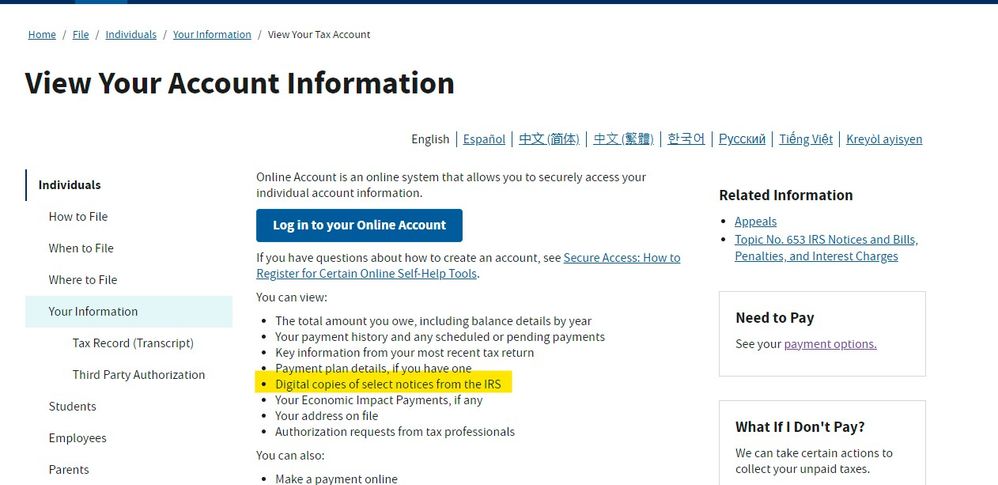

If I were you I would open an account on the IRS site ASAP so you have access to that missing PIN next year ... it is free and you will always have access to your information :

https://www.irs.gov/payments/view-your-tax-account

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TMM322

Level 1

caitastevens

New Member

HNKDZ

Returning Member

jjon12346

New Member

user26879

Level 1