- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I received a Notice of Proposed Assessment Indiana Department of Revenue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a Notice of Proposed Assessment Indiana Department of Revenue

I received a Notice of Proposed Assessment. It is for my full payment to the State of Indiana plus penalties. I look in Turbo Tax and I e-filed and it says everything went thru fine and that I have nothing left to do. I look at my checking account and nothing was taken out when you said it was done. Now I owe the money plus $229 in penalties. I don't think the penalty is my issue since your application said the e-file went fine. I am fine paying the Taxes not paid but I believe the penalty is yours. Let me how to proceed.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a Notice of Proposed Assessment Indiana Department of Revenue

How did you elect to pay the state taxes owed?

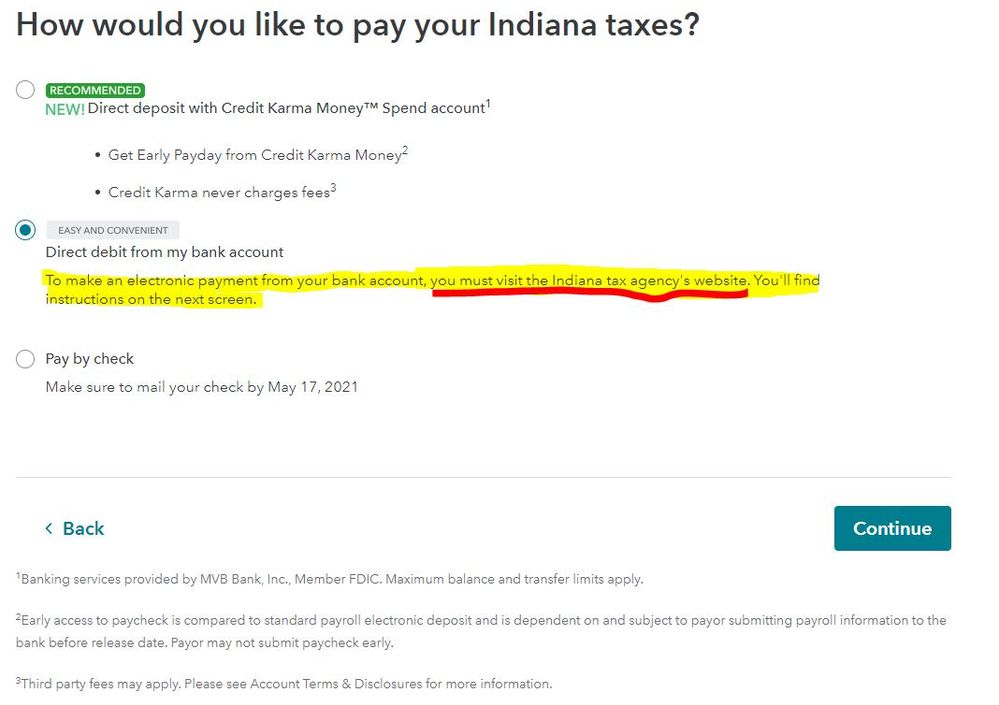

Most states do not allow a direct debit from a bank account when using personal tax preparation software.

In the File section of the program when taxes are owed you are given specific instructions on how the state taxes owed can be paid.

Look at the State Filing Instructions page for how you selected to pay the state taxes.

TurboTax will only reimburse penalties and interest for a calculation error made by the software. See this TurboTax support FAQ - https://ttlc.intuit.com/community/charges-and-fees/help/how-do-i-submit-a-claim-under-the-turbotax-1...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a Notice of Proposed Assessment Indiana Department of Revenue

How did you pay the state tax due? Your only proof is your bank account statement or credit card statement showing the payment coming out. And Turbo Tax doesn't pay any tax due for you. Turbo Tax just sends your payment method to the state. You either put down your bank account number for the state to pull it directly out of your account or you needed to mail in a check. Most states don't let you pay by direct debit. Did you check your bank account to see if it came out? You should have an instruction sheet telling you how to pay it.

Oh, and you can't have a state tax due deducted from your federal refund. Never. You can only have the Turbo Tax fees deducted from your refund.

https://ttlc.intuit.com/community/state-taxes/help/can-i-pay-my-state-taxes-from-my-federal-refund/0...

Check the printout or PDF of your return; look for the state cover sheet with the Turbotax logo. If you owed tax, it will show the payment information and how/when you decided to pay. Read the state payment instructions carefully since most states cannot be paid from within the TT system and requires additional steps.

https://ttlc.intuit.com/community/refunds/help/what-are-my-options-for-getting-my-state-refund-or-fo...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a Notice of Proposed Assessment Indiana Department of Revenue

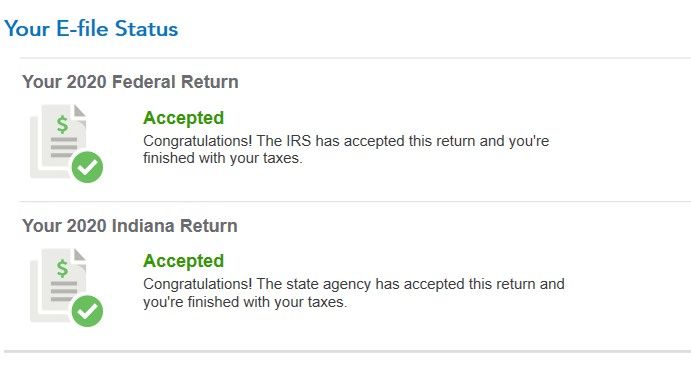

Excuse me but this is what I have on Turbo tax. I entered all the information to have it paid from my bank. Some of us are busy and don't check bank statements all the time.

THE STATE AGENCY HAS ACCEPTED THIS RETURN AND YOU'RE FINISHED WITH YOUR TAXES.

To me that means that it has been paid and I am FINISHED WITH MY TAXES.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a Notice of Proposed Assessment Indiana Department of Revenue

@ronandsha1 Your tax returns were accepted by the IRS and the state of Indiana. But that does not also mean your payment of taxes owed was accepted.

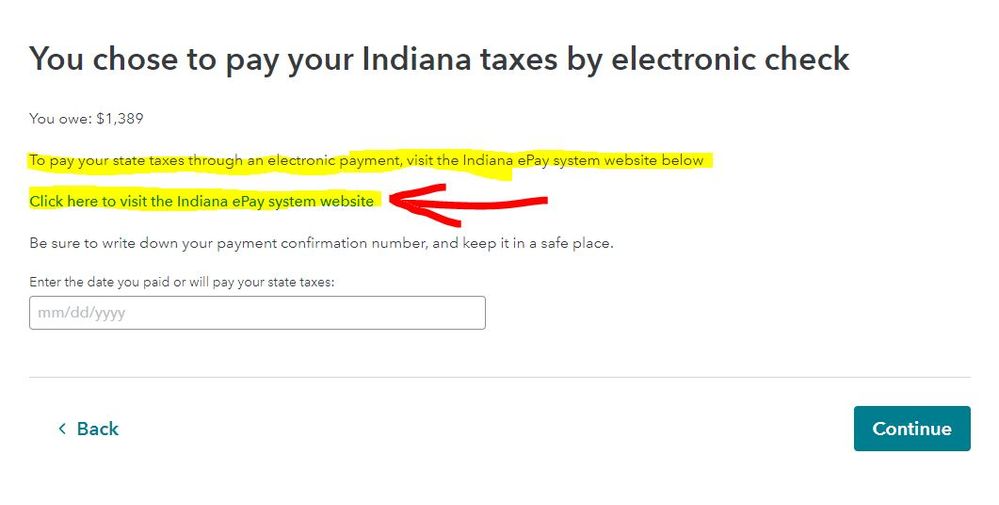

The state of Indiana requires that payment of taxes owed by direct debit from a bank account be paid through the Indiana ePay system website.

This payment information was given to you in the TurboTax program in the File section when you had Indiana state taxes owed. If you did NOT use the Indiana ePay system website to pay the taxes owed by direct debit from a bank account the taxes owed have not been paid.

See these screenshots from the TurboTax File section of the program for paying Indiana taxes owed -

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jcorry17

New Member

user17620428287

New Member

bees_knees254

New Member

garys_lucyl

Level 2

Rockpowwer

Level 4