- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

Both regular unemployment benefits and the jobless benefits provided by the stimulus legislation are subject to income tax. But the newly added tax exemption is for the first $10,200 of unemployment benefits

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

TurboTax is reporting that the American Rescue Plan will include some form of 2020 unemployment relief.

The bill also makes the first $10,200 of unemployment income tax-free for households with income less than $150,000. This provision would be retroactive to tax year 2020 (the taxes you file in 2021).

It is not clear how or when the IRS will implement the new law. At this point, if you have already filed your 2020 Federal 1040 tax return, it is not clear whether amended tax returns will be required or not. It is possible that the IRS could compute a refund of 2020 Federal 1040 tax returns that have already been filed, accepted and refunded.

At this time amended tax returns will not be available before March 18. See forms availability here.

The IRS considers unemployment compensation to be taxable income which you must report on your federal tax return. State unemployment divisions issue an IRS Form 1099-G to each individual who receives unemployment benefits during the year. States vary in how they tax unemployment compensation.

IRS information updates can be found here. TurboTax information updates can be found here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

@JamesG1 I understand that we all have to wait for the IRS guidance on how the UIB tax forgiveness will be handled. But my situation is unique. I already filed and Owe $1,000+ and have it set up to be paid 4/15/21. After the tax forgiveness is computed, I would get a refund. Whether I need to file an amended return or not, is it safe to Cancel this automatic withdraw for a tax payment? Or do I need to pay it on 4/15 and then file an amended return to reclaim it.?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

It is your choice to pay the balance due then get a refund later or not pay and have to answer a possible letter later from the IRS ... it is up to you to decide what your comfort level will be. It is very possible that the filing deadline will be moved again to possibly 6/15 similar to last year so keep watching for the IRS instructions in the next couple of weeks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

Cancellations, Errors and Questions:

- In the event Treasury causes an incorrect amount of funds to be withdrawn from a bank account, Treasury will return any improperly transferred funds.

- Once your return is accepted, information pertaining to your payment, such as account information, payment date, or amount, cannot be changed. If changes are needed, the only option is to cancel the payment and choose another payment method.

- Call IRS e-file Payment Services 24/7 at 1-888-353-4537 to inquire about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling.

- Cancellation requests must be received no later than 11:59 p.m. ET two business days prior to the scheduled payment date.

- If a payment is returned by your financial institution (e.g., due to insufficient funds, incorrect account information, closed account, etc.) the IRS will mail a Letter 4870 to the address we have on file for you, explaining why the payment could not be processed, and providing alternate payment options.

- In the event your financial institution is unable to process your payment request, you will be responsible for making other payment arrangements, and for any penalties and interest incurred.

- Contact your financial institution immediately if there is an error in the amount withdrawn.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

So if you haven’t filed yet and your unemployment benefits meet the tax exemption requirements would you just exclude entering the 1099-G? Or is it better to wait until more information is released?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

@sealevel wrote:

So if you haven’t filed yet and your unemployment benefits meet the tax exemption requirements would you just exclude entering the 1099-G? Or is it better to wait until more information is released?

You will need to wait until the IRS issues guidance on how to proceed. Hopefully this will be in the next few weeks.

After the legislation has passed Congress and after the President has signed the legislation and after the IRS has written the rules, regulations and procedures. And after the IRS has changed any forms or schedules to accept the tax code changes. And after the IRS has approved the changes in the TurboTax program that apply to the tax code changes, then it will be available for the users of the tax preparation software.

This can take anywhere from several weeks to several months before it becomes available.

See this TurboTax support FAQ for information on the American Rescue Plan - https://ttlc.intuit.com/community/tax-topics/help/how-will-the-stimulus-package-impact-me/00/1393859

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

Well TurboTax, let's hope someone gives us some direction soon. We filed already and have payments coming out to the IRS and the state soon. It would be nice to get a definite answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

Ok ... first if you have the payment coming out soon then STOP the payment by either not having enough in the account OR calling the feds/state to stop the debit. Otherwise let the payment happen then you will get it refunded later.

Then wait for the IRS to post information on when amending can be done.

My professional program has an update tomorrow for new returns with the unemployment on it so we can finally file returns correctly but amending filed returns are still in limbo so all everyone can do is wait patiently.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

I'm not worried about the payment coming out, no intentions of stopping it, that would just mess everything up! Are you sure there will be a refund coming for those who paid those taxes? And would an amended return have to be done to get that, or will they automatically calculate who should be refunded. And what if the final word on how to proceed comes after the 15th deadline, how would that work. Just a lot of unknowns. Too bad turbotax wouldn't send us an email stating how to proceed when it gets clarified...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

You are among millions who have now been affected by a mid-tax season change in the tax law. Patience will be necessary.

TurboTax will update the software for the unemployment but there is no timeline yet.

If you have not e-filed yet—-wait. And if you already e-filed and want to amend for this—WAIT.

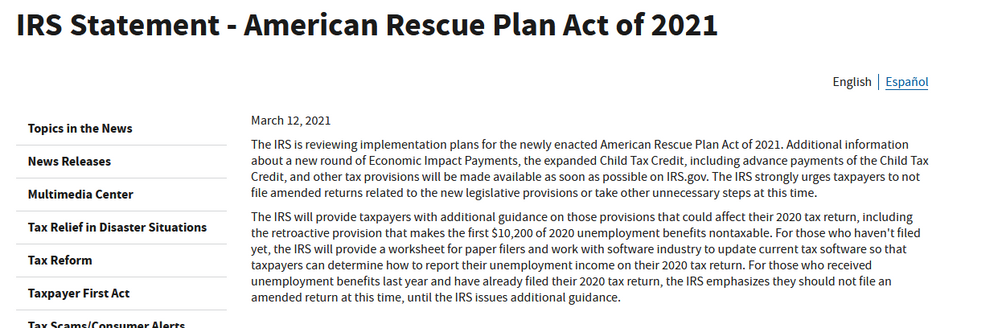

Please read this very recent news from the IRS:

https://www.irs.gov/newsroom/irs-statement-american-rescue-plan-act-of-2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How hard is it to amend 2020 tax return because of UIB tax forgiveness that was just passed?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

levind01

New Member

blueeaglewenzl

New Member

pivotresidential

New Member

coachmmiller

New Member

Naren_Realtor

New Member