in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Is Tax Act 152 the same as the path act message?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Tax Act 152 the same as the path act message?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Tax Act 152 the same as the path act message?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Tax Act 152 the same as the path act message?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Tax Act 152 the same as the path act message?

this is the message I received...is it PATH or is it message 152?

Check Where's My Refund in mid- to late February for your personalized refund status. It's updated once a day and remains the best way to check the status of your refund.

- Tax Topic 152, Refund Information

For refund information, please continue to check here, or use our free mobile app, IRS2Go. Updates to refund status are made no more than once a day.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Tax Act 152 the same as the path act message?

The message that you received is PATH. Where it's telling you to read the following information related to your tax situation, Tax Topic 152, Refund information, that is just Refund Timing information:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Tax Act 152 the same as the path act message?

Did anyone receive an update on your WMR today as of 2/15/2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Tax Act 152 the same as the path act message?

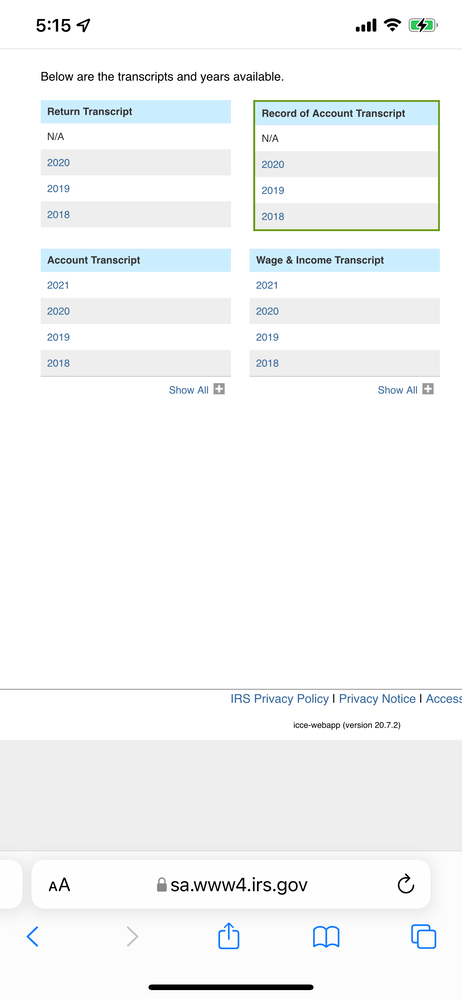

Mine went from one bar to “we apologize your tax return has been delayed longer than the normal timeframe” I tried to check my transcript and there’s no transcript available for 2021. Should I be concerned? Like cause I am. I have an amended return that they still have not processed from last year and they said to give them until March 7th for that. It’s like they just pushed mine to the side. Is anyone else experiencing something like this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Tax Act 152 the same as the path act message?

Most refunds are received within 21 days from the time a return has been accepted (received). However, some returns take longer than others. It's possible your return may require additional review and take longer to process. Please see My return is accepted but still not approved. Is there a problem? Should I be worried? for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

retired_ccie

New Member

rclksr

Returning Member

murphntobie

New Member

kagyel

New Member

Kenyamonique28

New Member