- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- How to get copies of past years tax returns

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

@Chavo12 wrote:

Not able to find a resolution for this. "My TurboTax" is not present, there are no dropdown. The only options I have is Intuit Account, Search, Help selection, or a Continue button to file this years returns. I tried the help button and it gives me the same answers. It won't allow me to speak to someone in particular without starting this years tax returns.

Very disappointed and frustrated with TurboTax, as I've ran into a similar situation last year. Not having any options or work arounds or the ability to talk to someone is not acceptable. Makes me really consider using someone else.

You have to sign onto your 2019 online account using the exact same User ID you used to create the online account.

Close all TurboTax windows on your web browser (including this one). Copy and paste the account recovery website link onto a new web browser window and run the tool.

Use this TurboTax account recovery website to get a list of all the User ID's for an email address. Run the tool against any email addresses you may have used - https://myturbotax.intuit.com/account-recovery

If none of the user ID's received will access your 2019 account, then use the option shown in blue on the account recovery website, "Try something else"

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

To access your prior year tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

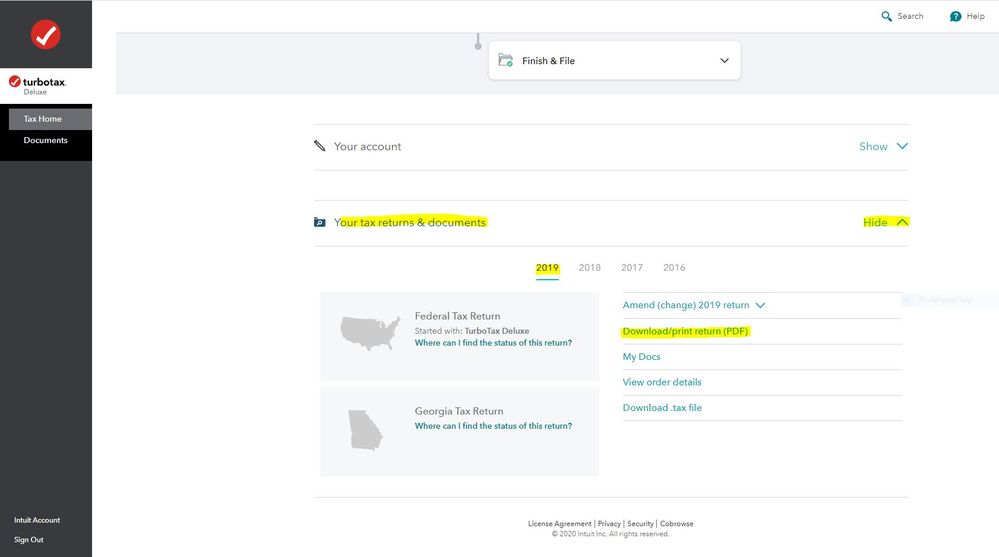

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

OR -

You may have to start a 2020 tax return before the links on the Tax Home web page become available. In that case start the 2020 tax return with the User ID you used for the 2019 return. Once some basic information has been transferred over, Tax Home should be visible on the left column. Click on Tax Home and then the other links will be shown as in this screenshot.

To access your prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

How do I retrieve my 2019 tax return from my phone iPhone 6

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

I'm looking for my 2019 return -- Had about a refund of $1,900. Havent' seen anything and I can't find on the computer now??

Hope you can help.

Linda Arena

[phone number removed]

[email address removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

@Nanalinz66 wrote:

I'm looking for my 2019 return -- Had about a refund of $1,900. Havent' seen anything and I can't find on the computer now??

Hope you can help.

Linda Arena

[phone number removed]

[email address removed]

You have to sign onto your 2019 online account using the exact same User ID you used to create the online account.

Close all TurboTax windows on your web browser (including this one). Copy and paste the account recovery website link onto a new web browser window and run the tool.

Use this TurboTax account recovery website to get a list of all the User ID's for an email address. Run the tool against any email addresses you may have used - https://myturbotax.intuit.com/account-recovery

If none of the user ID's received will access your 2019 account, then use the option shown in blue on the account recovery website, "Try something else"

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

To access your prior year tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

good

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

I just E-filed my federal & state but missed where I can print the returns for my records

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

@Rick Green wrote:

I just E-filed my federal & state but missed where I can print the returns for my records

To access your current or prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

Or -

When you sign onto your online account and land on the Tax Home web page, scroll down and click on Add a state.

This will take you back to the 2020 online tax return.

Click on Tax Tools on the left side of the online program screen. Then click on Print Center. Then click on Print, save or preview this year's return. Choose the option Include government and TurboTax worksheets

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

To get a copy of your 2020 tax return that you filed this year, sign in to the account you used to file this year's taxes and either:

- Select Download/print return if your return has been accepted.

- Scroll down to Your tax returns & documents (select Show if needed) and select Download/print return (PDF).

Please click How do I get a copy of a return I filed this year in TurboTax Online? to learn more.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

im looking for 2011,2014,2016 refund forms help how do I get these

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

@billymorningstar wrote:

im looking for 2011,2014,2016 refund forms help how do I get these

TurboTax and the IRS only retain tax returns for the last 7 years.

To access your prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

Or go to this IRS website for free federal tax return transcripts - https://www.irs.gov/individuals/get-transcript

For a fee of $43 you can get a complete federal tax return from the IRS by completing Form 4506 - http://www.irs.gov/pub/irs-pdf/f4506.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

@billymorningstar Do you mean you want copies of tax returns that you filed for those years or that you want the blank forms to prepare tax returns for those years? Your question is not clear.

If you are asking for copies of returns---the IRS and TurboTa save returns for 7 years, so you will not be able to recover a return older than that. You can use the account recovery tool to find returns that you prepared using TurboTax within the time that they are still on record.

Many people have multiple TT accounts and forget how to access them. Log out of the account you are in now.

Account recovery

https://myturbotax.intuit.com/account-recovery/

https://ttlc.intuit.com/questions/1901535-forgot-your-turbotax-online-user-id-or-password

Or did you use the desktop version of TurboTax? If so, the files are on your own hard drive or any backup device you used like a flash drive.

If you mean that you want tax forms to prepare:

2014

Form 1040 https://www.irs.gov/pub/irs-prior/f1040--2014.pdf

Form 1040Instructions https://www.irs.gov/pub/irs-prior/i1040gi--2014.pdf

Form1040A https://www.irs.gov/pub/irs-prior/f1040a--2014.pdf

Form 1040A https://www.irs.gov/pub/irs-prior/i1040a--2014.pdf

Form1040EZhttps://www.irs.gov/pub/irs-prior/f1040ez--2014.pdf

Form1040EZ Instructions https://www.irs.gov/pub/irs-prior/i1040ez--2014.pdf

PRIOR YEAR FORMS FROM IRS

2016

Form 1040 https://www.irs.gov/pub/irs-prior/f1040--2016.pdf

Form 1040 Instructions https://www.irs.gov/pub/irs-prior/i1040gi--2016.pdf

Form 1040A https://www.irs.gov/pub/irs-pdf/f1040a.pdf

Form 1040AInstructions https://www.irs.gov/pub/irs-prior/i1040a--2016.pdf

Form1040EZ https://www.irs.gov/pub/irs-prior/f1040ez--2015.pdf

You can go on the IRS site to find forms for 2011. Do be aware that you are too late to receive a tax refund for any of those tax years, but if you owe tax ---the IRS still wants to be paid. Any tax refund for tax years earlier than 2017 has been forfeited now.

https://www.irs.gov/filing/where-to-file-paper-tax-returns-with-or-without-a-payment

Form1040EZ Instructions https://www.irs.gov/pub/irs-pdf/i1040ez.pdf

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Federal and state returns must be in separate envelopes and they are mailed to different addresses. Read the mailing instructions that print with your tax return carefully so you mail them to the right addresses.

https://www.irs.gov/filing/where-to-file-paper-tax-returns-with-or-without-a-payment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

Need last years tax forms from 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

To access a prior year return, please reference the Help Article here.

Are you just needing to obtain your AGI? There are a few ways to obtain this. Please see the Help Article here for further instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

Need my agi from 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get copies of past years tax returns

@WisemanJanet wrote:

Need my agi from 2019

To access your prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on View adjusted gross income (AGI)

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

Or go to this IRS website for free federal tax return transcripts - https://www.irs.gov/individuals/get-transcript

For a fee of $43 you can get a complete federal tax return from the IRS by completing Form 4506 - http://www.irs.gov/pub/irs-pdf/f4506.pdf

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mandj119

New Member

random657

New Member

Propland

New Member

evansdante

New Member

tarajenkins2434

New Member