- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Cares Act Section 2302

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

This same thing happened to me. I have been using TT for about 30 years, and the last 2 years have been a nightmare. I definitely do not remember the questions listed and I am pissed. I reviewed my taxes for 2019, and the amount listed for Self-Employment tax is less, and on 2020, it shows more than 2019, but now they say I owe the half of taxes. I'm not sure i follow this logic. Any additional help would be greatly appreciated.

KC

Sac Clemente, CA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

I am certain I did not select any deferral of self-employment taxes due. And yet I received this letter as well.

Turbo Tax customer service is requested immediately. This deferred due amount should be liable by Turbo Tax for bad information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

@TAS2021 If you want to talk to customer support you have to contact them. We do not arrange that from the user forum for you.

To call TurboTax customer support

https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

Customer support is available from 5 a.m. to 5 p.m. Pacific time Monday-Friday.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

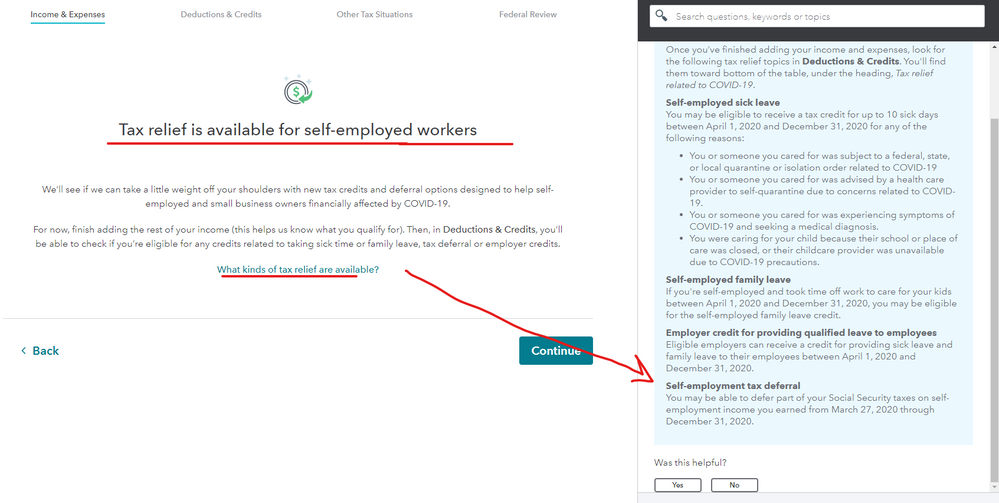

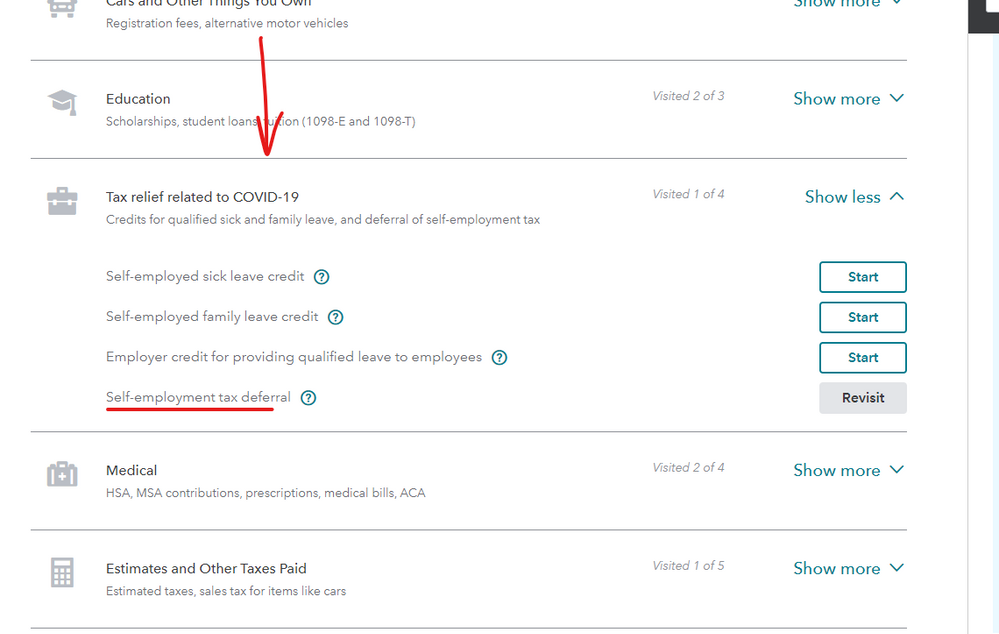

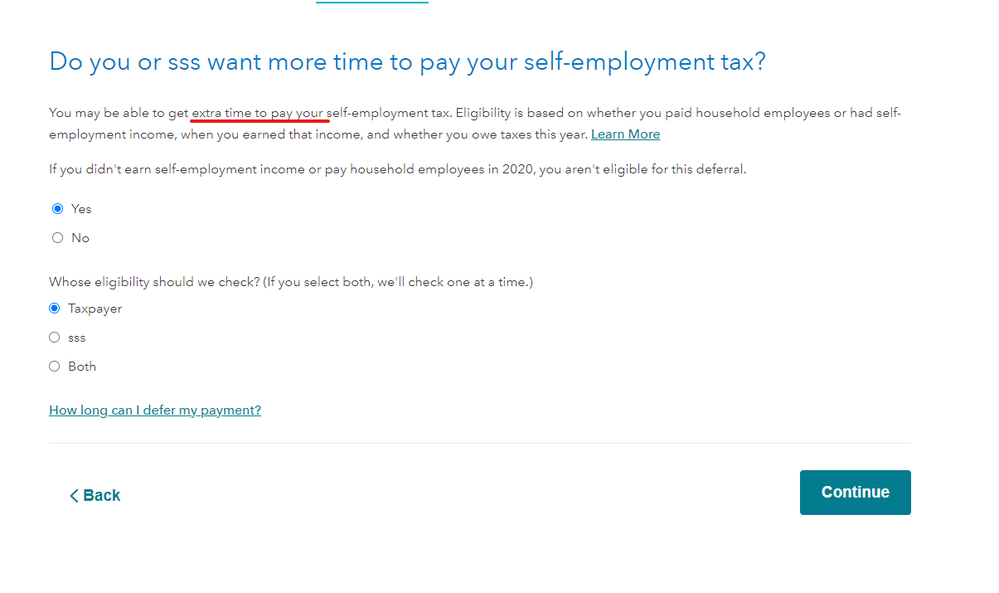

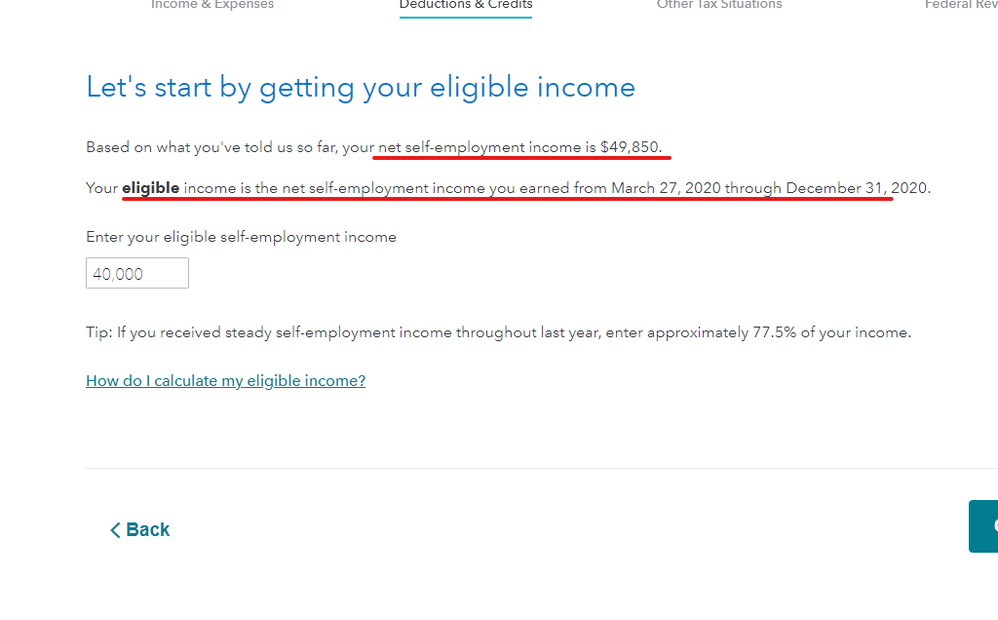

The installed version, not the online version, absolutely defaulted to the max deferral without verifying it with you. I also received an IRS letter and went back to my Turbotax to figure out what happened. The section about this deferral *now* asks you (likely an update). In my saved tax return, there is NO ANSWER as it never asked me and the amount it deferred is the full amount, by default.

In fact if I go back into that section and just click 'continue' without answer yes/no, it still defers the full amount. That's a nasty bug for all of us not expecting a several thousand dollar IRS bill.... thanks turbotax...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

How do I double check this? I do not see where I would owe thi? ggrrrr

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

@Tlk2j Are you looking to see if you owe the Self Employed Tax Deferral? SE Tax deferral is on Schedule 1 line 12e and goes to 1040 line 13.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

The interview walked you thru this election to defer the taxes ... nothing was done without your approval. If you did not want to defer the SE taxes then just pay them now in full or pay 1/2 now and 1/2 later either way you are going to make the payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

Hello Critter-3,

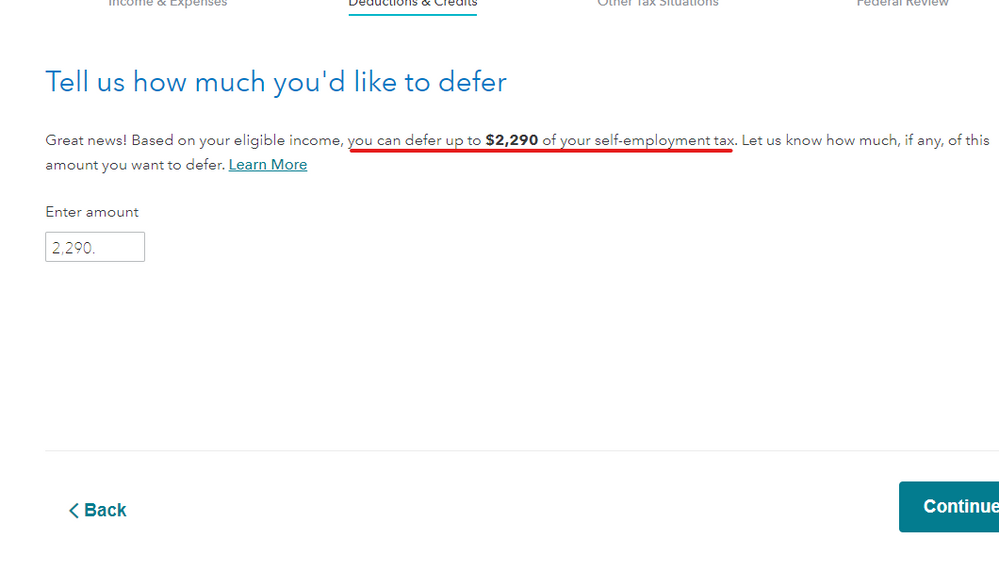

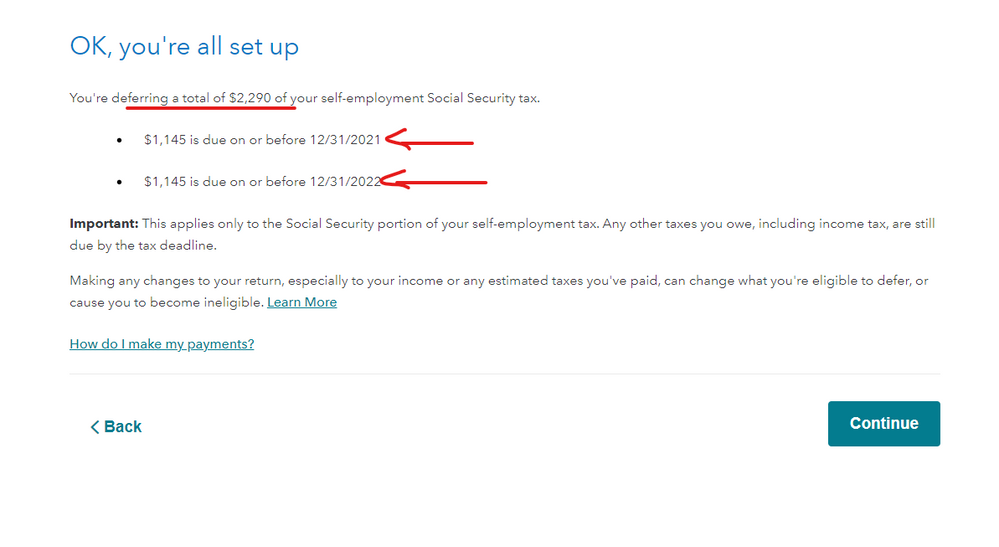

I am the original poster of this thread. I appreciate you taking the time to create the diagram but just because the bug is fixed now does NOT mean it was not there when I filed my taxes. I know beyond a shadow of a doubt that I would not have deferred my taxes as I have no reason to do it. If in fact those prompts that you show were part of the program that I used when I filed, I absolutely would not have missed them because as you show, they are very detailed. I get that Turbo Tax is not going to admit fault but making all of us that are complaining about the issue seem like we are wrong for missing it, is not going to make the fact that it happened go away.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

Weather you wanted to defer or not the facts are still the same ... you must pay the deferred taxes now or later. Good news ... technically this was an interest free loan so this did not really hurt you and the accuracy guarantee would only cover penalties and interest on a program error if there ever was one to begin with.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

you are missing the main fact...Turbo Tax screwed up!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

We did not get this "interview"...just admit Turbo Tax screwed up!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

Even if TT did screw up it doesn't change the facts at hand ... you did defer the taxes and they are due as instructed on the IRS notice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

No, I DID NOT defer...

Turbo Tax Deferred...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

Nope not the same. If I elected to defer my taxes then your argument is correct but you are missing the point. I DID NOT ELECT TO DEFER MY TAXES! There was/is a glitch, bug whatever you want to call it in the system. You are definitely making me rethink my relationship with Turbo Tax and will find another way to file my taxes this coming year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cares Act Section 2302

Please contact support via phone for assistance with this; contact details can be found here

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

m122

Level 2

margieparker87

New Member

schleemank

New Member

prettypetty90

New Member

sadiescott440

New Member