- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

nevermind, found it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

You can enter the accrued interest on bonds last year on Form 1099-INT in Turbo Tax Online. You may follow the steps below to enter the adjustment.

- Under Federal, jump to Interests and Dividends, click show more.

- Click on Interest on 1099-Int.

- Click yes "Did you receive interest income".

- On 'How do wnt to add 1099-Int", click "type is myself:.

- Enter the total interest from the 1099-Int, then select Continue.

- Under Do any of these uncommon situations apply?, click on I need to adjust the interest reported on my form.

- Click on Continue.

- Enter the adjustment amount and under the reason select My accrued interest is included in this 1099-Int.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

My accrued interest is higher than my earned interest so TurboTax is giving me an error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

That can happen for a bond purchased late in the Year.....depending on the interest payment dates.

You cannot enter the accrued interest until after that particular bond issues it's first interest payment to you.

__________________________________

Example...A bond pays out interest in Aug and Feb....you buy a bond In Nov 2022 with $100 of accrued interest that you had to pony up. But, it doesn't make it's next interest payment of (say) $350..to you..until Feb 2023.

In this situation you must delay declaring the accrued interest until yoru file your 2023 taxes in early 2024. SO you have to make a note to yourself in your new 2023 tax file to deal with it then.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

Your answers are helpful but I need a bit more detail. (using TT for 2022)

1) when I get to the page that says "Let's get your 1099-Int or brokerage statement details" there is a checkbox that says "my form has info in more that just box 1". Well, obviously I have no form because I am reporting accrued interest, but if I check that box the full 1099-int appears and I'm wondering if I should enter the accrued interest in box 3 which is "Savings bonds and treasure int". my I-bonds are both savings bonds and treasury interest so it would seem like I should check the box and enter the interest in box 3. yes?? no??

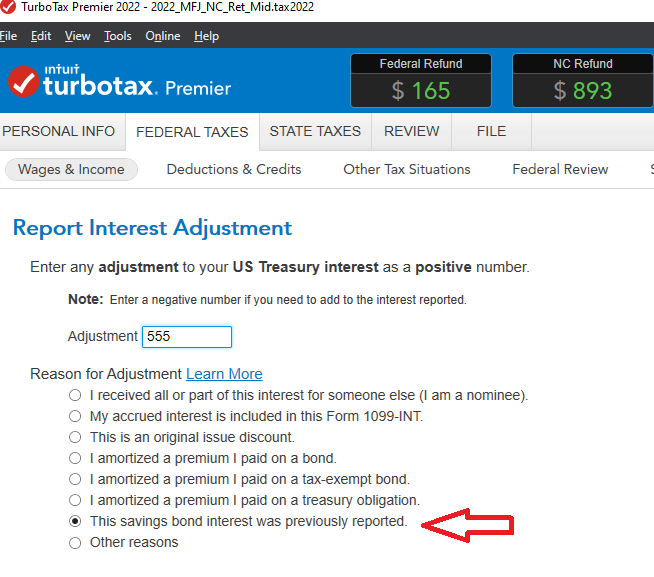

2) Assuming for the moment that I don't check the box and just enter the interest in the field for box 1 and click continue, I understand from your reply that I should then check the box for "need to adjust the taxable amount." and click continue. I do that and TT shows the "Report Interest Adjustment" page where I am asked to enter the amount of the adjustment (which could be negative or positive) and to give a reason for the adjustment.

What should I enter for the Adjustment? $0? The amount of accrued interest? positive or negative? And what reason should I check for the adjustment?

Thanks in advance!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

- Enter the accrued interest paid in the Adjustment box

- Select the Reason for Adjustment as My accrued interest is included in this Form 1099-INT

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

The type of "Accrued Interest" that you are trying to report for EE- or I-bonds is different from what the original poster is asking about. The original post is asking about bonds they bought on the secondary market...where they are paying the original owner for some of the interest that was accrued since the last interest payment occurred for that bond....usually semi-annually.

(For actually Treasury bonds/Notes, see my comment at the bottom)

_________________

For I-bonds or EE Bonds....EITHER:

1) you are not required to report accrued interest, until you either cash in that bond, or it matures. And at that time you report the total of all the accrued interest in box 3......and no adjustment is made on the follow-up page, since that page is referring to a different situation entirely.

....or....

2) You are also "Allowed" to instead report the smaller 1-year of interest that has accrued on the EE- or I-bond every year. But if you do this, you are responsible for looking up, and determining exactly how much that interest was each year, for the entire life of the bond (or until you redeem it if earlier). This reduces the one-time lump-sum interest reporting of situation #1, but keeping the record every year, requires meticulously-kept spreadsheets, and at times, frustration in finding out how much interest accrued in that one year...especially for paper bonds.

___________________

Yes, you are apparently allowed to change form one to the other...messy..but read:

See: Tax information for EE and I bonds — TreasuryDirect

___________________

IF you do use situation #2, you report the total of all yoru EE&I-bond Year's interest in box 3 of a 1099-INT....from the US Treasury. Then, in the year the bond matures, or you redeem it (or one), there will also be an actual 1099-INT for any bond redeemed/matured that reports ALL the interest, from purchase-to-date in box 3. .....and on the follow-up page in TTX, you select a checkbox

...."I /We need to adjust the taxable amount"

and on a later page, you get to enter the total of all interest previously reported in prior years (For whatever bond was redeemed..not everything you own), and check the box:

..."This savings bond interest was previously reported."

_________________

Thus for Situation #2 only, the previously reported interest for any bond redeemed in that year:

__________________

______________________

_________________________

Now, if you did buy actual regular Treasury Bonds/Notes, with interest that had already accrued, then those are treated entirely differently from EE- and I-Bonds.....and the $ are entered every year in box 3, and the first year you get an actual interest payment yourself, you will enter the accrued interest you initially paid, on the follow-up page...as already noted as "My accrued interest is included in this 1099-INT" just that one time

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

Thanks for your reply. I appreciate the effort you put into it. If my question should have been a separate thread I apologize for misunderstanding the original question.

To be certain I'm doing this right, let me clarify my situation.

1) It is to my tax advantage to report the i-bond interest as it accrues.

2) I understand that I have to keep track of the interest from all years.

So what I'm doing when I report this interest is to

1) Enter the name of the payer as : "I-bond accrued interest"

2) check: "My form has more info...."

3) Enter the accrued interest in box 3 (savings bond and treasury) and click continue

4) I do not check: "need to adjust the taxable income" on the next page.

In the year I redeem the bonds I will adjust the income as you suggested in the later part of your reply (which was very clear, thank you).

I can't upload a screen shot, but if I go to forms and view the Form B, it all looks correct to me, no errors are flagged.

let me know if I've got this wrong, and many thanks for your quick reply.

many thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

Second set of procedures

1) enter the Payer as US Treasury

2) Yes

3) Yes

4) Yes...with the following exception.

___

..if you also have individual Treasury Bonds/Notes. (i.e NOT EE- or I-Bonds)

But you can ignore the following if all you have are I-Bonds or EE-Savings Bonds

IF, in a particular year, you buy an individual Treasury Bond or Note , where you have to pay the seller for accrued interest that the bond has not yet been paid out yet...then you would indicate an adjustment, and enter the accrued interest that you had to pay for that purchase as an adjustment amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

I've been reporting the yearly accrued interest on my children's EE US Savings Bonds since 1981 in a spreadsheet. In 2020, I finally entered over 900 bonds into the Savings Bond Calculator and have used it to determine the total and accrued interest. It's way easier and safer recordkeeping.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

Did exactly what you said. Put in $1047.82 as the adjustment for accrued interest (out of $1125 paid this year.

Schedule B doesn't show the adjustment below the subtotal as it is supposed to per IRS regs. But the total interest on line is less than the subtotal by $680.91. Not less by $1047.82 and I've no clue where they got $680.91. So what is Turbotax up to???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

The problem is that TTX only provides one place to enter accrued interest......and the software can't know whether you are referring to box 1 $$$ (corporate bonds), Box 3 $$ (treasury bonds), or box 8 $$ (Muni bonds ).

And thus the software simply applies those accrued $$ proportionately (and improperly) among the box 1, 3, & 8 $$ amounts.

_______

Your solution for reporting it properly is this: If your 1099-INT is a mix of box 1, 3, and 8 in any combination. And if you have accrued interest to report for bonds you bought.....Then the all the bond interest for that bond type should be removed from that 1099-INT and entered manually on its own 1099-INT, from the same broker.

Example: You bought a Treasury bond with accrued interest that you can report for 2022. The Treasury bond interest is reported in box 3, but that 1099-INT also has box 1 and box 8 $$ on it. You remove all of the box 3 $$ (and box 12, if any) and put box 3 (and 12) $$ on it's own 1099-INT before indicating the accrued interest paid for that bond. IF you don't, the accrued interest will be divided up proportionately (and improperly) among boxes 1, 3, and 8

.....same thing goes for box 1 ( and 11) bond interest,

......or box 8 (9 and 13) bond interest.

...If bonds purchased and related to any of the boxes 1 or 3 or 8 don't have accrued interest to be reported, those $$ can remain on the same 1099-INT form.

_____

Clearer?

Some day TTX may get on the ball and provide separate accrued interest lines for each bond type on the follow-up page, so that one 1099-INT can always be used.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

Thank you for that advice. I tried it and it did correct the offset for accrued interest to the full amount and the net total line 2 on Schedule B is correct. However, Form B is still incorrect in that it doesn't show the offset above the total line either as an amount nor as "Accrued Interest". And there's no way to enter it manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the accrued interest paid on bonds? last year there was an adjustments section and i can't find it this year

Interesting. ....the "Forms Mode" form doesn't show everything

_________

If you also had an ABP adjustment, the Accrued interest doesn't show on the "Forms Mode" page (even though line 2 calculates OK)

.... BUT.....IF you actually create a PDF of the Schedule B, the total of ABP and Accrued interest will show on the PDF copy as a total "Interest Adjustments" subtraction, (and a backup sheet that shows the individual ABP and Accrued interest totals)

________

I checked back on the 2018 desktop software, and it did it the same way.

_______

AND...if you only had Accrued Interest to report for any taxable bonds ...no ABP....then it does show both in Forms Mode and the PDF copy of Schedule B.

Same for ABP....where no accrued inters is being reported...it does show as an APB adjustment both in Forms Mode and on the PDF of Schedule B.

______

Other wise, with both ABP and Accrued interest to report, you only see the full picture in the PDF....and then only the total of both together (and it was doing that back in 2018 too....haven't seen this as an IRS issue (((yet))))

Sure hope the IRS gets the correct full version...the electronic copy e-filed would be entirely illegible to us.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

djpmarconi

Level 1

Long52

New Member

DX77

New Member

mana1o

New Member

Huxley

Returning Member